What Is Deferred Annuity? Types, Benefits & More

by Shahnawaz Alam Financial Planning Published on: 05 August 2022 Last Updated on: 17 July 2024

Do you want to know about the total concept of Deferred annuity? If yes, you must read this complete article to clarify your idea.

Deferred annuities are insurance contracts that will help you generate retirement income in exchange for one-time or recurring deposits for at least a year.

Most of the time, the annuity company will offer you total repayments of your investments plus some incremental returns.

What Is A Deferred Annuity?

A deferred Annuity is an insurance contract that will help you leverage income for retirement. You can withdraw money for at least one year or generate a recurring deposit for at least one year. Sometimes the annuity company can also pay you some total repayments for your investments plus some of the returns.

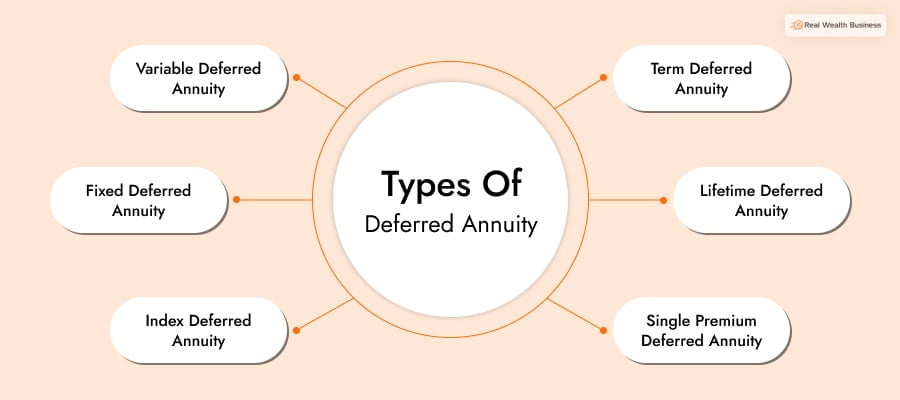

Types Of Deferred Annuity?

There are several types of deferred annuities that you can opt for at your end. Some of the crucial annuity plans which you must know at your end are as follows:-

1. Variable Deferred Annuity

Variable annuities will not provide you with any type of guaranteed rate of returns. However, with the help of variable annuities, you can invest in stocks, bonds, mutual funds, and money market accounts.

Now, if your investments perform well, you can grow your money from the investments of variable deferred annuity. In addition, it will increase the level of your future payout.

Now the other side of the coin is your investments also can underperform. In such a scenario, you may lose your money. So make informed judgments about your investment plans.

2. Fixed Deferred Annuity

In contrast to the Variable annuity, a fixed annuity can provide you with fixed returns from your investments. Therefore, it is often compared to the CD (Certificate Of Deposit).

You can gain fixed returns from your investments. The best part is you will have a safe return on your investments. The rate of interest may be low compared to the market returns.

You will experience less risk when you have a fixed annuity in your name. However, if you want a steady return of income after your retirement, then it is the best option.

3. Index Deferred Annuity

An index annuity will allow you to earn more money from your investments. If the market condition is good, you will gain more money; if the market performs poorly, you will make less.

It may sound like a variable annuity, but there is a fine line of difference as the ceiling and loss rates have limitations.

You will not have the highest possible gain, or you will not have the highest possible loss. However, one thing is guaranteed here you will not lose your initial investments.

4. Term Deferred Annuity

It is a type of annuity plan where you can get the maximum returns from your investments for a specific period or terms. Here a particular time is set, say five years to 20 years.

If you die within the term, your heirs or dependent individual of your family will receive these term deferred payments. Now even if you are alive and the time ends, you will stop receiving the payments.

You need to know these facts while you want to reach your goals at a specific point in time. Then, make investments in your retirement plans after going through the plan details.

5. Lifetime Deferred Annuity

With the lifetime deferred annuity, you make the selection for your future payments, which will last for your entire life. Once you die, your payment will stop, and you have to renew your account.

Once you renew your account, your spouse can get the annuity amount in your favor. You have to understand these things while you want to reach your goals within a specific time frame.

6. Single Premium Deferred Annuity

With a single premium deferred annuity, you have to pay in a lump sum for the annuity amount. However, it can take the shape of a large deposit from your savings to transfer to the retirement plan under 401K.

For the taxed advantage traditional retirement plan, you have to pay the income tax on all income on your annuity plan if it is not taxed before.

Benefits Of Deferred Annuity

There are several benefits of it that you must consider on your end while selecting the deferred pension. Some of its core benefits are as follows:-

- It helps to build guaranteed future retirement income.

- You can enjoy higher investment flexibility.

- No maximum contribution you have to make as per the IRA guidelines.

- Using the contract riders, you can gain extra benefits.

What Is Deferred Income Annuity?

Deferred income annuity allows you to make lump sum retirement purchases to get the guaranteed retirement paycheck. In addition, it offers you guaranteed income at a particular time.

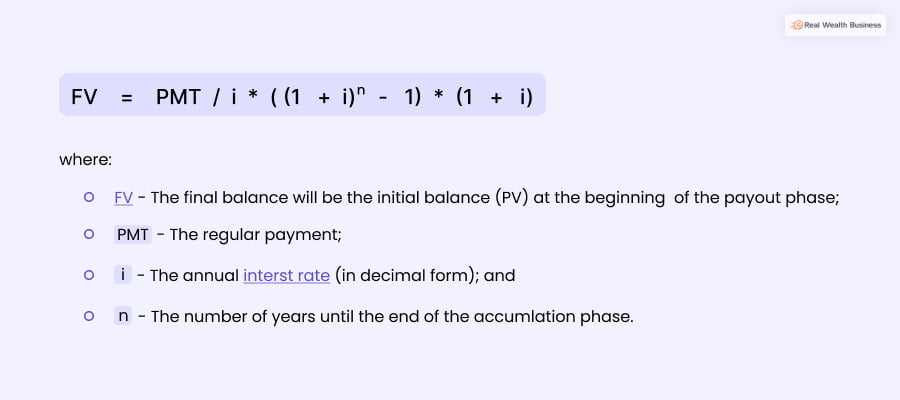

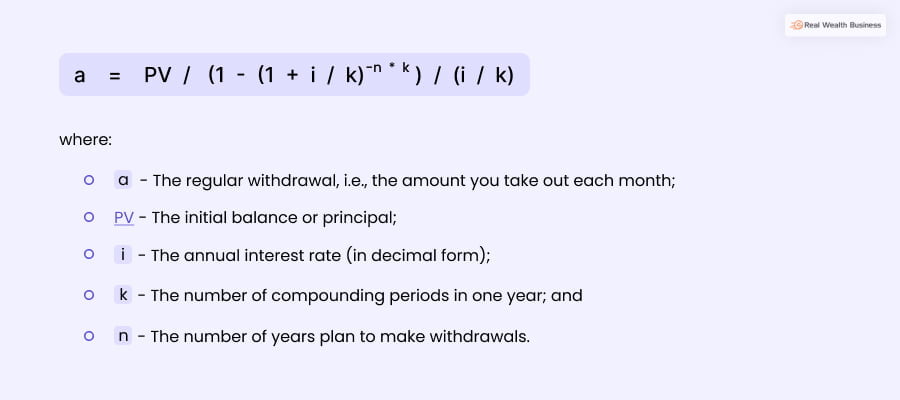

Method Of Deferred Annuity Calculator

The calculator of the plan is divided into two phases. Therefore, you must consider the two calculation phases that I mentioned below…

These are the two crucial calculators for this plan which can help you to bring maximum results for your investment plan.

1. Accumulation Phase

2. Payout Phase

What Is Tax Deferred Annuity?

A Tax-Deferred annuity plan is a particular form of retirement plan which will complement base retirement plan of your employer. It falls under 403(b) plans. It is a supplement plan and tax-sheltered annuity.

Frequently Asked Questions (FAQs):

Annuities are suitable investments for those who want a fixed income after retirement. It will help you to get better levels of returns from your investments.

You will get this at the beginning of the payment interval, while you can generate an ordinary annuity for your business at the end of the payment interval. Therefore, you must consider these facts when you want to get a deferred annuity.

You will have to pay a 10% withdrawal penalty if you withdraw the amount of the annuity before 59 1/2. You also might have to pay the surrender charges if you withdraw the annuity before the maturity period.

You can withdraw it as per your wish before the period of its maturity. But you may have to pay the surrender charges or penalty to the concerned financial organization.

Final Take Away

Hence, it is the total concept of the deferred annuity which you must consider at your end while you want to propagate your brand message. Proper planning will increase the chances of your returns for a specific period.

You can feel free to share your views, ideas, and opinions in the comment box to help us understand your thoughts on this matter. We value your feedback and must know your take on this matter.

It can secure your future, and after you retire from the service, it can provide support to your finances.

Read Also: