What Is The Difference Between The Rule Of 70 And 72?

by Abdul Aziz Mondal Investing 22 June 2022

Do you want to know the difference between the Rule Of 70 and Rule of 72? If yes, you have to undergo specific facts which can make things work well in your way. You need to know the points that can help you achieve your goals.

The rule of 70 means how much time it will take to double up your rate of return within an estimated time frame. Some of the core factors you need to take care of here are your financial backup and the strength you possess to provide the required returns on time.

Your rates may fluctuate, and calculations sometimes can be incorrect. Therefore, you need to know the facts very minutely before making your investment decisions.

What Is The Rule Of 70?

The rule of 70 means an estimated period your money will take to double up. From the rule of 70, it can be determined what the amount of capital you have invested in the stock market or the share market is.

The property, commodity, and gold which have doubled up within a specific period is the estimated rule of 70. Or you can say the amount of time it can make things work well in your way while you make this calculation.

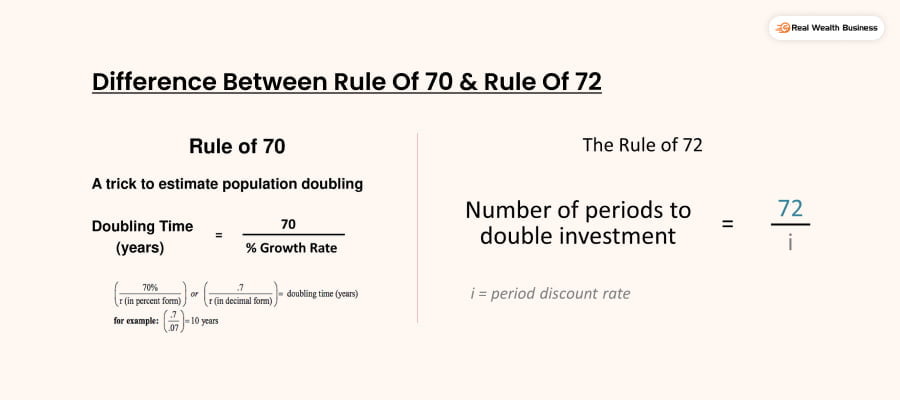

Difference Between Rule Of 70 & Rule Of 72

There are several facts about the rule of 70 and rule of 72, which you must know on your end while developing your financial investment plan in the right direction.

1. Difference In Time Frame

The two concepts rule of 70 and rule of 72 are quite different from each other. In the case of the rule of 70, it is estimated about the required amount of time it takes to double up the money. On the other hand, in the case of the rule of 72, it is estimated that the amount of time it will take to double and the fixed annual rate of interest on the investments you have to make at your end.

2. Calculation Procedure

In the case of the rule of 70, you have to divide the annual rate of growth & yield. On the other hand in the case of 72, it involves dividing the 72 as the yearly rate of the return. In the previous case, the main focus is the growth and the yield, and in the case of the former case, the main focus is gaining the annual rate of return. Effective planning can help you to achieve your objectives in the correct order. Prepare plans to achieve your goals in the correct sequence.

3. Difference In Parameters

In the case of the 70, the main focus is to identify the amount of time it will take to double the amount. On the other hand, the main focus is to make the investments in the amount of time to double the interest rate. It can help you to achieve your goals effectively. You need to identify the procedure well before making your investments.

4. Estimated Calculations

The calculation procedure for the Rule of 70 is => number of years to double return = 70/annual rate of return. On the other hand, in the case of the 72, the calculation procedure is In(e)=1. You have to know these procedures before correctly making or planning your financial investments. Estimated planning can help you to reach your objectives appropriately.

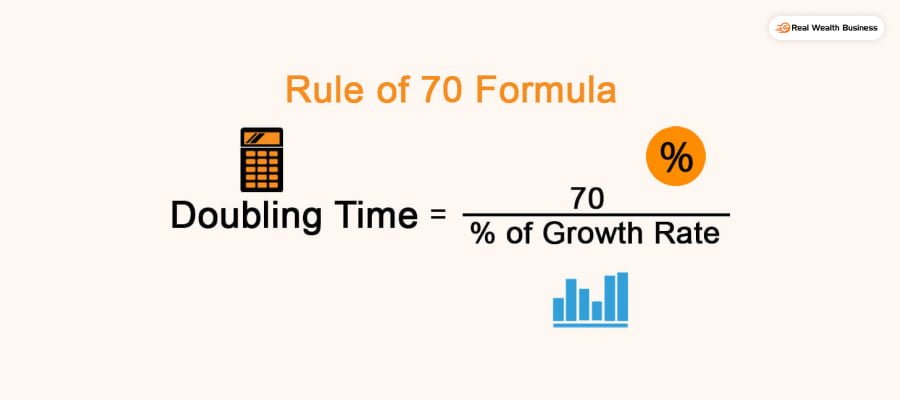

Rule Of 70 Formula

Number of years to double= 70/Annual Rate Of Returns. It is the fundamental formula for calculating the rule of 70. Before making the difference between the two concepts, remember these facts on your end. Ignore making your selection on the wrong path while investing your money.

How To Calculate Rule Of 70?

For calculating the rule of 70, you need to follow the below-mentioned procedure to achieve your objectives in the correct sequence. First, let’s get through the rule of 70 calculators.

Number of years to double= 70/annual rate of return.

Frequently Asked Questions (FAQs):

You have to divide your growth rate by 70, and after that, it will take time to double up your investment rate. In the case of mutual funds, it will take a 3 percent growth rate before making your investments.

The best example is if a country’s economy grows by 1% every year, then it will take 70 years to double up your economy. So it can make things easier for you to achieve your objectives in the proper sequence.

Doubling time means the amount of time an investment takes to duplicate its size within a shorter time frame. You need to know these facts before making your investments in future ventures. Ensure that you ignore making your selection n the wrong track.

Employees’ age and the total time the employee will take to complete his service and depending on that, the amount of money he will receive is known as the Rule of 70. It can help you get better returns at the age of your 70s.

Final Take Away

Hence, these are some of the core factors of the rule of 70, which you must know at your end before making your investments. Ensure that you do not make your selection from the wrong perspective while you want to achieve your aim.

Feel free to share your views, opinions, and ideas before you use it to achieve your aims. However, ensure that you must not make your mistakes on the wrong path while adhering to this rule.

Therefore, before making your investments, you need to make the rule of 70 a success before achieving your goals in the right direction. Ensure that you do not falter in that at any point in time. You must know the calculation procedure before making your financial investments plan in the proper sequence.

Read Also: