What Is Cash Coverage Ratio? How To Calculate It?

by Arnab Finance 30 May 2022

Every organization starting from the renaissance runs on the balance sheet. Without proper cash calculation, it is impossible to run your company successfully. Therefore, you need to understand these factors while you want to develop your business in the correct direction.

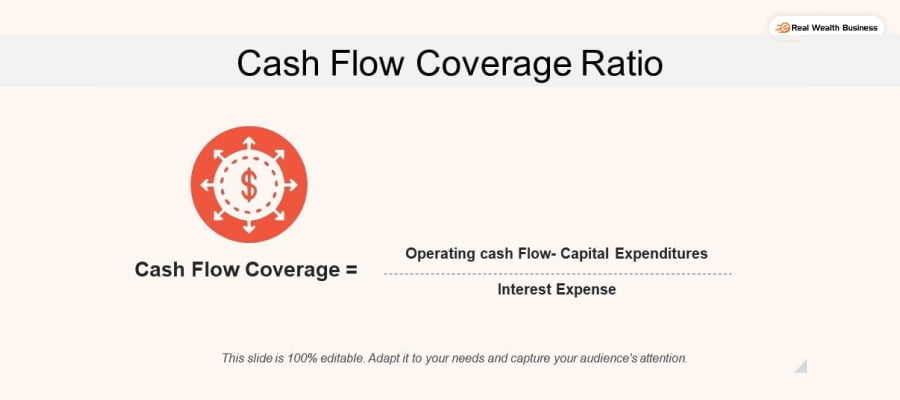

The cash flow Coverage ratio is one of the most critical parameters you have to take care of while developing your business. It is necessary to measure the business’s liquidity to gain better returns from your investments.

To learn the benefits and process for calculating the cash coverage ratio, you must read this article in detail. But, first, you need to understand the facts that can help you make sense in all possible ways.

What Is Cash Coverage Ratio?

The cash coverage ratio is the calculation that determines the ability of the company to pay off all the debts and the liabilities of the existing cash. Therefore, it is one of the best ways to effectively measure the business’s liquidity. Most of the time, the coverage ratio includes all the cash and the cash equivalents.

Benefits Of Cash Coverage Ratio

There are several benefits of the cash coverage ratio formula that you use while calculating the assets. It offers the following benefits which are essential for you.

1. Become Eligible For Credit

To determine the credit eligibility of most of the creditors, use the cash coverage ratio. It provides you with a fundamental idea of how your business will pay off its debts.

Some creditors will get qualify for the loan. It will help the brands to identify their eligibility.

The cash coverage ratio formula will work well in your way. It can make things work if you have the correct calculation in place.

2. Creating Opportunities & Revenue Improvements

When you identify the cash coverage ratio, it will allow the business to identify the opportunities for improvement.

In most cases, the shareholders will also use these ratios to predict the level of future finances of your business.

This is one of the most fundamental aspects of the Cash reserve ratio that you must know at your end before going through the calculation process. You need to know these facts before making your selection in the right way.

3. Identify The Liquidity Of The Company

The cash coverage ratio will reflect the ability of the brand how quickly they can pay off the business debts to its debtors.

It reflects the financial strength of the company to make things work well in your way within an estimated time frame.

If a company can quickly pay off the debt of its investors, then it can build a positive reputation for the brand. In addition, it can make things work well in your way within a stipulated point in time.

4. For Attracting Investors

Some of the established brands of the world use the cash coverage ratio to attract investors towards them. It shows that businesses can quickly cover up their debts as more investors are willing to pay off the debt.

You can also make use of this ratio to identify the company’s funding needs. Sometimes it can help derive the funding needs of the company.

It can make things work your way within a stipulated time as you make your investments.

How To Calculate Cash Coverage Ratio?

You have to follow specific steps to calculate the cash and cash equivalents. It can make the cash coverage ratio more useful.

Step 1- Calculate cash and cash Equivalent

You first have to calculate the cash and the cash equivalents assets or the investments you can quickly convert into cash within 90 days. For example, it may include the number of treasury bills, government bonds, and money market funds.

Formulae= Cash +Cash Equivalent = Total Cash Available With The Company

Step 2- Divide The Total Current Liabilities Of The Company

After calculating the total cash & Cash equivalent, you have to divide the company’s total current liabilities by the total cash equivalent. It will provide you with the data on the cash coverage ratio.

Formulae= Total Cash Available With The Brand/ Current Liabilities= Cash Coverage ratio

Step-3- Analyze The Calculation

After you get the figure of the cash coverage ratio, you can make your decisions to pay off your company’s debt.

If the cash coverage ratio gives results of less than 1, then it means your company cannot pay off all its debt. On the other hand, if the ratio is above 1, then it has the ability with it to pay off all its current debt.

What Is Cash Debt Coverage Ratio?

The cash debt coverage ratio shows the ability of the company to pay off all the debts within a stipulated time frame. You need to know these calculations before making your investment decisions at your end.

Ensure that you do not make your choices the wrong way while achieving your objectives effectively.

FAQ (Frequently Asked Questions):

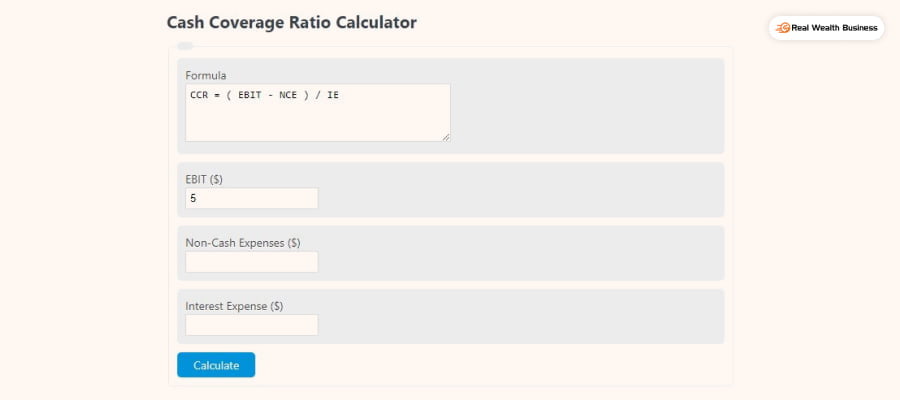

The formula for cash coverage ratio is (Earnings Before Interest & Tax + Noncash Expenses)/Interest expense = cash coverage ratio. You can put this formula and calculate your company’s cash coverage needs.

A higher current coverage ratio of cash debt highlights a company’s liquidity position concerning its current financial status. For example, if the ratio stands in the figure of the perfect balance it indicates that the business’s current financial position is good and is in a place to pay off all its liabilities.

The higher your cash coverage ratio indicates, the better the financial position of your business. You need to know these facts while you want to reach your objectives effectively. Therefore, ensure that you do not make your selection on the wrong pathway.

You need to understand the interest coverage ratio as the lower the ratio, the more the company is burdened by all the debt expenses and less capital. The main objective is to meet the interest expenses, which may be questionable at times.

A coverage ratio of cash debt is of one indicates that the business has a high capacity of cash liquidity to create the debts on time. You need to know these facts while having a low cash debt ratio. Ensure that you do not make your selection in the wrong way.

Final Take Away

Hence, these are essential core factors that you need to have a clear idea about the cash coverage ratio. You need to identify these facts while you want to achieve your objectives effectively. Ensure that you do not make your selection incorrectly.

Feel free to share your views, ideas, and opinions about these facts. However, in this article, you have to understand the core factors which can work well in your way. Ensure that you avoid making your choices in the wrong direction.

The cash coverage ratio will highlight the current financial status of your company, and how you can achieve your objectives will work in your way. Consider the cash coverage ratio formula to make things work better whenever you are making your investments.

Read Also: