What Is The Declining Balance Method? – Explanation With Examples

by Shahnawaz Alam Finance 06 June 2023

When accounting depreciation for assets such as a computer or similar technological equipment, the declining balance method can apply.

This accounting method makes it easier to calculate depreciation for assets that drop in value once they are ready to be used.

Completely opposed to the straight line method, the declining method for depreciation deducts a huge amount of an asset’s depreciation in the beginning. Then it keeps decreasing the net book value of an asset at a constant rate from the value remaining after its previous deduction.

Go through this article to have a clear idea about the declining depreciation method and how to use it.

What Is the Declining Balance Method?

Businesses need to calculate the depreciation of the assets at the start of the useful life of any asset. The declining balance method is the process that helps with this calculation. The declining balance method is also termed as the reducing or diminishing balance method.

At the start of the useful life of any asset, a larger depreciation amount gets calculated against the asset’s value. The recording of depreciation value is lower during the later years of the asset’s life cycle.

When depreciation is calculated for any asset, a constant depreciation rate is used for the asset’s book value every year. Due to the use of a constant depreciation rate throughout the useful life of an asset, the initial depreciation amount always remains high and results in accelerated depreciation.

| Key Points: Accountants also call this method the accelerated depreciation method. It records a high amount in depreciation expense at the beginning of the asset’s useful life. This technique helps account for mobiles, computers, and similar assets. It is opposite to the straight-line depreciation process. |

Why Is Declining Balance Method Important, And What Do You Learn From It?

The declining balance method makes it easier to calculate depreciation on assets that inevitably will become obsolete someday. This method is good for assets that quickly lose their value.

Some assets would normally include computers, phones, high-tech equipment, etc. This equipment or assets initially have their value. But, once the course of their usage start, they gradually start to lose their capability/use cases/ and depreciates in value.

The use of the accelerated or declining balance method is for calculating the depreciation value of the product throughout its life cycle.

The declining balance depreciation method is completely different and opposite to the straight-line depreciation method. In the straight-line depreciation method, the book value of any asset drops steadily throughout the useful life cycle of an asset.

In this process, the salvage value of the asset gets subtracted from the cost of the asset. Then the answer gets divided by the useful life cycle of the asset. So, for example, if a company spends $25000 for an asset, and if the salvage value and the useful life cycle are $5000 and 5 years, then the straight line depreciation is –

($25000 – $5000) / 5 = $4000

How To Calculate Declining Depreciation?

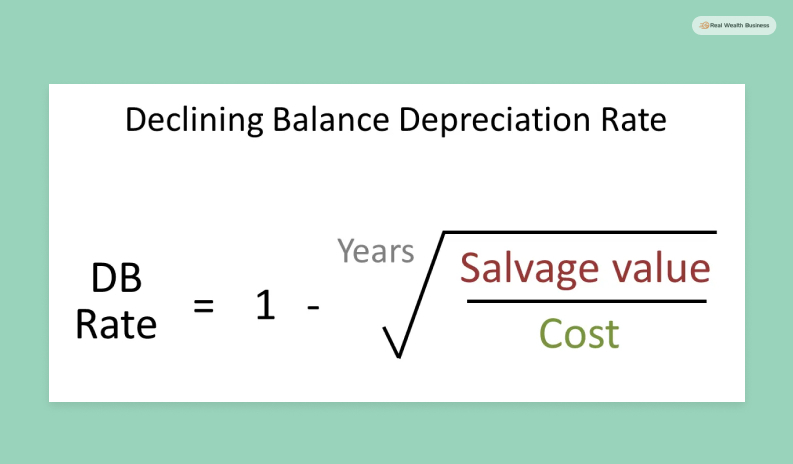

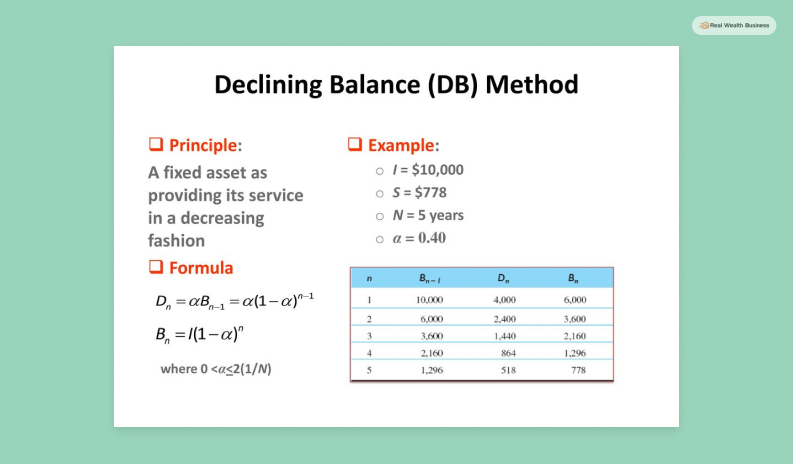

As mentioned before, the declining depreciation incurs a high depreciation amount at the start of the useful life cycle of any such depreciable asset. When calculating the declining balance method, you have to follow the formula for the same.

Declining Balance Method Formula

Accounting managers use the declining balance method formula for calculating depreciation. Below is the formula for calculating it as the declining balance method formula.

| Declining Balance Method = (Net Book Value – Residual Value) X Constant Depreciation Rate |

Example Of Declining Depreciation Calculation

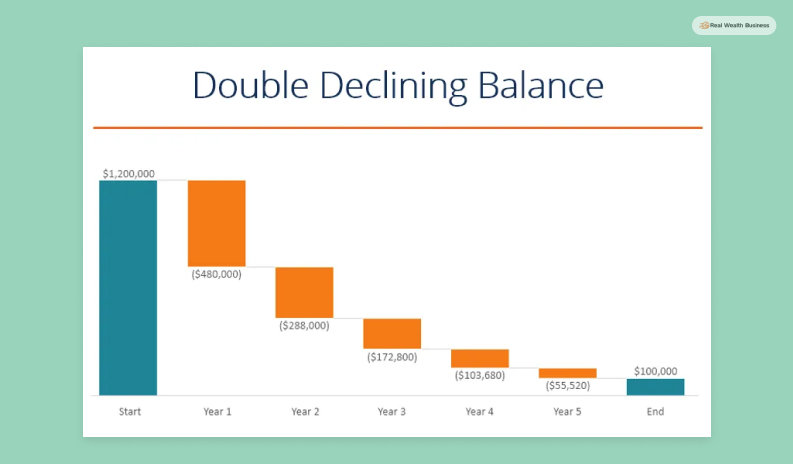

As mentioned in the formula and the definition, in this accounting process, the asset value depreciates significantly at the start of the useful life cycle.

So, if we assume that the value of a quickly depreciable asset is $21000 and if the salvage value remains $1000 after 10 years, then here is how you can calculate the depreciation –

| Year | Depreciation Rate | Depreciation Amount | Value At The End Of The Year |

|---|---|---|---|

| 1 | 20% ( 21000-$1000) | $4000 | $16000 |

| 2 | 20 % of $16000 | $3200 | $12800 |

| 3 | 20% of $12800 | $2560 | $10,240 |

Here, I have calculated the depreciation of the asset at a declining rate throughout the end of three consecutive life cycles of the asset.

The asset’s depreciation gets calculated by decreasing a high amount in depreciation during the initial years. As a result, the depreciating amount reduces throughout the end of the subsequent year ends.

Pros And Cons Of Using The Declining Depreciation Method

Yes, the declining depreciation method for calculating depreciation applies to some goods and assets that have become obsolete. But there are both advantages and disadvantages to these methods. Here are the different advantages and disadvantages of using the declining depreciation method –

Pros

- This depreciation method is good for assets that lose their value immediately once their useful life cycle starts. These products eventually become obsolete. Some of these products include computers, technology products, and the like. This way, describing the fair market value of the products on the balance sheet becomes easier.

- Since the initial years of the useful cycle have higher depreciation, the net income gets reduced. This results in tax benefits the tax outflow also becomes lower.

Cons

- The net income increases gradually as the depreciation value of the assets decreases throughout the useful life cycle. So, initially, businesses see a lower net income because the asset value depreciates significantly in the initial year.

- Also, the declining depreciation method cannot be profitably applicable to assets that do not lose their value immediately.

- Also, under this method, asset value cannot be reduced to zero.

- Compared to the fixed installment m method, it is difficult to determine the depreciation rate in the declining method.

- The Declining Method.

Final Words

The best depreciation method always closely connects with the asset a company is accounting depreciation for. The declining depreciation method, for instance, is great for assets like computers and different technological equipment. These assets eventually become obsolete and lose their book value instantly at the start of their useful life cycle. This method is ideal for tax calculation on computers and similar equipment.

But, if a company wants to calculate depreciation for other machinery equipment, the straight-line depreciation method is best. Was this explanation simple enough? Please let us know if you have any queries. Thank you for reading.

Read Also: