by Mashum Mollah Real Estate 20 September 2024

Imagine you get a property tax appraisal but you do not even realize it? However, the appraisal is off-key and is far from what you expected it to be. What do you do?

Well, the simple answer is ‘wallowing in self-pity.’ But something tells us you are not looking for the simple answer. You are here for the intelligent answer. Well, follow along as we help you understand the nuances of how to protest property taxes.

So that you do not have to pay for that extra set of cash.

What Is Property Tax? – A Thing to be Proud of!

Before we start with our ‘how to protest property tax,’ we need to have a deep and clear understanding of the phenomenon. Otherwise, you will gain half-baked knowledge that will be of no use. Therefore, let us start from the basics and learn what property tax is, and then we can worry about how to protest property taxes and win.

Property tax is paid annually. This is usually paid by the legal owner of the respective property to the local municipal government or corporation. Only a tangible property qualifies for property tax. Therefore, a segmented swath of land without value would not fetch taxes.

Property tax is a nuanced subject. Pointers differ state-wise. Therefore, you need to inquire about the local regulation of property tax. This can feel taxing, but it is undoubtedly one of the critical components of tax management, significantly if you are investing in tangible assets like real estate.

How To Know If The Appraisal Value Increased?

As we have already pointed out, property tax is a nuanced subject. Therefore, it is of seminal importance to understand the nitty-gritty of the subject to use it to your advantage.

Thankfully, if your respective district decides to increase your property value, it must send you a formal intimation. This intimation should reach you by April 1st. However, if your property is a homestead, you can expect a letter by May 1st or any time that is practical after that date.

Subsequently, if you do not agree to the revised appraisal, you can file a protest. Luckily, the notice comes with detailed knowledge of how to protest property taxes. Therefore, you need not worry.

Still, we have decided to go the mile and list all the pointers you need to remember if you plan to go through the process unaided.

What Can You Protest?

Before we get to the meat of things, you need more clarity on the whole deal. Therefore, in this section, we will look at the pointers or situations that you can protest.

This would fill in the gaps in the discussion on how to protest property taxes and make it more wholesome. Here are some of the situations in which you can protest

- The proposed value is too high for the property or needs to be more appraised.

- The appraisal district denied your application for specialized property appraisal for open spaces or ultimately rejected the modified exemption notice.

- The appraisal district did not produce any document stating their decision.

- Violation of Tax codes put

syou in a difficult spot.

Forms You Need

you will likely not be satisfied with your current property appraisal. As a result, you want to repeal or protest the property tax decision. However, you cannot do anything if you do not present certain documents.

Therefore, having a clear understanding of the documentation part of the ‘how to protest property taxes’ is an important aspect. In general, you will have a time of around 30 days after the appraisal to start a re-appeal process or protest.

If you really want to go down that road, you must be very careful and heed the ‘What Can You Protest’ section of our How to protest property taxes article. You will have to specify your reason for protest. This would decide the evidence that you need to present.

You must be very careful about the data you present in this application. Otherwise, your application might get rejected. Take our word and learn how to format or what to write in tax protest applications. This would help you streamline the process and get your job done faster.

Prep Work Tips

The government does allow the scope to protest. However, it will only lie down with a rigorous screening process. This screening process is put in place to safeguard the interests of investors, taxpayers, and the government itself.

Therefore, think like Batman and start preparing for the hearing. Honestly, there is no checklist. However, we have screened some experienced taxpayers, and this is what they shared about the prep list:

- Always ask your appraiser to elucidate the finer details of the process. This would enhance the overall clarity of the process and help you in return.

- Go through the appraisal notice and check and re-check every tiny detail, like the general description of the property, measurement, location, etc. Make sure that the points match your property.

- Check the pointers mentioning the defects. In some cases, evidence of defects is presented in a photographic manner. Therefore, cross-check if it matches your property.

- Ask the district to present you with the details of the appraisal of similar properties in your administration. This would help you build your case stronger. Check to see if there is any form of discrepancy or discrimination.

- Consider hiring a legal third-party appraiser to get a fresh set of eyes on the document.

- Assess the cost of staging a protest, the property appraisal and the rebate you are going for. Do not go for a protest if it is not financially viable. Otherwise, you will end up with lighter pockets and wasted minutes.

- If the property changed hands or was bought & sold, then get a sworn statement of purchase and sale. This would help you build a stronger case against the newly revised property tax bracket.

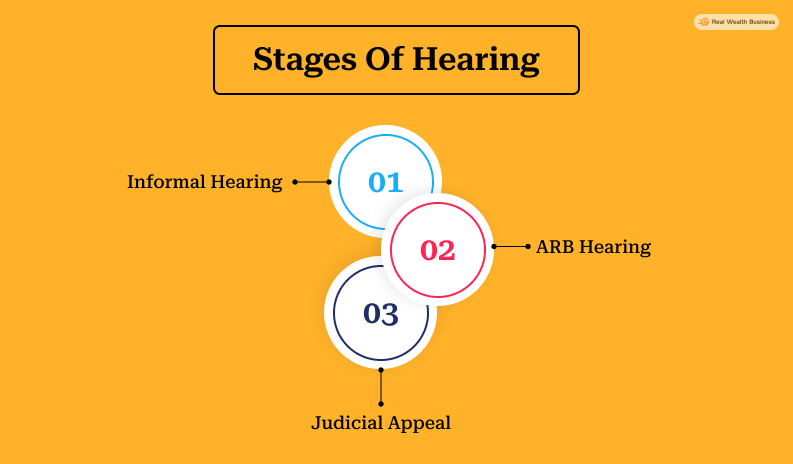

Stages Of Hearing

With that, you have reached the final section of our ‘How to protest property tax’ discussion. In this section, we will help you navigate the protesting process so that you can breeze through the process with ease.

Not only that but knowing these stages will also enable you to formulate a maximum investment plan using property tax. Here are some of the stages or ways to protest property taxes. Let us dive right in.

Informal Hearing

Informal hearing is the very first stage of the property tax protest. This is an informal meeting between the district and the taxpayer where details of the appraisal and the cause of protest are assessed.

You need to keep things amicable and remember that the presiding officer might not be the one who assessed your property. This ensures objectivity and smooth sailing.

Informal hearing is a subjective process that might differ from state to state. Therefore, how to protest property taxes in Texas might vary in other states.

ARB Hearing

The ARB hearing will be the next stage of your ‘how to protest property taxes’. ARB, or Appraisal Review Board, is a group of individuals whose primary aim is to mediate between the district and the taxpayer.

ARB hearings are all about reaching the middle ground. Therefore, you can expect some counteroffer. Keep an open mind and listen to the points that the board presents.

In most cases, ARB consists of a three-member panel. Most of these members need more real estate knowledge. They only get four hours of training before the hearing. This can be a major downside

Therefore, this can be a double-edged sword as they might need to assess the whole deal more effectively.

Judicial Appeal

The third and final stage of the whole process is the judicial appeal. However, only special or complicated cases reach this final stage. Therefore, if your case is straightforward, then the chances of your case enduring this stage are low.

Therefore, you can rest assured. However, if you end up here, you must understand the importance of hiring a professional.

Is It Worth It?

We have already tried including all the significant points that you need to know about ‘how to protest property taxes.’ But is it worth it? Well, the only way to determine this is by assessing your case, the tax rebatement bracket, and the overall extent of the discrepancy.

If the situation is under control and the appraisal is not herculean, it is best to let go. However, you decide you. If you want to take advantage of property tax abatement programs, you can certainly explore this avenue.

The Final Thought

In summation, that is all there is to know about how to protest property taxes. If you are one of them who is not happy with their appraisal, you must undoubtedly re-appeal or protest.

Things might seem tedious at first, but the returns can genuinely help you and your cause. Therefore, never back down.

Hopefully, we could elucidate the essential points that you need to know about the protest. If you liked this piece of content, then let us know and follow us for more information.

Additional Reading: