What Makes For a Successful Management Buyout Process?

by Arnab Dey Business Published on: 15 March 2022 Last Updated on: 16 March 2022

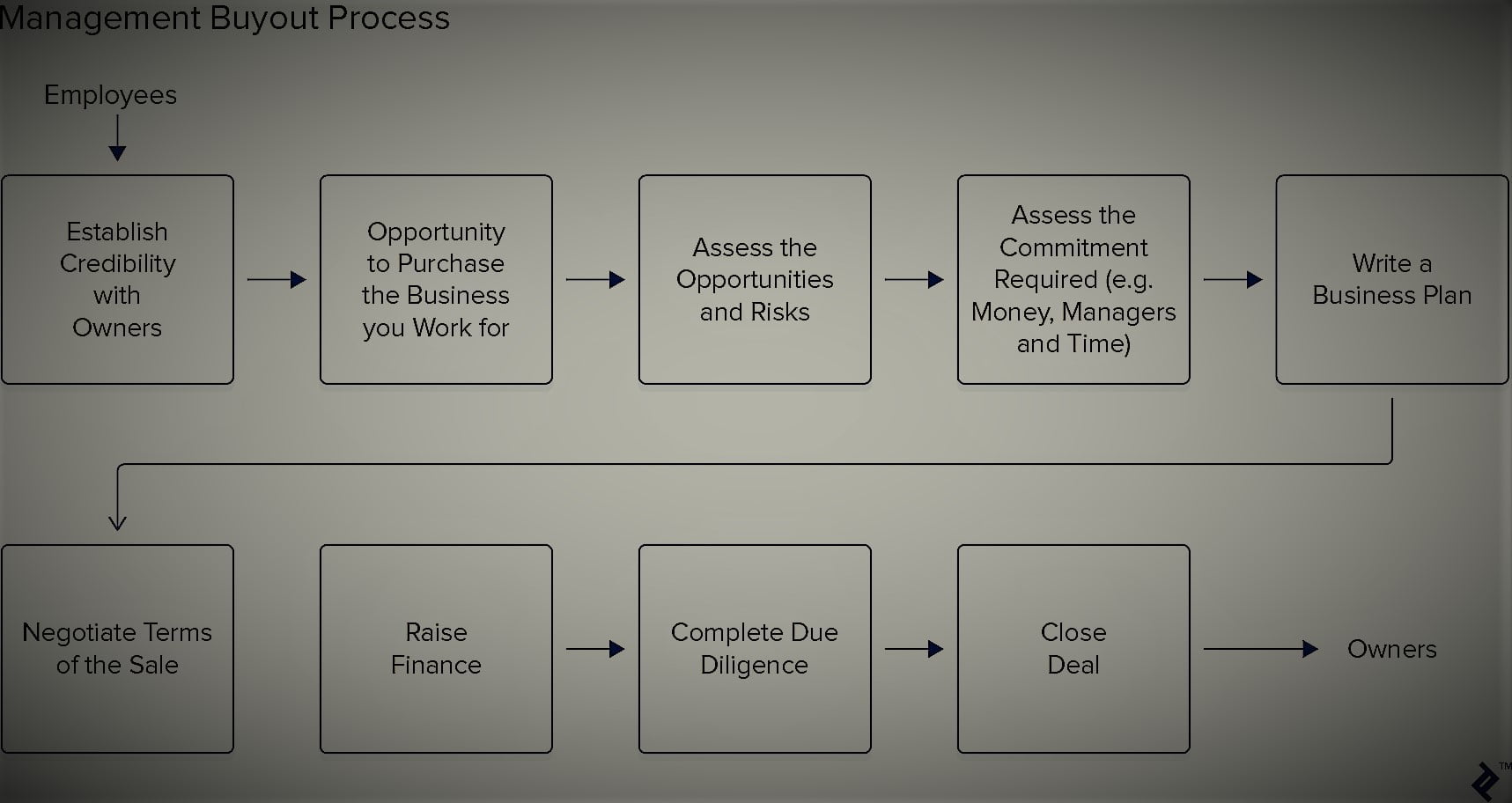

A management buyout is a process that has been popular since the 80s and involves the management staff of an organization acquiring the business from the owner.

This is often preferable to a trade sale as management will know the ins and outs of the company and you do not have an outsider coming in to run the company.

As you might imagine, it can be a complex process, though, so read on for all that you need to know about MBOs.

What is the Management Buyout Process?

Management teams will rarely have the financial resources to buy the company outright, which is why pooling resources and securing funding is so important with a management buy out.

This is a more specific form of a leveraged buyout (LBO), which is a transaction that involves a business being purchased with a combination of equity and debt with the cash flow used as collateral to secure and repay the funding.

What are the Incentives of an MBO?

An MBO can work out well for both the buyer(s) and the seller. From the owner’s point of view, they know that they are leaving the company in the hands of people that they trust and know the organization (this is particularly important for family businesses).

An MBO also lowers the risk of confidential information being used by a competitor, which can be an issue if you decide on a trade sale.

For the buyer, an MBO can be a smart move because it provides the opportunity to earn more money, take on greater responsibility and grow the business.

There is also less risk for the buyer because they will know the asset well and know what they are getting into.

How Are MBOs Funded?

The key to a successful MBO is the management team securing funding for the transaction.

There are many options for this, including debt financing where the management team will have to spend a large amount of capital with a bank lending the remaining portion required.

Other options include owner/seller financing, private equity financing, and mezzanine financing.

An MBO is often the best option when the owner of a business decides to step away for one reason or another.

Management buyouts can be preferable to a trade sale and management teams can often take the reins with minimal disruption, but these can be complex and expensive transactions so it is important to know what to expect with an MBO.

Read Also: