What Does Passive Income Mean, and How Do You Get It?

by Arnab Dey Money Published on: 16 February 2022 Last Updated on: 02 August 2023

“The best time to plant a tree was twenty years ago. The second best time is now.”

Ancient Chinese proverb from an anonymous source

Across the board, the wealthiest entrepreneurs in the world agree that the establishment of passive income streams is paramount not only to financial stability but to financial success.

Where someone like Warren Buffet is concerned, if you’re not setting up passive revenue structures, you’re setting yourself up to keep working because you have to — and not because you want to.

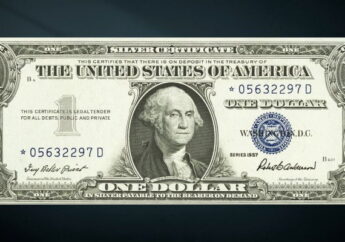

Passive income is a simple concept: it’s money you make without direct action, rather than money you are paid in exchange for performing a service or selling goods. Most of the time, passive income is derived from owned assets, be they tangible assets like investment properties and storefronts, or intangible financial assets like stocks and bonds.

Passive income can also take the form of automated sales platforms, which essentially require no paid labor to operate and maintain. For example, musicians, podcasters, and video producers reap a financial reward — royalties — via the distribution of their intellectual property on online media platforms.

In all cases, the generation of royalties from intellectual property is considered passive income. You could say that passive income is, essentially, money made from owning something, rather than doing something.

The best thing about passive income streams is how much of your time they require, which is none. Passive income flows no matter if you’re awake or asleep, working or not working, and if you are working, even better. Of course, that old saying applies here: you have to spend money to make money.

To set up passive revenue structures, you need to invest one way or another. It can be as simple as purchasing fractional stocks via one of many fintech apps, or as involved as investing in a restaurant in a happening part of town, but either way, you have to plant seeds if you want things to grow.

Passive Income Examples

1. Stock Market Investments

Stock market investing shows us two distinct forms of income generation: value appreciation and dividend distribution. In all cases, shares of a publicly-traded company’s stock should be purchased with the expectation they will appreciate, allowing the owner of the shares to liquidate their stock later in exchange for an amount of money greater than what they initially paid.

However, stocks should be treated as a long-term investment, not a short-term gamble; in most cases, stocks won’t appreciate profitably within a short period, and purchasing stocks to make a quick buck is a risky move.

Instead, look for stocks that reward shareholders with dividends, a portion of the company’s profits determined by the value of shares held. A rich and diverse stock portfolio will produce usable income via quarterly dividends.

2. Fractional Stock Investments

These days, there’s no excuse to be locked out of the stock market just because you can’t afford a share, or you feel uncomfortable sinking your limited investment starter budget into one or two expensive stocks. Even a modest investment can develop a diverse portfolio by purchasing fractional, or partial, shares.

Fintech apps like Cash App have made it easier than ever to casually invest in the stock market by letting users purchase what they can afford. Just like with whole shares, owners of fractional shares are entitled to dividends, though in this case, the dividends are also fractional.

For those new to the stock market, or without a large budget to work with, fractional shares are a great way to lay an investment foundation.

3. Cryptocurrency

If we’re talking about stocks, we may as well mention crypto. As investments, cryptocurrencies behave similarly to stocks. They appreciate or depreciate based on market variables, and they sometimes pay out dividends to their holders.

Generally, the same investment rules that apply to stocks apply to crypto: invest for the long term, and invest because you like the product and believe in it. Of course, cryptocurrencies can generate passive income in a way stocks can’t: they can be mined.

“Mining” refers to running software that verifies cryptocurrency transactions and nets a reward for doing so. While mining cryptocurrencies was once a relatively non-intensive process that could be performed by most consumer laptops, verifying the blockchain of today’s bitcoin or Ethereum now requires specialized computer equipment to efficiently turn a profit, and the energy costs are high.

Thankfully, there are specialized services that allow you to purchase mining computers and have them hosted at remote facilities built for efficient mining, allowing you to create a passive income investment without even plugging anything in.

4. Rental Properties

What’s something everyone needs? Did you guess housing? Real estate investment may just be the most common form of passive income, and it’s also one of the most stable. Consider that every time you’ve ever paid rent, you’ve contributed to someone’s passive income stream, and, as stocks do, that dwelling likely appreciated during the time you lived there.

Rain or shine, boom or bust, housing will always be in demand, and you’ll always be able to take advantage of that demand if you own property.

While many rent their excess or unused properties, some seek out rental properties to purchase and pay off over time. Property ownership can be a fully hands-off experience if you hire a dedicated property manager.

Pete Evering, of California’s Utopia Management, insists “the best way to monetize your property is to let someone with expertise, experience, and resources take care of it for you in all regards, ranging from tenant interaction to property maintenance.” Remember, it’s not passive income if you have to be an on-call landlord.

5. Royalties

Do you have an artistic streak? Are you a bedroom music producer in your downtime? Do you often find yourself daydreaming about that book you said you’d write?

Many of us are creative at heart, with hobbies that revolve around making something new and exciting, be it music, art, literature, or anything else printable, readable, viewable, or listenable. In other words, we have a tendency and talent for creating intellectual products, otherwise known as intellectual property.

It’s never a bad idea to finish and publish that book, that song, or that typeface you’re so proud of. Your amateur short film could land you a paid gig with an up-and-coming studio, but it could also earn you cash every quarter from YouTube streams.

That E.P. you’ve been planning in your head during every lunch break could one day provide you with some needed financial cushioning via streaming royalties, or better yet, sync license royalties wherein you are paid for your music being used in other media.

Never write off your art as unlucrative — there’s a market for everything — and in this case, your initial investment isn’t money; it’s your ideas.

6. Mutual Funds and CDs

There are two distinct types of financial investment vehicles that can be considered the safest, least risky forms of financial investment: mutual funds and certificates of deposit, or CDs. They differ in important ways, but as passive income structures they are quite similar, and any well-built investment portfolio should include one or both of them.

Mutual funds and CDs typically payout annually, unlike stock dividends. While stocks can tank, and even real estate can surfer tremendous devaluation, mutual funds and CDs guarantee a complete return on investment, plus interest.

Mutual funds are themselves investment portfolios composed of a diversity of bonds, which are like loans made from a personal entity to a company or the government. While it’s possible to purchase individual bonds yourself, most choose to invest in mutual funds because their monetary return is usually more robust due to the diversity of the bonds held.

CDs, on the other hand, are structured more like savings accounts but dole out much more lucrative interest payments than modern savings accounts.

A CD represents an agreement with a financial institution to loan your money for a predetermined, finite period, after which the initial deposit is returned in addition to an amount of interest accrued by the date of maturity. Different financial institutions offer different CD rates, so be sure to do the proper research on the best CD rates in Hawaii before making any final decisions.

It’s never too late to begin investing in passive income streams. The sooner you start putting your money, your property, or your ideas to work, the better.

Just like that old Chinese folk saying goes, there’s no better time to plant a tree than twenty years ago, but if there’s a second-best time, it’s now.

Read Also:

All Comments

Hemp Gummies

Exploring hemp gummies and pre roll weed has been an enlightening journey instead of me. The status and aroma of these products are stirring, offering a calming and enjoyable experience. Whether I'm unwinding after a extensive light of day or seeking originative enthusiasm, hemp pre-rolls produce a common choice that I can trust. The convenience of pre-rolls combined with the benefits of hemp flowers occasion them a go-to fitting for the treatment of r 'rest and mindfulness. I know the limelight to squad and spotlessness of the products, enhancing my overall satisfaction. Greatly recommend tough hemp flowers and pre-rolls an eye to a holistic and fulfilling event!