What Is Depreciation, Depreciation Methods, and How to Calculate?

by Shahnawaz Alam Finance 17 May 2023

Both small and high-capital businesses need to understand the principles of depreciation. This important aspect helps companies create accurate financial statements and determine their payable tax.

However, what does the term depreciation mean? Simply, it denotes the decrease in the value of an asset used over the years to run a business. I know you need more explanations. That is why I suggest going through this article to learn about depreciation, its different types, and how to calculate depreciation.

Here, you will learn five different ways to calculate the depreciation of an asset, with examples and formulas added to each of them.

What Is Depreciation In Accounting?

Depreciation is a term used to denote and allocate the value of a tangible or physical item or resource throughout its life cycle. The term also helps identify how much of an asset’s value has been decreased or used over a period of time.

In accounting, depreciation also suggests the explicit and indirect cost a company incurs yearly through fixed assets, machinery, equipment, or other expensive tools. Businesses use this term as a process for deducting the cost of an expensive item they had brought for the business. In this case, rather than doing all of it in a tax year, businesses write it off part by part over time.

If broken down into simpler words, depreciation means – when an asset is used for a period of time, the monetary value of it decreases due to its continuous use. The decrease in this value is measured as depreciation. Different conditions, like the unfavorable conditions of the market, affect the depreciation of a certain asset.

During the tax depreciation process, assets get categorized among different classes. Each of the classes has a different useful life cycle. Businesses usually have different depreciation methods for their financial statements. They can calculate the life cycle of an asset based on how long they want to use the asset.

Read More: How to Stick To Your Business Budget?

Why Is Depreciation Important For Accounting?

Evaluating depreciation is crucial for businesses because it helps determine the amount of tax a business owes and more.

Reduces Payable Business Tax

Different tax rules allow businesses to deduct the depreciation tax. A business can save a lot of tax with high depreciation expenses. When a company has equipment or assets that depreciate, it will supposedly have a reduced level of taxable income. As a consequence, they will owe less amount in tax.

Cover Asset Cost Through Its Life Cycle

Businesses can recover the cost of an asset from the start of its purchase with the help of depreciation. Instead of immediately recovering the cost of an asset, depreciation helps a business cover the cost through the asset’s life span. In the future, businesses can use an appropriate amount of revenue to replace future assets.

Create An Accurate Statement About Incurred Expenses

The depreciation process also helps businesses state the incurred expense due to the use of a certain asset. A lack of depreciation may lead to misleading asset expense statements resulting in flawed financial information.

Understand The Net Book Value Of An Asset

Calculating depreciation can also help a business collect information on the net book value of a certain asset. By deducting the depreciation cost from the original purchase price of a given asset, a business can stay updated on the net book value of the same.

Read More: Top 5 Small Businesses To Start With Minimum Investment

What Is An Asset?

Anything with a dollar value can be deemed as an asset. It can also be referred to as property. The assets with dollar value can be tangible or intangible. Tangible assets are physical assets, like things that you can touch. For example, a visible material asset is an office building, machine, or a computer.

However, intangible assets are not physical, hence, they cannot be touched. Such assets may include copyright, patent, or other intellectual properties. Both of the assets can depreciate. But, for intangible assets, the process of depreciation is called amortization.

What Type Of Assets Can Depreciate?

There is a guideline provided by the IRS on which products can depreciate. The following are the criteria that these assets need to meet –

- You have to own the product.

- You have to use the asset in your business to generate revenue.

- The useful life of the asset should be determinable.

- The asset should expectedly last for more than a year.

Here are some of the common examples of depreciable assets –

- Vehicles.

- Office furniture.

- Computers

- Equipment.

- Real estate businesses.

Read More: The Pearson Economy: Things To Know

Factors To Know About Depreciation

When calculating depreciation, you will be coming across different terminologies such as fixed asset cost, salvage value, useful life cycle, etc.

- Fixed Assets Cost: The fixed assets cost is the price that an organization pays to buy a material asset.

- Salvage Value: Selling the asset helps recover the remainder cost of an asset after the useful life cycle.

- Useful Life Cycle of Fixed Asset: the useful life of any asset means assumed number of productive years for any given asset. You can see it as the time for which a product remains valuable.

Types of Depreciation

Since all tangible items and assets deplete or depreciate with time, all firms follow five different methods for charging for them. Here are the different methods of depreciation –

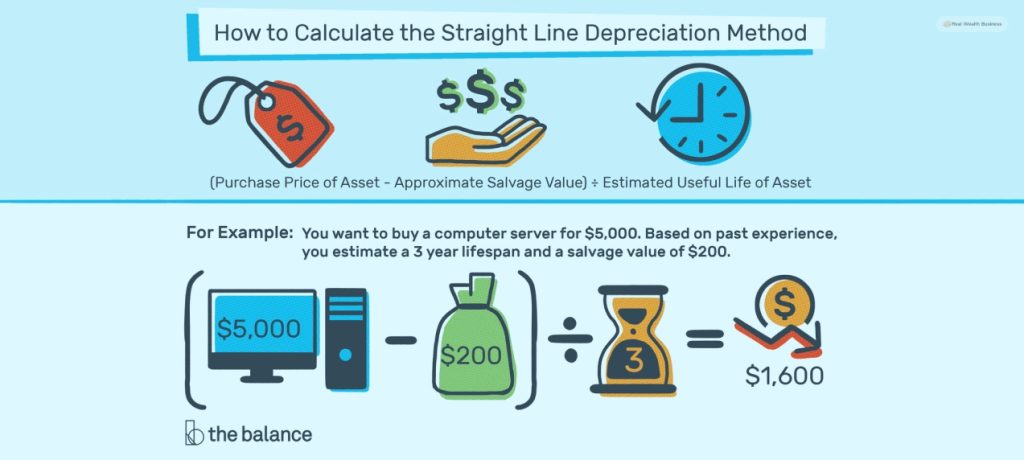

1. Straight Line Method

The most simple way of measuring depreciation is through the straight-line method. The value of the asset is divided evenly throughout the useful life cycle of the asset. Small businesses and accounting systems can benefit from this method.

The business firm wishes to recover the salvage value of an asset at the end of its useful life. The company deducts the salvage value from the predetermined asset cost during this process. After the deduction, the acquired value is divided by the asset’s useful life.

| Formula: (asset cost – salvage value) ÷ useful life |

Example:-

Let’s say that A INC. is a shoe manufacturing company. The company bought shoe-making machines and equipment worth $105000 in 2018. The manager of the plant thinks that the shoe-making machine will last for at least 5 years, and he determines the salvage value as $5000. So, here is how the depreciation expense will be determined using the straight-line method –

- Shoe-making machine cost – $105000

- Salvage value – $5000

- The useful life cycle of the machine – 5 years

Solution:-

Depreciation = ($105000 – $5000) ÷ 5

Answer: $20000

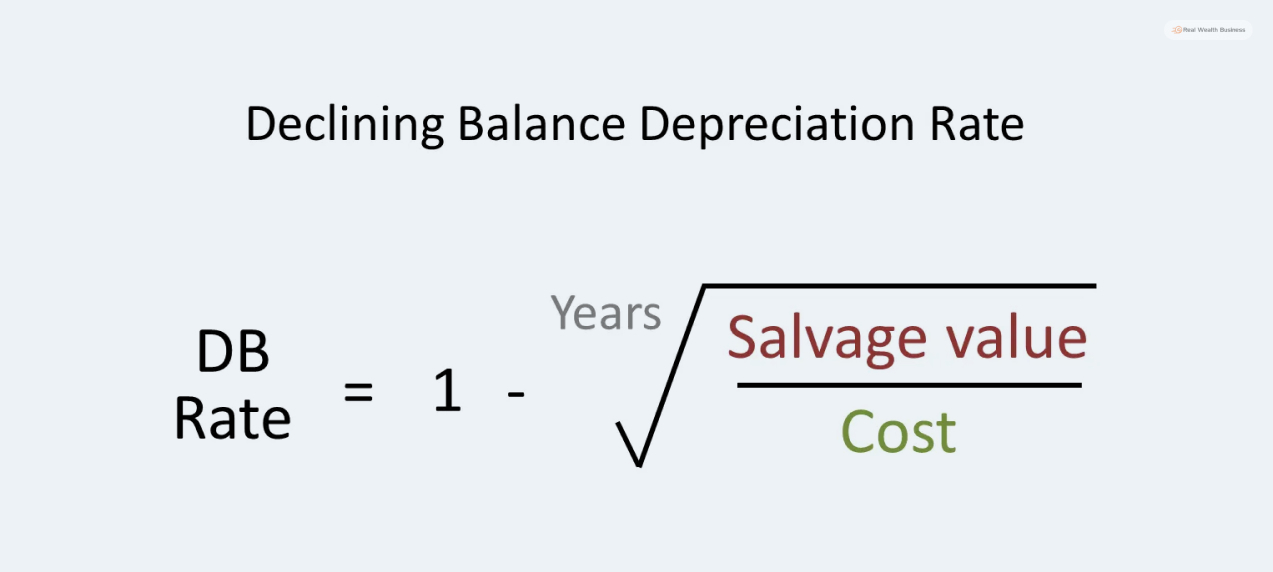

2. Declining Balance Method

The declining balance process might seem like a more accurate way to calculate the depreciation of a company’s assets. In this method, the accountants charge the depreciation on the net carrying amount of the fixed asset.

This netbook value is what remains of the fixed asset value after the deduction of its depreciated cost in the previous cycle. This way, the depreciable value lowers every year, making the depreciation expense decrease in the process.

| Formula: (Net book value – salvage value) x depreciation rate |

Example:-

For the same example used before, when the firm charges 15% per annum, what should depreciation expense be? Here, utilize the declining balance method for the result –

- Depreciation rate – 15% per annum

Solution:-

| Year | Value of the Depreciable Asset | Depreciation Rate | Amount Depreciated | Net Book Amount |

|---|---|---|---|---|

| 2019 | $105000 = $100000 | 15% | 15000 | 85,000 |

| 2020 | 85,000 | 15% | 12750 | 72250 |

| 2021 | 72,250 | 15% | 10,837.5 | 61,412.5 |

| 2022 | 61,412.5 | 15% | 9,211.875 | 52,200.625 |

| 2023 | 52,200.625 | 15% | 52,200.625 | – |

You should know that the shoe-making machine will fulfill the last year of its useful life in 2023.

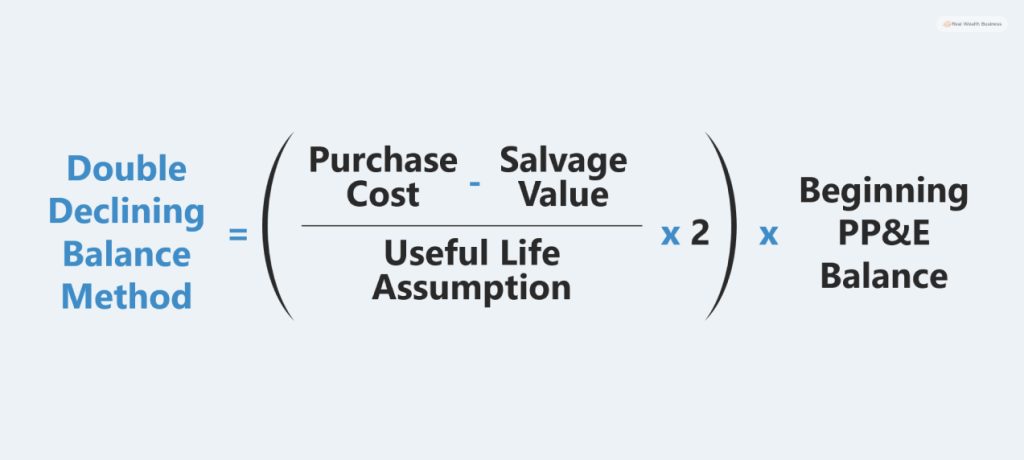

3. Double Declining Balance Process

The double declining balance method is quite similar to the declining balance method. However, the only difference is that the process charges a double amount of depreciated rate on the net book value or the fixed asset’s remaining balance. For this reason, the method is also called the accelerated method. Here are the steps you need to follow –

| Formula: Depreciation = Net book amount – salvage value x depreciation rate x 2 |

Example:-

If we follow the data of the same business and its equipment the calculation should look like as visible below –

In this case, the new rate of depreciation would be 2x 15% p.a = 30%

Solution:-

| Year | Value of the Depreciable Asset | Depreciation Rate | Amount Depreciated | Net Book Amount |

|---|---|---|---|---|

| 2019 | $105000 = $100000 | 30% | 30000 | 70000 |

| 2020 | 70000 | 30% | 21000 | 72250 |

| 2021 | 49,000 | 30% | 14,700 | 34,300 |

| 2022 | 34,300 | 30% | 10,290 | 24,010 |

| 2023 | 24,010 | 30% | 24,010 | – |

You should know that the shoe-making machine will fulfill the last year of its useful life in 2023.

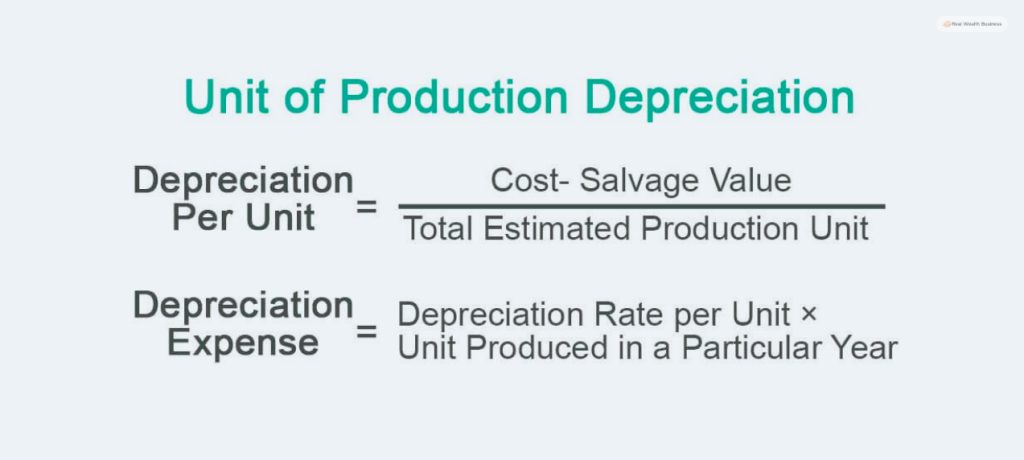

4. Units Of Production

Another easiest way to depreciate any equipment is by judging it based on the amount of work it does. It can be based on the number of units the equipment has been able to produce within a year or based on the hours it has served.

Under this process, the salvage value is deducted from the fixed asset value of the equipment. Then the result is divided by the number of units produced within a specific lifetime.

| Formula:(asset cost – salvage value) ÷ units produced in useful life |

Example:-

Again, for the units of production method, you need to follow the formula explained above. We can use the formula above to calculate the hourly depreciation of the equipment.

- The cost of the equipment is $105000.

- Salvage value – $5000

- The equipment can be used for -100,000 hours before its useful life expires.

Solution:-

In this case, its hourly depreciation should be –

$105000 – $5000 ÷ 100,000 = $1

So, if the machine worked for 10000 hours within the first year of its use, then the yearly depreciation would be –

10000 x $1 = $10000

Now, the business can write off that number as the first year’s depreciation. After the first year’s depreciation, the net book value of the machine will change, changing the next depreciation in the process.

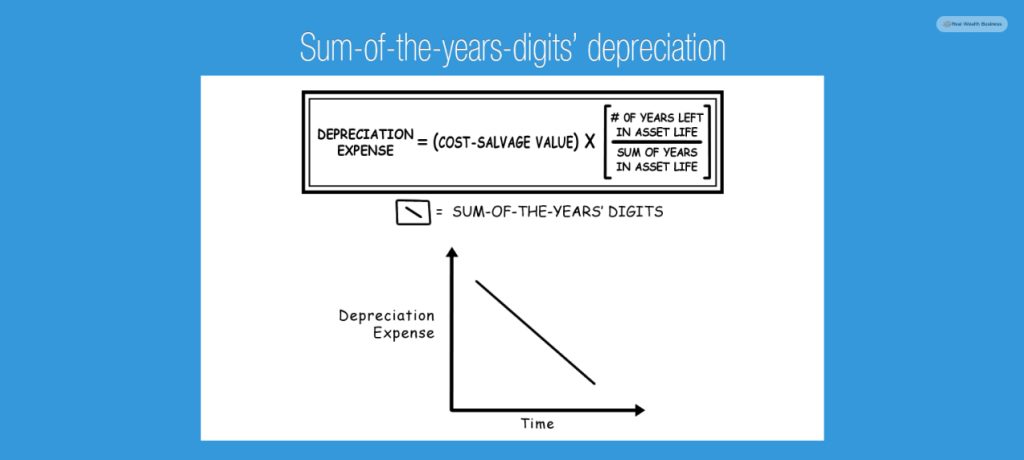

5. Sum Of Years Digits Method

Yet another method of calculating the depreciation of any asset is using the sum of years digits method. It allows businesses to depreciate more costs of assets at the beginning years of their useful life than at the end.

This calculation requires you to arrange the digits in ascending order and sum them up. Now the remaining number of useful years gets divided by this sum. Next, multiply the result you get by subtracting the salvage value from the asset cost.

| Formula: (remaining lifespan ÷ SYD) x (asset cost – salvage value) |

Example

This is yet another interesting way of calculating depreciation. The main difficulty here is calculating the sum of an item’s life span.

Solution:-

For example, if an item has a life span of 3 years, its SYD would be –

1+2+3 = 6. Similarly, the SYD for our equipment ( if it has useful life of 10 years) here would be – 1+2+3+4+5+6+7+8+9+10 = 55.

In this case, it is –

(10 ÷ 55) x (105000 – 5000)

Answer: 18,181.8

Effects Of Depreciation On Accounting Ratios

Different financial ratios are affected by the depreciation in the following ways –

- Depreciating assets can affect capital-intensive firms’ balance sheets and income statements.

- The depreciation expense and the asset value stated also get affected by the preference of useful life and the salvage value. Shorter useful life cycle and lower salvage value change the depreciation of an asset.

- The return ratios also get subdued by the higher depreciation expense. Analysts should be careful about this when comparing firms with versatile methods. When compared with the SLM, both the net income and the shareholder’s equity can get depressed by the accelerated depreciation method during the starting years.

- Using accelerated methods lowers the return ratios making it more conservative. However, the impact gets reversed in the later years with the lesser depreciation expense.

- High-capital firms can benefit from the traditional depreciation approach of adopting the accelerated approach because they can compensate for the less depreciation on the older assets with more depreciation on newer assets.

- Deprecation with the conservative method also helps increase the ratio of asset turnover.

Read More: Top 3 Things To Know About Data Quality Management

Bottom Line

The value of fixed assets is supposed to decline every year. When a business buys equipment, they use it for a long time. During this time, the equipment depreciates, and that impacts the generation of taxable income within that business. Knowing the process of calculating depreciation helps businesses create an accurate business statement.

If you have gone through this article carefully, you will know about the definition, importance, and different types of depreciation. The added examples should also make the understanding clearer. You should know that the numbers used for different examples were hypothetical and not based on any particular business.

I hope that the topic was clear. If you have any queries about the same, you can ask us in the comment section. Thank you for reading.

Read Also: