Bad Credit Loan Scams and How to Avoid it

by Abdul Aziz Mondal Loans & Credit Published on: 21 December 2017 Last Updated on: 26 September 2024

A car has become more of a necessity especially for those living in rural areas and working jobs in the city. Public transport is ideal, but sometimes it is not the best option with traffic and availability always a hindrance. If you’re thinking about getting a vehicle to call your own, but don’t have the money up front, a loan is your next best option. But is it safe?

A Credit Loan Scam

One thing you should try to avoid is a credit loan scam. A credit loan scam is aimed towards people with bad credit who are looking for loans. A clear sign of a loan scam is when the lender asks you to send them money first before they can approve your request. They often call this a “collateral” or an “origination fee”.

After you send them the money, you have to wait for the lender to send you the loan. But it never comes, and you never hear from that person again, and you will have less money than when you started.

How not to Fall victim to the scam

It is illegal for lenders to ask for money when you are seeking a loan. Legitimate firms already know that you are short on cash, and thus they don’t ask for payment upfront. Before you make your transaction, do your research about the company first. Here are a few ways you can do that:

Reputable lenders

Find lenders that are known for their excellent business. Ask friends or co-workers for any money lender that they recommend. Another option is to check out long-standing companies. The longer they have been in the industry, the better.

Plan your budget

Compute your income and other expenses. Check how much you can spare for loan payments each month with consideration for fuel and maintenance. Once you’re done, stick to it and talk to the lender to help you come up with a payment plan that suits your needs.

Don’t fall for sales talk

Salespeople are just doing their jobs, but don’t fall for any of their tricks. They will offer buyers a variety of products like extended warranties. Availing of these add-ons often increase your monthly payments and thus should be avoided if you intend to stick to your budget.

Information is Key

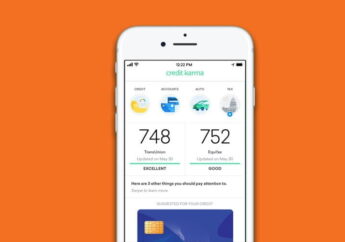

The best way to make sure that you’re doing businesses with the best possible company for you and your income is through extensive research. Aside from that, know your credit score and find out what your limitations are because some lenders will try to take advantage of your situation for their gains. So, it is best to be prepared for anything they might throw your way.

What to do in case you fall into a scam

In case you do fall into a scam, the first thing you need to do is to report to the authorities and give them as much information as you can. Next is to warn your friends and families so they will not fall victim. Finally, seek the help of financial counselling for your troubles in case you have lost money in the process. Also, know that the money you have sent to the lender (if any) will not be coming back.

Keep these tips in mind and be vigilant when you’re on the hunt for the best way to get your vehicle. A lot of companies will want to take advantage of your situation. And the best way to avoid that is by knowing how to sidestep the malpractices that these folks are often taking part of.

Find the best bad credit car loan provider in your area to ensure that your money will be safe for your peace of mind.

Read More:

All Comments

loans online for bad credit

Step 3: Evaluate a bad credit score private loans.