Maximizing The Benefits Of Installment Loans: A Comprehensive Guide

by Arnab Dey Loans & Credit Published on: 15 May 2023 Last Updated on: 16 May 2023

Installment loans have emerged as a popular form of borrowing that offers many advantages to borrowers. They provide the convenience of fixed monthly payments over a set period of time, allowing individuals to manage their finances better.

However, to fully maximize the benefits of installment loans, it’s essential to understand how they work when to use them, and strategies for managing them effectively.

What are Installment Loans?

Installment loans are a type of loan where you borrow a specific amount of money and repay it over a set period of time in equal installments. These loans include personal loans, auto loans, mortgages, and student loans.

Benefits of Installment Loans

Predictable Monthly Payments

One of the significant advantages of installment loans is their predictability. You know exactly how much you have to pay each month, which helps with budgeting and financial planning.

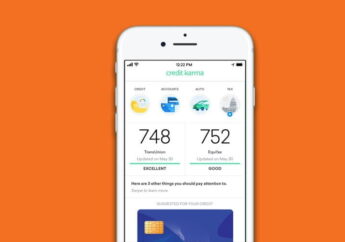

Building Credit Score

If managed properly, installment loans can help build your credit score. Regular, timely payments are reported to credit bureaus, positively affecting your credit history.

Lower Interest Rates

Compared to revolving credit like credit cards, installment loans generally offer lower interest rates, making them an affordable borrowing option.

Strategies to Maximize the Benefits of Installment Loans

Understand the Terms

Understanding the terms of the loan is crucial to maximize its benefits. This includes the interest rate, the term length, the total cost of the loan, and any penalties for early or late payments.

Make Timely Payments

Making timely payments not only avoids late fees but also helps build your credit score.

Consider Extra Payments

If your loan agreement allows, making extra payments can save you money on interest and shorten the term of your loan.

Refinancing

Refinancing the loan to a lower interest rate can also help save money in the long run.

Unique Insights into Installment Loans

While the basic aspects of installment loans are well-known, there are unique insights that you may not have considered.

Installment Loans vs. Revolving Credit

While both installment loans and revolving credit can be used for similar purposes, they function differently. With revolving credit, you can borrow up to your credit limit, repay it, and borrow again. With installment loans, you get a lump sum and repay it in installments.

Impact on Credit Utilization

Installment loans do not significantly impact your credit utilization ratio, which is a significant factor in calculating credit scores. This is because they’re considered installment debt, not revolving credit.

Long-term Planning

Installment loans can be part of a long-term financial strategy. For example, using a personal loan to consolidate high-interest credit card debt can save you money and simplify your financial management.

Statistics and Data on Installment Loans

According to a 2022 report by the Federal Reserve, approximately 34.2% of American households had some form of installment debt. Moreover, Experian’s 2022 consumer credit review indicated that the average personal loan balance was $16,458, demonstrating the prevalence of this loan type in financial planning.

Moreover, a 2023 study by the Consumer Financial Protection Bureau found that borrowers who made extra payments or refinanced their installment loans saved an average of 12% in interest costs over the life of the loan.

Conclusion

In conclusion, installment loans can be a practical and beneficial financial tool when managed effectively. By understanding the terms, making timely payments, considering extra payments or refinancing, and incorporating the loan into a long-term financial strategy, you can maximize the benefits.

Read Also: