All a Loan: Your Guide to Taking out a Personal Loan

by Arina Smith Loans & Credit Published on: 29 January 2019 Last Updated on: 18 July 2019

Approximately 6% of Americans have an open personal loan in the form of credit cards, mortgages, or student loans.

Taking out a personal loan has been made easy by financial technology startups. These companies account for about one-third of personal loan lending.

You might be in need of a personal loan for various reasons, whether it’s to consolidate debt or meet your education expenses, a personal loan isn’t out of reach. In the past, the process of taking out a personal loan was complicated and time-consuming, but not anymore.

The personal loan industry has changed for the better with the onset of online lending companies. However, it’s essential that you understand the process that’ll qualify you for a personal loan. Most personal loans don’t require collateral and amounts may range from $1,000 to $50,000.

Personal loans are typically paid back in installments that spread over two to five years. Here are the steps that you successfully need to go through when taking out a personal loan.

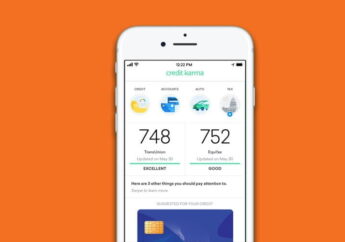

Check Your Credit Rating:

Whether you are considering taking out a personal loan from a bank or online lender, your credit score matters. A strong credit rating increases your chances of getting a high loan limit at a low-interest rate. You can take a look at your credit rating from credit reporting bureaus.

Should you see an error in the credit report, dispute it as soon as possible, or it’ll reduce your eligibility for the loan. If a lender decides to offer you the loan, they might slap you with a very high interest rate.

Generally, scores are categorized as follows:

- Above 720 is regarded as excellent credit

- 690-719 is good credit

- 630-689 is an average rating

- 300-629 is considered a bad credit score

If your rating falls below average, you can take steps to build it before taking out a personal loan. Consider making timely payments on your already existing loans. Late installments are the most significant factor that negatively affects your credit score.

Getting Pre-Qualified or a Loan:

The process of becoming pre-qualified for a loan can involve several steps. It provides a sneak peek at the offers that available to you.

Many lenders will perform background checks to prequalify you. This happens even if they’re considering you for loans for good credit.

Some of the things they’ll ask you at the prequalification stage include your personal information. This includes your social security number, income, current loan status, and employer’s name.

They may also ask for your date of birth, previous address, email, and phone number.

At this point, the lenders may disqualify your application based on several reasons. Your credit score might be excellent, but the following factors might get in the way:

- Lack of work history or income

- A high debt-to-income ratio (ideally 20% or less)

- Lack of proof or ability to repay

- Too many recent credit card applications

Check that the above factors are in order before you submit your application for a personal loan.

Compare the Offers:

After you have been prequalified for a personal loan, compare the terms of credit from the various lenders. Compare the amount offered by each, and the interest rates. The repayment period is also crucial.

If you’ve got a bad credit rating and fear that online lenders may not consider you, try credit unions. The institutions offer lower interest rates, and their terms are more flexible. They’re also your best bet for credit amounts of $2,500 or less.

As you check what the lenders have to offer, consider other credit options. Before settling for the personal loan, check if you qualify for a credit card with 0% interest. If your credit score is above average and you’re sure you can repay on time, this would be the cheapest option.

Alternatively, you can consider going for a secured loan. Giving your car as collateral will increase your chances of being issued personal credit. In the same line, your home, if you own one, can help you acquire a home equity loan.

This is a much affordable option than an unsecured loan.

Read and Understand the Finer Details:

During your interaction with lenders at the prequalification stage, there are many details you won’t get to know. Once you have been approved for your loan application, read the fine print before appending your signature.

Penalties:

Check if there are penalties for prepayment or late payment, and how they’ll impact you financially. Most online lenders don’t charge penalties but don’t assume.

Automatic Withdrawals:

If the lender prefers automatic deduction of the installments from your account, alert your bank. You can avoid overdraft charges by setting up a low balance alert with your bank.

Additional Fees:

The total cost of your loan should be disclosed in the agreement form. It should not come as a surprise much later after you have committed to the credit facility.

Getting Approved:

After the above steps, it’s time to select a lender that best suits your needs. The final step is to provide the lender with your identification documents, address verification, and proof of income. Identification documents can include a driver’s license, state ID, passport, or Social Security card.

For verification of your address, the lender will ask you to submit a copy of lease or utility bills. Proof of income includes bank statements, W-2 forms, or tax returns.

The lender will run a few checks based on these documents. They’ll then send the funds to you according to the lending terms.

Taking Out a Personal Loan – Conclusion:

Taking out a personal loan is no longer as complicated as it was a few years back. With all the online lenders coming up, the loan application and approval process are more competitive. This means that your chances of you getting financed are high, especially with a good credit score.

If you want to speed up the process of getting finances, prepare by checking your credit score. If it doesn’t look good, work on repairing it. Shop around before settling for any lender to make sure you’re getting the best terms.

Upon approval, read and understand the more delicate details. If they’re good enough for you, your loan application process is as good as complete.

Do you want to learn more? You can continue reading finance blogs.

Read Also: