How SIP Calculators Can Help In Making Profitable Investment Strategy

by Sarah Jay Investing Published on: 11 October 2017 Last Updated on: 23 September 2023

Have you been thinking of making some investment in mutual funds using a systematic investment plan (SIP)? Well, then you are going on the right path but can you be assured that the plan that you are making is going to yield positive results for you? Well, the plan that you have made may not bring you the desired results, but if you contemplate it and look at the measures to make it profitable you certainly can come up with an accurate investment strategy wherein SIP calculators can be your extremely handy tool.

SIP calculator is a tool that, when used wisely can help in making wise investment decisions. It will not only give you precise results but can also help you see how much you will get with each of your investment options, thus giving you a platform to analyze all available options without moving from one door to another. As we all know, that a mutual fund investment should only be made after thorough research, analysis, and devising, using an SIP calculator is the best option to confirm the plans for your investment in mutual fund programs.

If you are willing to make some money through your mutual fund investments then using a constructive tool like a SIP calculator can help you have a strategic approach towards your aim. But, before we keep praising the SIP calculator for its excellence and ability to give you perspective on your investment plan, let’s have a look at some of the features of an SIP calculator that make it such a unique investment planning tool.

Features of the SIP Calculator

Provides Accurate Results

The SIP calculator is designed keeping in mind several parameters like NAV, time, the value of money, and IRR that directly impact the mutual fund investment. This is why the results calculated by the SIP calculator for mutual funds are very accurate.

Helps You Choose the Correct Plan

As the tool allows you to calculate the returns that you will be making on your investment, it becomes easier to compare different investment schemes available in the market and select one that meets your requirements best.

It’s User Friendly

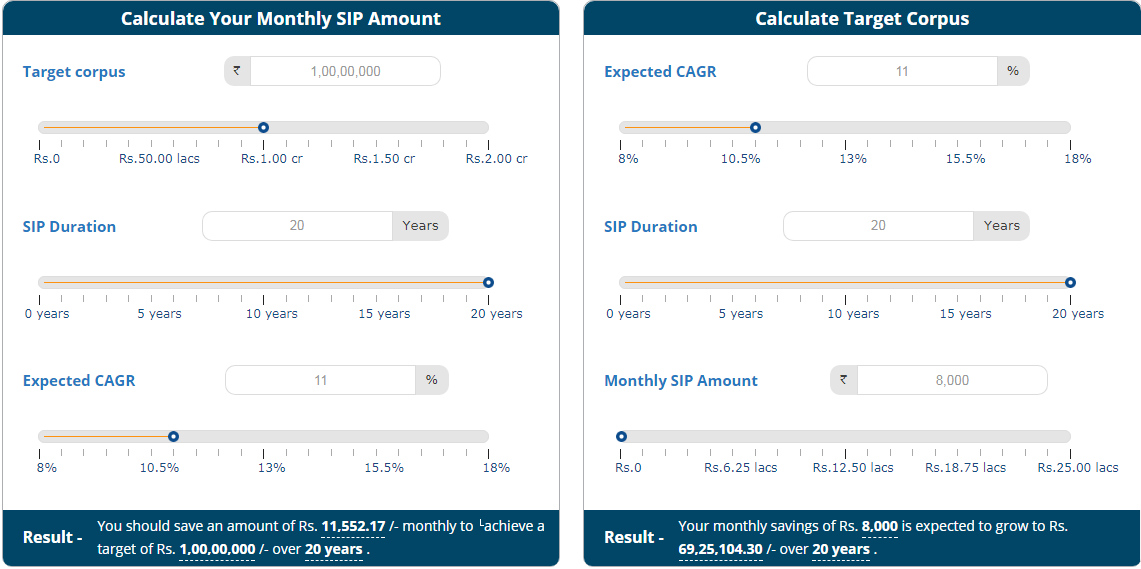

Most of the SIP calculators available online come with an easy and user-friendly interface that can be accessed by anyone, even those who have never used any type of investment calculator before. Most of the SIP calculators ask for three basic questions to make the calculation which include the monthly amount you are willing to invest, the tenure of the investment, and the rate of return you are looking at. Providing this much information is enough for an online SIP calculator to give you the exact worth of your investment in the future.

You Become an Independent Investor

Because this tool is extremely easy to use and also offers accurate results it enables investors to not only make comparisons between the various schemes but also helps them in deciding which plan is best suited for their needs independently. They can decide on which plan should they choose for investment without the help of any broker.

With these many features, a SIP calculator has certainly simplified the process of finding the right mutual fund SIP investment. Now that you know its features, you must be craving to know how you can make the most of it. To help you in your quest, we have enlisted some of the vital benefits of the SIP Calculator.

Benefits of the SIP Calculator

You Can Find The Right Amount Required For SIP Investment

There will be a time when you will find it difficult to decide the right amount you should invest in SIP so that you can meet your financial requirements in the future. In such a case, SIP calculators can be of great help to you as it will help in analyzing the right amount you need to invest on a regular basis so that you can reap the desired benefits in the future.

You Can Calculate the Accurate Worth Of Your Investment

How will you feel if you get to know the exact return on your investment that you will get to enjoy in the future? Well, amazing of course, and SIP calculators can actually help you rejoice with that thought. In just a few easy steps you can calculate the precise return on your investment in the near future. This assessment of ROI can be a game-changer for your finding the right investment option game. Also, once you know the near-accurate future value of your investment you can easily plan your future in advance accordingly.

So, if you want to fetch maximum benefits out of your mutual fund investment then it is best to opt for a SIP calculator as it will only help you make an informed decision for your investment plan. The benefits that an SIP calculator comes with can help you have defined results that you can further analyze to see whether they are meeting your expectations or not.

Any mutual fund investment company in the country will offer you a Systematic Investment Plan wherein you can make your step-by-step investment in a mutual fund to get rewarded for your savings in the future. The best thing about SIP is that you don’t have to put your lump-sum amount at risk, which makes it safer than any other investment option. The disciplined approach that SIP investments bring with them allows people to make an investment on a weekly, monthly, and quarterly basis, thus not putting any burden on their regular expenses.

If you are in search of an SIP calculator that can help you make an investment in the profitable Systematic Investment Plan (SIP) then you can visit the website of a financial services company like Paisabazaar.com or any mutual fund investment company that provides free SIP calculator tools to help you assess your investment potential and future returns.

Read Also: