Why You Should Know About Investing in Real Assets?

by Mashum Mollah Real Estate 04 September 2024

Are you wondering if investing in real assets is a good idea? Here is an elaborate article that can help you make informed decisions. As corporate employees, when we think of investment, there are usually the generic options of mutual funds, real estate, and other such options.

There’s more to investment than these limited options. Real assets are part of this group. Investing in real assets is something that not many would know without the expertise of an investor.

Let’s look at the different ways to invest in tangible assets. Did your advisor (colleagues, tbh) recommend these?

What Are Real Assets? Is That Real Estate Spelled Wrong?

Real assets are tangible and have an intrinsic value due to their properties and substances. These include commodities, precious metals, land, equipment, and natural resources.

Yes, real estate forms a part of real asset investment opportunities. These have been popular investment options for a long time due to their stability compared to stocks or mutual funds.

Real assets have better appreciation over time, which protects the volatile nature of the stock market. When exposed to investing in real assets, you are more likely to receive better returns. The popular investment areas may give you different stable, sure-shot returns on your investments.

Moreover, as most generic options depend on or are connected to the stock market, they have a surprise element. One day, you are making a significant amount; on other days, it is in shambles.

The investor’s mental health goes to another depth of hell, which does not happen with tangible assets.

The following sections will dive deep into the different tangible assets that can be a great investment option. Also, recommend some of the most important texts to help you make excellent investment options in this area – even if you do not opt for expert assistance.

Let’s check out the best real assets to invest in that can be an investment option for you.

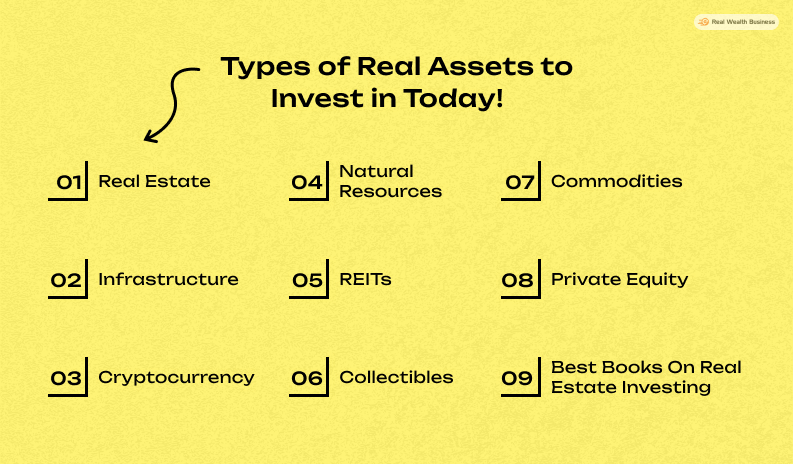

Types of Real Assets to Invest in Today!

These are some of the most lucrative investment options in the tangible assets sector that will make your dreams more straightforward. Check out the best real asset options to make you an intelligent investor.

World tours to fast cars, unlock all your dreams with these:

Real Estate

A great real estate investment strategy is to analyze the market before you buy the first property that comes into your vision. Sound investments in this sector guarantee a solid return on your investment with a high chance of success.

Real estate investment has an essential element that favours it – practically minimal stake is necessary. You can start with a comparatively smaller amount than other assets.

If you are new to investing in this sector, here’s some advice: Start with renting out a property that you have bought or already own and is lying vacant. If you do not have a property like that, you can own an entire property with a minimum down payment.

This is one of those lucrative tangible assets that help make good money with little investment. This investment opportunity allows you to dabble in real estate investment trusts or REITs. This also makes it an excellent avenue for real estate marketing ideas.

Infrastructure

Architectural development is the following type of tangible asset that will be a good investment for you. These projects start frequently, so you will have several opportunities to invest in tangible assets.

One of the most significant advantages of investing in this infrastructure is the variety that is present. From transport to public facilities, every single structure is a tangible asset.

Notably, there is a high expenditure initially, but that gives you an excellent opportunity to acquire intangible assets such as goodwill. Your reputation will see a boost as well.

Cryptocurrency

You may be familiar with Dogecoin, the infamous cryptocurrency made famous by Elon Musk. It is one of those options for investing in tangible assets that may initially seem dicey. Trust us; it is a solid investment area that can give you great returns.

For example, a type of peer-to-peer cryptocurrency, Dogecoin, has gone from being a joke to one of the leading cryptocurrencies. Some claim that cryptocurrency is as risky as the stock market. However, it is one of the best passive income options. It has great rewards, which makes it a substantial hedge against risk-on investments.

Natural Resources

Natural resources are already something that humankind needs to catch up on. A global natural resource crisis is pushing us towards sustainable methods of living so that the load is much less on the planet.

Natural resources are those that are drawn from nature and are use after a few modifications. A few examples of natural resources are natural gas, coal, sand, stone, and oil. There are several ways you can get into any of these sectors.

For example, you can invest in farmland and timberland as they provide tangible assets. These guaranteed cash flow from – you guessed it – resource extraction, among others.

Investing in tangible assets such as natural resources help investors protect themselves against inflation. In addition, the investor also sees capital appreciation with this investment.

REITs

REITs help you capitalize on the increasing market value of artificial intelligence in this sector – for instance, data center REITs. It makes you wonder is real estate investment trusts a good career path?– with proper knowledge and experience, it will become a great path.

Data center REITs can offer high yields in dividends and attractive growth potential. How? It is a fantastic investment opportunity due to generative AI’s need for extensive processing power and data storage.

One of the following sections will tell you about the best books on real estate investing. Check them out if you are keen on investing in real estate assets.

Collectibles

These are any object with a particular value and can be of specific interest, such as historical interest. Collectibles or collectible items are those that do not necessarily have monetary value, but they hold significance as real property.

These can also be sold to authorities and include investing in tangible assets like something you maintain. You may collect high-end watches, sports or art, and entertainment memorabilia. You may have noticed that some people have lobby cards, film props, original movie posters, and even autographs.

The list is endless!

Commodities

One of the most reliable options for investing in real assets, commodities are raw materials that have given some of the best returns. Investors may invest in tangible goods such as silver, gold, oil, and agricultural products.

These have real-world uses, which means they will keep appreciating. Moreover, there is always demand due to their characteristics (everyone wants to wear a gold ring or a necklace.

An easy example of a commodity that can be a great investment option is the stability in gold’s price. This is due to its use in different industries. It’s going to remain relevant and retain its value sometime soon.

Private Equity

A refined branch of stock investments, private equity is venture capital. You may have heard of the designation venture capitalist. This is someone who seeks business investment opportunities to invest their millions and billions in.

Take this example-

You are a self-made billionaire looking for an opportunity where investing in real assets becomes easy. Someone with a business idea or a small company may be a place where you provide capital in exchange for equity.

You may get a budding Kylie Jenner with their makeup line to come to you with an exciting offer that makes you want to invest.

Best Books On Real Estate Investing

Real estate investing benefits may seem to be few, but it is one of the most stable areas of investment, so much so that you do not have to worry about any other source of income if you have even one income channel open from real estate.

From providing you tax benefits to solid protection from inflation, you are in for a lucrative ride if you choose real estate while investing in real assets. Here is a list of some of the best books on real estate investing that helped me know all about the investing opportunities:

1. The Millionaire Real Estate Investor by Gary Keller, Jay Papasan & Dave Jenks.

This one comes from the author, who conducted a thorough investigation to bring you first-hand information. The author conducted interviews with over 100 real estate investors who shared their journey.

This comes as a guide that is straight to the point and does not beat around the bush. This was the first book that I picked up during my newfound interest in real estate investment. The book will help you learn from the real-life journeys of investors – from getting ahold of their strategy to working on real estate lead generation. This book will become your best friend until you learn to invest in real assets such as real estate.

2. How to Invest in Real Estate: The Ultimate Beginner’s Guide to Getting Started by Brandon Turner & Joshua Dorkin.

Some of the most prominent names in the world of real estate business have collaborated on this book. You can look up their individual work on real estate and find some profound advice on the same.

Another one of the top guides for you, this book also offers real life stories on investment and some valuable advice that will blow your mind! You get 28 tried and tested methods to crack real estate deals that will give you a peek into this world.

3. Real Estate Investment & Financial Analysis by Gaurav Jain

If you are considering making an overseas investment or living in the subcontinent, you will find this book helpful. I was able to make some of the most profitable investments through this book. The book is an excellent guide to getting your basics right and getting an overview of financing through REITs.

Conclusion

This was all about investing in real assets for you, whether you are a beginner or a seasoned investor – you will find great hacks here. The article lists the top types of real assets that can become great investment opportunities for you. This makes it easier to understand the basics of real assets investment.

This guide is also great for anyone looking to start their investment journey with real assets. The article also highlights some of the best books that can help you get real-life advice from seasoned experts who have been in the game for quite some time.

In the comments Tell us which real asset type you are investing in.

Additional Reading: