What Is The Sortino Ratio? And How To Use?

by Abdul Aziz Mondal Investing 29 July 2022

In the stock market, finding out what trades will be best for you is the best way to make lots of profits. I mean, why not take the time to analyze all the investṣment opportunities and make the best decision possible when you don’t want to lose out on precious money by finding out the Sortino ratio?

Every investment opportunity has some form of negativity to it. There is a chance that the stocks might suffer from losses since the market is pretty volatile and constantly changing. That is why it is essential to know Math and calculate some ratios to understand the shares’ volatility better.

Therefore, to learn more about the Sortino ratio, read this blog below. Here, you will find lots of essential information on the Sortino ratio and how it can help investors make the right choice.

In addition, you will also get to know about the differences between the Sortino ratio and the Sharpe ratio – the ratio from which it is derived.

What Is The Sortino Ratio?

It can be pretty risky whenever investors are willing to invest theory money in the stocks of a certain company or firm. This is because investors only think about the rate of return and the dividends they will receive from the investment.

However, investors are more likely to invest their money in a particular company’s shares only if they predict good returns.

However, there still exists a possibility that the return from the investment might not be what was expected. The chance for these expected returns to go down and bad is still not out of the picture yet.

Therefore, you can say that calculating the risks against these investments is also necessary before making the trade. So for calculating such risks, the Sortino ratio is used by investors.

It is the same as the Sharpe ratio. The only difference is that it helps calculate the potential risks to investments instead of its profitability.

How To Use The Sortino Ratio?

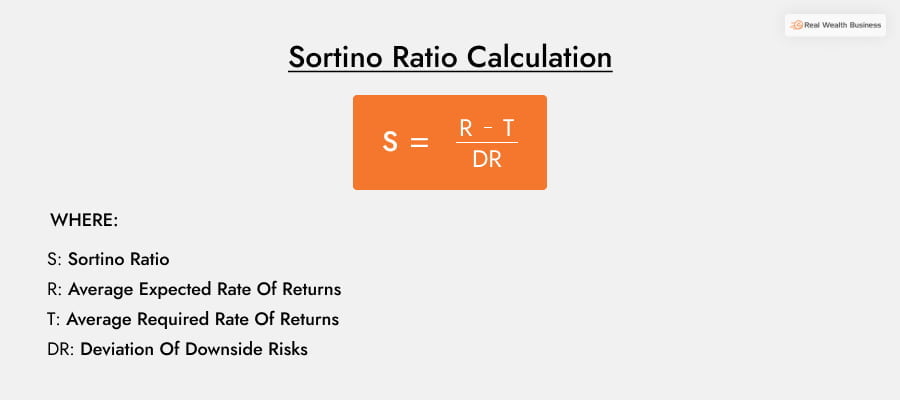

If you want to know how to do the Sortino ratio calculation, then you can do so by using this formula:

S= (R-T)/DR

In the above Sortino ratio formula, the abbreviations stand for:

- S: Sortino Ratio

- R: Average Expected Rate Of Returns

- T: Average Required Rate Of Returns

- DR: Deviation Of Downside Risks

In the formula above, the DR is denoted as a percentage. Therefore, investors consider it as a form of standard deviation.

You need to understand how the Sortino ratio gets used. The example below will hopefully be enough to help you understand how the formula works:

Let’s take two different mutual funds – A and B, respectively. A will provide annual returns at 12%, with a downward deviation being around 10%. On the other hand, mutual fund B will provide annual returns at 10%, with a downward deviation being around 7%. In both situations, the risk-free percentage or rate is around 2.5%.

Therefore, if you want to calculate the Sortino ratios for both, you will calculate it by:

Sortino Ratio Of Mutual Fund A: (12% – 2.5%)/10% = 0.95

Sortino Ratio Of Mutual Fund B: (10% – 2.5%)/7% = 1.07

From basic observations, we can see that mutual fund A provides more dividends and returns than mutual fund B. For example, a provides approximately 2% more returns compared to B.

However, when you calculate the earnings, in the long run, you will notice that the dividends provided by A have a higher chance to increase compared to B, which has a higher risk of falling. Therefore, since A has a higher Sortino ratio, it is the better investment option overall.

Read Also: What Is Cash Coverage Ratio? How To Calculate It?

The Sortino Ratio vs Sharpe Ratio: What Is The Difference?

Most investors prefer the Sortino ratio as an improvement over the Sharpe ratio. The latter ratio is mostly used to calculate investment risks so far.

However, since the Sortino ratio came into the picture, investors have been using it to assess the risks of potential investment opportunities better.

This happened because the Sharpe ratio sees risks as a whole. Therefore, if there is a risk, the investment is considered to be bad. However, the Sortino ratio incorporates the downward deviation into the factor.

Therefore, it only considers the good risk and eliminates bad risks. Therefore, it provides a clearer representation of whether the investment’s risks are worth it.

Frequently Asked Questions (FAQs):

Ans: According to investors, the answer to what is a good Sortino ratio will be somewhere around 2. It can also be more than 2. Therefore, you can say that an investment rate like 0.392 is pretty bad in comparison.

Ans: If the Sortino ratio is higher, the investment results will also be better in comparison. Therefore, if you have to decide between two different investment deals and opportunities, then you must go for the one with the higher Sortino ratio.

Ans: If you look at it from a simplistic point of view, then both the Sortino ratio and Sharpe ratios are the same. The Sortino ratio only provides slight variations on the Sharpe ratio, mostly identifying and evaluating bad trades and downsides to an investment opportunity. Therefore, the Sortino ratio is mostly used to analyze highly fluctuating and volatile investment opportunities.

Ans: Yes, the Sortino ratio is essential to understand. The answer lies in the fact that this ratio defines an investor. With the proper calculation, the Sortino ratio can help the investor determine relative risks and returns to a particular investment opportunity. Stock market brokers and investors mostly find this ratio.

Conclusion

The Sortino ratio calculates the worth of an investment opportunity by measuring the risks involved. Unlike the Sharpe ratio, it uses the standard deviation of threats instead of the risks as a whole.

Therefore, it only considers the reasonable risks involved in the investment, not the bad. This is better because it provides a more accurate representation of how the risks will affect the investment and how its dividend earned and profitability can change over time.

Read Also: