Accumulated Depreciation – Definition, Formula, Calculation All In One

by Shahnawaz Alam Finance 14 August 2023

Accumulated depreciation is one of the most used ways for businesses to calculate asset depreciation.

Businesses use this method to calculate depreciation to best use their capital assets at the right time. This method of calculating depreciation allows companies to use their capital assets every year and generate revenue in doing so.

You can see this type of depreciation in such a way – it is the total amount depreciated for an asset till a single point in time. If you are curious about this type of depreciation, I suggest going through this article. Here is a detailed definition and explanation of accumulated depreciation and different methods for calculating it.

What Is Accumulated Depreciation?

Accumulated depreciation refers to the total and fixed depreciation of an asset or property charged since it was acquired and made available for use. The purpose of accumulated depreciation is to match different benefits generated by the asset charged accumulated revenue against within its useful life.

This is also seen as a contra asset on the balance sheet. This depreciation represents the credit balance. So how does the depreciation appear on the balance sheet? Well, it is reported as a reduction from some fixed asset’s gross amount.

Accumulated depreciation for an asset is bound to increase over time while depreciation continues to be calculated against the asset. When the asset is sold or put to use, the accumulated depreciation related to it will get reversed, thereby eliminating its record from the balance sheet.

However, if this derecognition were not supposed to happen, the company would build up a massive amount of gross fixed asset cost little by little. This would also accumulate accumulated depreciation on the balance sheet.

Why Is Accumulated Depreciation Important?

Why should a business calculate accumulated depreciation on a certain asset? If you see from the perspective of accounting, then you will understand why companies record the expenses of their assets on a monthly, quarterly, and monthly basis. It allows them to see how accumulated expenses affect a company’s revenue.

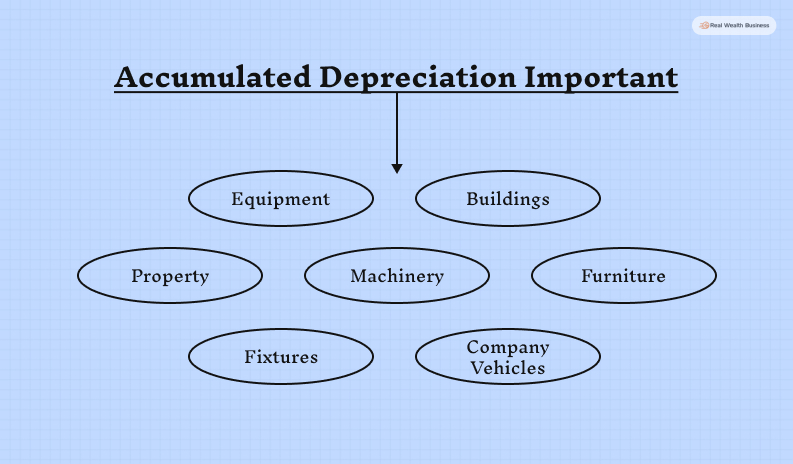

It also offers necessary and valuable insight into the capital gains and their losses when they stop using an asset or sell them. This depreciation also allows a business to gain insight into the asset’s sale. Here are some examples of the capital asset –

- Equipment

- Buildings

- Property

- Machinery

- Furniture

- Fixtures

- Company vehicles

However, you must know that accumulated depreciation is not applicable to lands. Your land is a fixed asset, but you cannot use accumulated depreciation on it. The reason is that land does not outgrow its usefulness of itself throughout a fixed period of time. However, the different examples given above are depreciable.

Accumulated Depreciation Formula

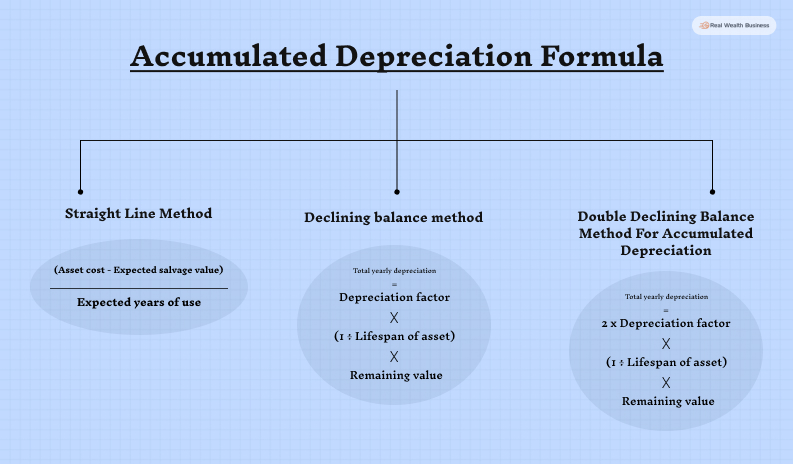

If you want to calculate accumulated depreciation, you need to follow one of the three major formulas there are for calculating it. Here are the three different methods you need to follow to calculate accumulated depreciation –

1. Straight Line Method

Here is the formula for calculating accumulated depreciation using the straight-line depreciation method –

| (Asset Cost – Expected Salvage Value) ÷ Expected Years Of Use |

When a business first gains an asset, the cost of the asset is seen as the original value of it. But the total expected salvage value of the asset is represented through the salvage value once it has gone through a long tenure of use.

When wanting to calculate accumulated depreciation using the straight-line method of depreciation, you have to follow the steps below –

- First, you have to subtract the asset’s salvage value from the asset’s cost.

- Use the life of the asset to divide the value into 1.

- Now, use the number of years to multiply the result by 2.

2. Declining Balance Method

Another way of calculating accumulated depreciation was through the declining depreciation method. It is one of the most relevant methods for realising the depreciation of most assets during the early days of their useful life.

According to this method, a company charges or balances out most of its asset’s depreciation during the beginning years of its useful life. It is done when the company gains ownership of this asset. Throughout the later years, when the asset loses its value and usability, the company reduces the rate of depreciation of its value.

Here is the basic formula for accounting accumulated depreciation of an asset through the declining balance method –

| Total Yearly Depreciation = Depreciation Factor x (1 ÷ Lifespan Of Asset) x Remaining Value |

Later you can calculate the depreciation value on a monthly basis. But, for that, you have to divide the result using 12. Also, if you need to assume a higher rate of depreciation, you have to multiply the rate by two.

3. Double Declining Balance Method For Accumulated Depreciation

The double declining balance method is an accelerated method of depreciation used in accounting to determine an asset’s accumulated depreciation.

However, there is a difference between the declining depreciation method and the double declining balance method. This accounting system depreciates an asset at twice the speed of the previous method we discussed.

| Total Yearly Depreciation = 2 x Depreciation Factor x (1 / Lifespan Of Asset) x Remaining Value |

The double declining balance method is applicable to assets that quickly lose their value after they go into use.

If you want to calculate accumulated depreciation using the double-declining method, then follow the steps mentioned below –

- First, find the straight-line depreciation rate.

- Now find the asset’s remaining book value.

- Use the remaining value to multiply the straight-line rate.

- Now multiply it by two.

Final Words

It is common for businesses to have assets that depreciate quickly. According to the business’ accounting needs, they can use the accumulated depreciation method to keep their accounting process clean and clear. This depreciation method also helps them generate revenue using a particular capital asset concerned.

I hope that this article was helpful. In case you want us to provide you with any more answers to your queries, you can use the comment box below to let us know. We value your insightful feedback. Thank you for reading.

Additional Top Resources: