How New State Tax Laws Are Going To Affect Your Ecommerce Business

by Mashum Mollah Ecommerce 17 January 2020

Let us begin with some important questions-

- Do you run an eCommerce company operating in different states of the USA?

- Are you a seller on Amazon, eBay or some other big eCommerce portal?

- Have you read and understood the new Supreme Court ruling on the Wayfair Nexus?

- Is there a chance that you might be ignoring the serious repercussions of Nexus Laws and State taxes?

In this article, we will be discussing all the important questions that have been raised above. We will also be looking at the South Dakota versus Wayfair Supreme Court Ruling of June 2018. In addition, for those not familiar with what Nexus and State Laws are, we will be briefly highlighting some important points.

Economic Nexus Laws or State Tax Laws: Meaning and Definition

In simple words, ‘nexus’ means a connection, which a business operating in a particular state might have with the state’s tax-collecting authority. In other words, if you are business, who does business in a state, you need to collect state tax from your consumers in that state and pay the same to the state’s taxation or regulatory authority.

Economic Nexus Laws are not a new occurrence in sales tax and other financial taxation histories. Various states have from time to time raise the sales tax from businesses by imposing some form of a state tax. However, there were legal loopholes, jurisdictional hurdles, and lobbying by businesses, which were preventing the same. Click to find more about Tax Debt Settlement Options, and the attorneys who can help you.

The trend of stated implementing the same and businesses taking them to court for the imposition has been going on for some quiet time. In the following, we will be looking at the two major cases concerning economic nexus laws and state tax laws.

The State of North Dakota versus Quill Corporation, 1992

In 1992, Quill Corp. took the State of North Dakota to the Supreme Court against the imposition of Nexus State Taxes on its operations. The company claimed that it did not have any physical entity or presence in the state. This included no factory, warehouse, office or store in the state.

Yes, it was doing business, but it argued that the physical presence of a business should be set as the basis of collecting and charging sales tax. The Supreme Court ruled in the favor of Quill Corp. and the same continued for a period of 26 years.

The State of South Dakota versus Wayfair, 2018

In June 2018, the Supreme Court overturned its earlier judgment in the State of North versus Quill Corp, 1992. This was not only a huge decision in itself, but it also opened the flood gates of states going after corporations with differing sales tax criteria.

The Supreme Court has stated that businesses need not have a physical presence on the state to pay nexus state tax. They need to just do business to the tune of $100,000 USD or 200 transactions with the population of the state.

While South Dakota agreed to the $100,000 or 200-transaction rule, others have argued that bigger states should levy more, or that some smaller states, should levy less. In other words, this ruling has been criticized at multiple levels by both proponents as well as critics of the ruling.

What does it mean for Online Ecommerce Retailers and Sellers?

In addition to added paperwork, more legal complications, a check on the rules and regulations, online retailers are burdened with the financial aspect. In an era of increasing competition, the aim is to charge the customer as less as possible and offer the greatest possible services.

The Quill Corp judgment allowed online retailers to not collect state tax from consumers. This helped in keeping the prices down and help businesses grow. However, the burden of passing on the tax to customers means those brands would have to rethink their strategy.

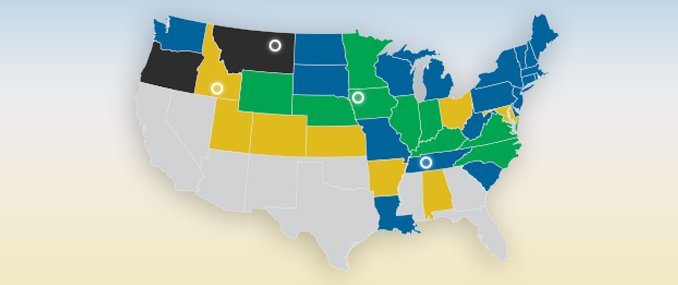

While Nexus laws and state taxes will not be implemented in a retrospective manner, it is important for online retailers to see whether they are complying with the same in different states. As of now, 30 states in the American federation have passed some type of sales tax policy based on the Wayfair Nexus.

Do you think Nexus laws are fair from an online retailer standpoint? Let us know in the comments section below.

Read Also: