Amortization Definition And Its Importance – Let’s Find Out

by Shahnawaz Alam Finance 20 June 2023

One of the many perks of running a small business is that you get to learn a lot. You stay involved with marketing and sales and even work on accounting and creating financial statements for your business. One of many of those accounting terms you learn is amortization.

But what is amortization? Simply put, small businesses with some intangible assets can reduce their taxable income through amortization. So, if you are curious to learn about amortization and how it works, go through this article.

What Is Amortization?

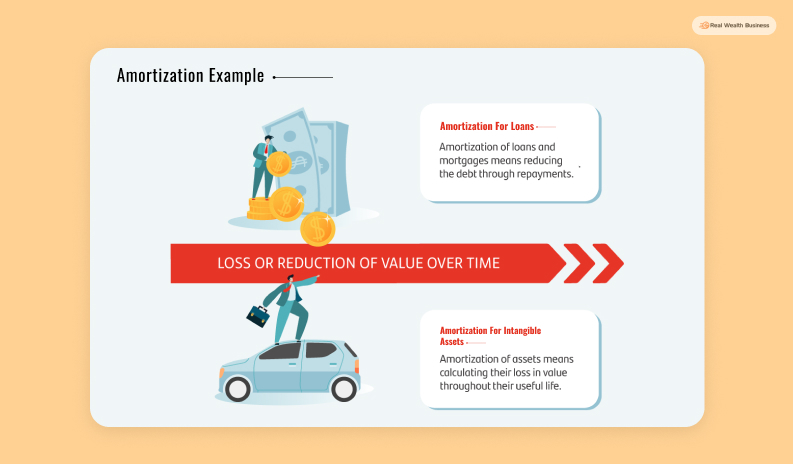

Amortization can be in two different aspects for a small business. The first one is the amortization process for business loans and the amortization of assets.

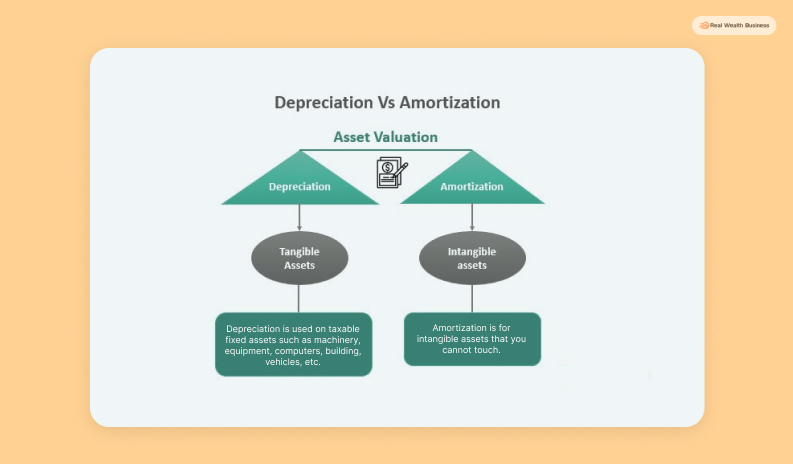

You cannot mistake amortization for depreciation. There are two different accounting methods for different types of assets needed for running a business.

Through this process, the cost of an intangible asset is distributed over time. Business owners have a fixed and designated period/amortization schedule throughout which they pay installments.

The business book records different portions of the cost as amortization expenses. The key purpose of amortization is to reduce a business’s taxable income throughout the useful Lifespan of an asset.

What Can You Amortize?

Businesses can use the amortization process on only a few assets. But what are those assets that a business can amortize? Here are the different assets that amortize –

While fixed assets depreciate, amortization is for intangible assets and spreading their costs through the useful life cycle of an asset. These assets do not have any physical presence, but they add some value to your business. For example, it is difficult to amortize trademarks.

Through this process, business owners can write off the cost of an asset throughout its useful life cycle. However, intangible assets with an indefinite life cycle cannot be amortized.

How To Do Amortization Journal Entry?

Amortization is an important accounting method, and its calculation requires three fundamental elements. Three of these elements include the primary value of the asset, the useful life the asset has left within, and the salvage or the residual value of the asset at the end of the useful cycle. Here, go through these points to have a clearer understanding –

Find The Asset’s Initial Value

It is not easy to define the initial value of an intangible asset. Also, it is not that easy to know the initial cost of an asset. That is why you might need the help of any legal assistant or lawyer.

- Estimate The Lifespan Of The Asset

This part is about figuring out how much time you will use the asset. Let’s say you have a design and will use it for over 14 years. So, if you patent that design for 14 years, you can amortize it for 14 years.

- Find The Asset’s Residual Value

When an asset is in use, it decreases in value during its useful life span. Once the useful life span ends, the remaining value is called the residual value.

How To Calculate Amortization?

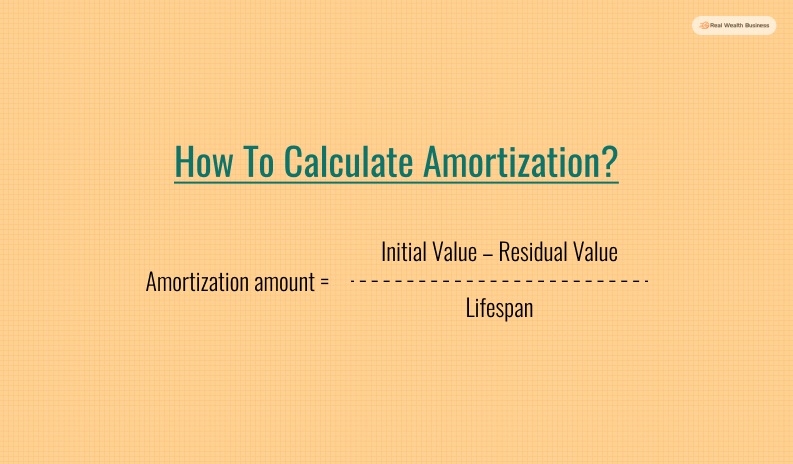

Once you have all the data required for calculation amortization, follow the amortization formula.

Amortization Formula

| Amortization amount = (Initial Value – Residual Value) ÷ Lifespan |

So, now you can use the amortization formula to calculate amortization for any intangible asset. Here is a step-by-step guide –

- First, subtract the residual value of your asset from the basis price (the amount you spent on the asset).

- Now divide the figure using the remaining life of the asset (the amount of time you can use the asset for).

- Following the steps before should give you the time you can pay off.

Amortization Example

Businesses can amortize assets such as trademarks, patents, licenses, and more. Those are some examples of intangible assets that a business can amortize. Here is a simple example of amortizing an intangible asset –

💲 Amortization For Intangible Assets

Let’s say that a business holds a patent to equipment that is valid for 30 years. The equipment requires you to spend $30000 to create it. Now you can amortize the cost throughout the 30 years span. In this case, you can record $1000 each year in your journal to amortize the patent of this equipment.

💲 Amortization For Loans

Amortization for loans works by recording the repayment of the principal each year. Let’s say that you have a loan of $8000 outstanding. If you repay $2000 of the loan’s principal, you must record $2000 in amortization against each year.

Importance Of Amortization

When a business has a loan, it can use amortization to calculate or determine the amount they have to spend monthly for loan repayment. Here are a few important things you need to know about amortization –

- Amortization lets a business determine what to spend on loan payments (including interest and principles.)

- The amortization schedule has a table consisting of the breakdown of a loan. This allows you to see different parts of the loan.

- Through amortization, they determine which loan is best for them and which lender they should choose.

- Businesses can also make well-informed business decisions using amortization as an accounting method.

- Also, amortization helps a business rescue its taxable income by writing off the cost of an intangible asset over time.

Difference Between Amortization And Depreciation

Depreciation and amortization have similar processes for spreading the cost or writing off the cost of fixed and intangible assets. However, there are some fundamental differences you need to be aware of. Go through this table to have a detailed idea about the comparison between both of these accounting terms –

Depreciation Vs Amortization

| Depreciation | Amortization |

|---|---|

| ✅ Depreciation helps account for long-term fixed assets and spreads them throughout an estimated lifespan. | ✅ Amortization writes off an expense over a long period for intangible assets. |

| ✅ Depreciation helps reduce the taxable income of a business. | ✅ Amortization also helps reduce the taxable income of a business. |

| ✅ Depreciation is used on taxable fixed assets such as machinery, equipment, computers, building, vehicles, etc. These are items that you can touch. | ✅ Amortization is for intangible assets that you cannot touch. These are patents, trademarks, or a loan. |

Bottom Line

As an important accounting method, amortization can help businesses a lot. Once you go through this article, you will clearly understand how amortization works. I have discussed its benefits and the processes businesses use to journal amortization.

However, please let us know through the comment section if you need further assistance. We will get back to you in no time.

Wait…before you leave, consider these top resources: