What Is Straight Line Depreciation? Formula & Full Guide Of Straight Line Depreciation

by Shahnawaz Alam Finance 29 May 2023

The monetary value of assets like equipment decreases over time due to their use. This process is termed depreciation. But in accounting, it is something more.

It is the process of spreading the cost of any fixed asset throughout the period the asset is likely to be used. Previously, we had discussed depreciation and elaborated on different types of depreciation. Straight line depreciation is one of those types.

This article will discuss specifically straight-line depreciation. Go through this topic to learn about the most common GAAP complied accounting depreciation method.

What Is Straight Line Depreciation?

Straight-line depreciation helps spread the cost of an asset throughout the useful life of the equipment that is getting accounted for. When calculating straight-line depreciation, you require only need three elements –

- asset cost

- useful life

- estimated salvage value

The process allows calculating an asset’s worth after its useful life is over. The difference between the salvage value and the asset’s cost is called the depreciable base. This base is divided by the number of years the asset is usually expected to function. You can use the number to calculate the annual depreciation expense during accounting.

The depreciation amount is uniformly charged during each of the accounting periods. The process reduces the asset’s book value, making it reach its salvage value at the end of its useful life.

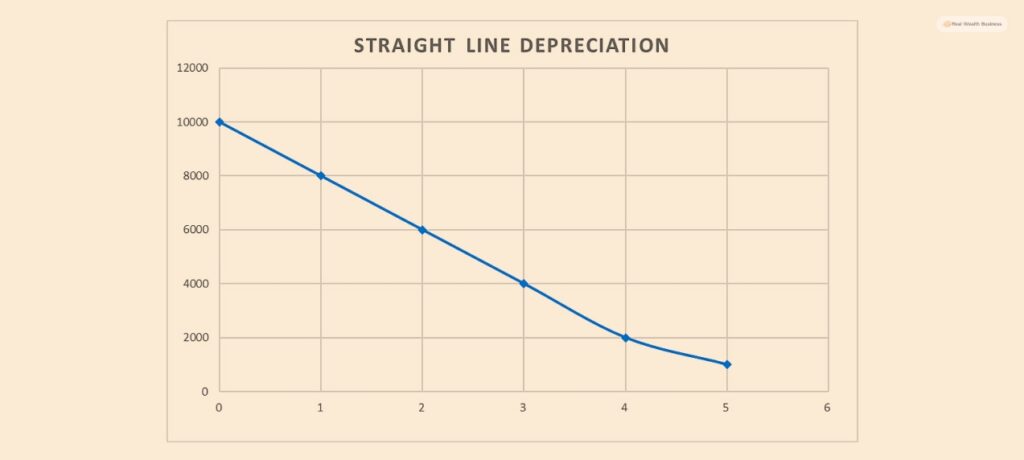

Here, go through the below graph to notice how the net book value of an asset depreciates throughout its useful life.

Straight Line Method Of Depreciation: Explained

Depreciation is a helpful accounting process. It assists in smoothing out the value of costly business equipment, buildings, and machinery throughout their useful life. Since these items are costly, using depreciation helps avoid anomalies in cash balances and the profitability in the financial statement at the end of the year.

Smaller and medium-sized businesses usually use the straight line depreciation method because it is easy to calculate. This process requires you to assume that an asset or equipment will last for a specific period. The usefulness of the same will decline over this period.

The depreciation amount gets recorded on the income statement as a debit or an expense. The balance sheet does not have a separate record of the accumulated depreciation. Instead, it gets recorded in a contra-asset account in the form of credit.

Straight Line Depreciation Calculator: Step-By-Step Process

So, how to calculate straight line depreciation? Here are the different steps you need to follow to calculate straight line depreciation –

As mentioned before, you need only three data points for calculating straight line depreciation –

- asset cost

- useful life

- estimated salvage value

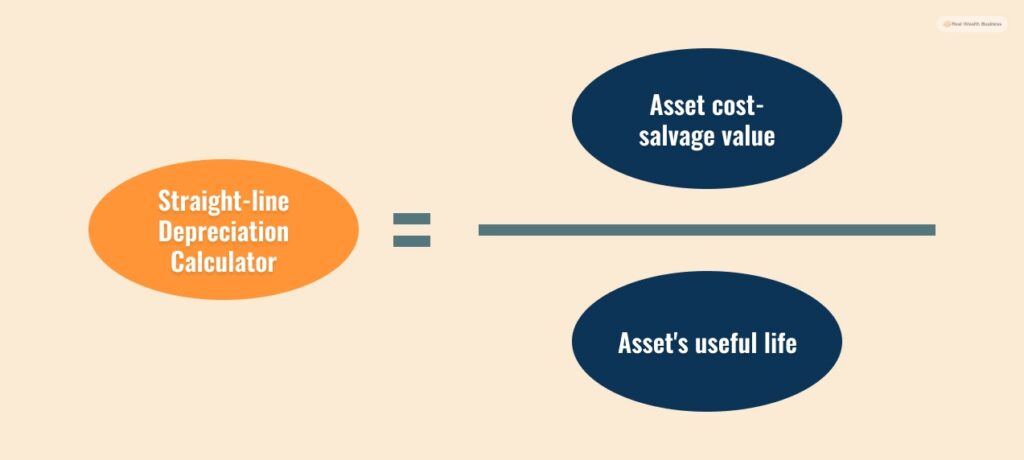

Once you have three of these data points, you have to use the straight line depreciation formula to calculate the asset’s depreciation.

| Straight Line Depreciation = (Cost – Salvage Value) / Useful Life |

- Only the asset cost is based on hard facts, while the useful life of the equipment and the salvage value are estimates. Here are different steps you need to follow if you want to calculate straight line depreciation.

- First, you must determine the all-in cost and the additional costs the asset requires for functionality. This cost will help the asset get started.

- Once you have found the cost of the asset, estimate its useful life cycle. This useful life cycle means how long the equipment or the asset is expected to serve.

- Once the useful life is over, the old equipment can be sold for a price that is the asset’s salvage value. After estimating the useful life, you have to calculate the equipment’s salvage value.

- Now you must use the straight line depreciation formula to calculate the annual depreciation expense.

- Divide the annual depreciation amount by 12 to find monthly depreciation. However, this is not strictly necessary.

Pros & Cons Of Straight Line Depreciation

Straight line depreciation has many pros and cons. Go through the below section and have a clear idea about what is good about this method and what is not.

Pros

- Straight line depreciation is constantly applied and is easy to calculate. It is the most popular method among small and medium businesses for calculating depreciation.

- Straight line depreciation applies widely to diverse types of fixed assets. Especially when the obsolescence of different such products is because of the passage of time, the straight line depreciation method comes in handy.

- Using this method for depreciation calculation reduces the amount of record-keeping needed for accounting.

Cons

- This depreciation method does not work well against assets that usually depreciate based on their input, usage, and their outputs.

- This method needs MACRS recovery periods to be accepted for U.S. tax purchases. As a result, it requires more calculations, increasing additional complexity.

- Some assets like computers and vehicles experienced accelerated obsolescence in the early years. Straight line method of depreciation does not account well for these assets.

- The salvage value and useful life estimation are not always correct and can be inconsistent and subjective.

Why Is Straight Line Depreciation Important?

The calculation of a company’s profitability is better assessed by matching the expenses with revenue. The straight line method of depreciation evenly distributes the cost of assets throughout the useful life. In doing so, it makes budgeting and forecast financial data easier.

Additionally, the consistent charges of the depreciation amount make cash flow analysis and operating profitability simpler. Also, once you have gone through the different pros and cons mentioned earlier, it should be easier to understand why this is the easiest and most useful method for calculating depreciation.

Final Words

In simple words, straight line depreciation is the most useful method for allocating or distributing the cost of any fixed asset throughout its useful life cycle. This way, accounting and assessing profitability becomes much easier for organizations. Due to being the simplest GAAP-compliant process for deprecation calculation, it is used widely.

I hope you have found what you were looking for in this content. But, if you need us to explain similar topics, please mention them below. We appreciate your valuable time and feedback. Thank you for reading.

Additional Reading: