What Are The Different International Payment Options When You’re Traveling Abroad?

by Arnab Dey Finance 29 July 2022

When traveling to another country, you always need to carry their currency so that you can easily make payments for your stay, food, and other things. We can always carry a small amount of cash with us, but carrying a bigger amount is not a great idea. So, what if we need to make a payment of a large amount?

What if you buy something and you don’t have enough cash to make payment for it? Don’t worry about it! We know carrying currency is not a great option, and in this article, we’ll describe five different Internation Payment Options that can help you make payments without any hassle

Top Five Payment Options You Can Use While Traveling Overseas:

1. Credit Cards

Using credit cards is hassle-free, you can keep track of your spending easily, and get reward points for every purchase that you can redeem later.

You might be traveling abroad for the first time believing you can make your payments for everything with your credit card. This is true but it’s only possible as long as your credit card allows foreign transactions.

Moreover, you may have to pay a small transaction fee of 1-5% on each foreign transaction. It may sound like a small amount, but it adds up very quickly. So, if you’re traveling internationally with a credit card, make sure it doesn’t charge any additional fee for foreign transactions. Visa and Master Card are the most widely accepted credit cards.

2. Prepaid Debit Cards

Prepaid debit cards are one of the best alternatives for credit cards. In this, you simply add money to your prepaid debit card, and then you can use it either to withdraw cash or make payments overseas. These cards work really well, but they can be quite expensive.

You might need to pay an activation fee of $20 to use the card overseas, and there can be transaction charges of 1-3% on every foreign transaction.

All these charges are not enough, you’ll also need to pay a monthly fee too, varying from $4-$10. And, if you fail to make a transaction on your card in six months, you may end up paying a penalty fee.

3. Traveler’s Cheque

The traveler’s cheque gives you the security of replaceable funds as cash. You can take these cheques anywhere with you, and if in case, you lose these cheques, you don’t lose your cash. You can purchase a traveler’s cheque from a bank using USD money and when the time comes to make payment for anything overseas, you can convert your traveler’s cheque into cash.

All you need to do is to take your cheque to a bank, currency exchange, or forex office like Bookmyforex to cash them in. The agent will do the verification process and once it is done, you’ll get the cash for your cheque. Lastly, if you’re in favor of using a traveler’s cheque, you must know that it is an outdated form of exchanging foreign currency and today most travelers prefer to use forex cards for a hassle-free experience.

4. Forex Cards

Forex travel cards are the most affordable and reliable options to carry money and make payments when traveling abroad. They are also cheaper than other cards and convenient as debit and credit cards. The best thing about forex cards is you can use the card for multiple trips, and get to enjoy special discounts and privileges wherever you go.

The forex cards are accepted worldwide, and you can either make payment via a forex card or use them to withdraw cash in foreign currency at an ATM.

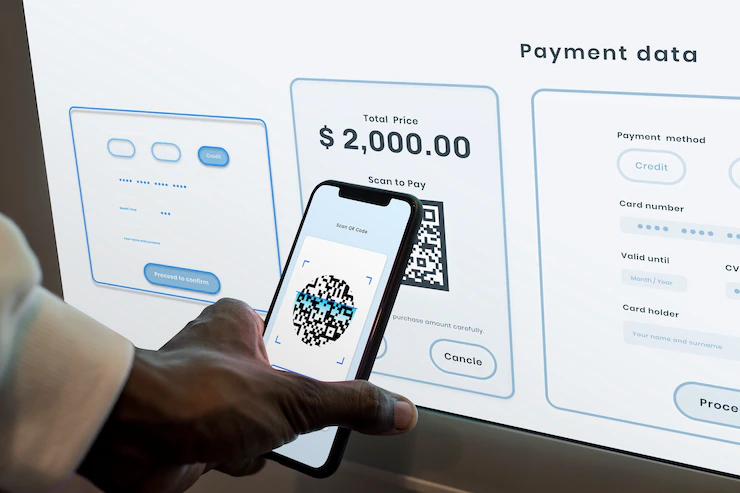

5. Bank Wire Transfers

If you’re planning to perform bank wire transfers, you should know this method can be used either for paying an individual or an organization in foreign. These are one of the most secure ways of making payments overseas.

However, you should know, it is most expensive than other options. Also, you’ll need to pay a flat payment varying from $30-$80. Moreover, bank wire transfers usually take up to five business days to complete. And, if you’re one of those looking for a speedy and cheap option, bank wire transfers are not a good option for you.

Conclusion

All of these payment options have their pros and cons, but each of them will work when you’re traveling internationally and need to make payments.

Overall, your best bet to use is forex cards. It would save you the stress of running out of cash in a foreign country. Also, these cards are least expensive than other options and very easy to use.

Moreover, you can always choose a forex card based on your traveling requirements. Want to know more about forex cards, do let us know in the comment section!

Read Also: