What Is Bad Debt Expense: How Can You Calculate And Report It?

by Barsha Bhattacharya Business 25 March 2025

Let’s think of a scenario. You run a data center business, and you have offered a data management solution to a tech company. Now, the company fails to pay the amount.

The amount you were supposed to receive from the company is a bad debt expense. Now, you must account for it as an expense, as you cannot recover it from the client.

A bad debt expense can impact your business in the form of huge losses. It can even lead you to bankruptcy.

To avoid that, in this Real Wealth Business Guide, we will discuss bad debt expense in detail, along with how bad debt is calculated and recorded.

What Is A Bad Debt Expense?

Once again, a bad debt expense is the amount a client is supposed to pay you but they don’t pay due to incompetency or unwillingness.

A client may refuse to pay you the just amount because of insolvency or dissatisfaction over the products and services you have offered.

However, unfortunately, every business has to take the risk of sales on credit. And when the risk turns into a bad debt expense, it is accounted for using the “percentage sales method” or the “accounts receivable aging method.”

Furthermore, a bad debt expense makes the receivables on your balance sheet less. Your accountant has to then show it as an expense under the general, sales or administrative expenses.

Also, a bad debt expense is only accounted for if your business follows an accrual accounting system. In this context, accrual accounting is the method of recording transactions when they occur.

Whereas, if you take payments in the cash flow method, you don’t need to account for a receivable amount as a bad debt expense. Cash flow accounting only happens when you actually receive the money from a client in your account.

That is why a company cannot go on for months with the sales on a credit practice. If you don’t receive the payment for months and there is an accrual accounting system in place, you have to transform all the receivable amounts into bad debt expenses.

As a result, the recorded revenue will undergo a complete upheaval.

Is Every Uncollectible Debt A Bad Debt Expense?

No, every uncollectible debt is not a bad debt expense. A bad debt expense is something that you cannot collect.

On the other hand, an uncollectible debt is still in the process of recovery. The table below gives you a better idea of the difference between the two.

| Bad Debt Expense | Uncollectible Debt |

|---|---|

| • The loan or the amount to receive will NOT BE PAID by the customer • The amount has already been written off as a loss. • Further, the amount no longer exists in the list of receivable and it is mentioned in the income statement as an expense. | • The loan is not written off as a loss yet. • It will still be in your receivable account. You must try recovering it actively. • You, the lender, can still recover the amount through various efforts and legal processes. |

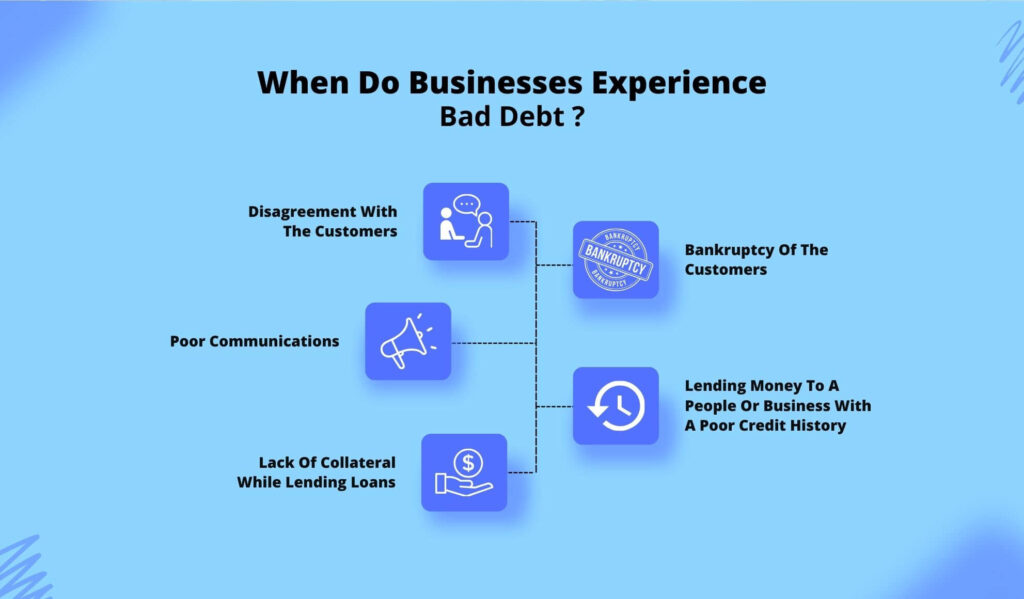

When Do Businesses Experience Bad Debt

A business can experience bad debt expenses under the following situations.

Disagreement With The Customers

If your customer is not happy with your product or service or there is a disagreement over the terms and conditions, they may refuse to make the payment.

Bankruptcy Of The Customers

If your customer goes insolvent or bankrupt, they will be incompetent to pay the amount receivable by you.

So, there will be a bad debt expense.

Poor Communications

Think of a scenario: The sales team receives input from the accounts receivable or AR team, but it fails to understand all the payment terms.

Now, when the sales team offers the credit terms to the customers, there will be some gaps due to miscommunication between the two teams. This lack of clarity about credit terms will lead to bad debt.

Again, poor communication with the customers during the billing and payment cycle can lead to a pay skip on their part. In other words, a good customer experience always helps to minimize the amount of bad debt expense.

Lending Money To A People Or Business With A Poor Credit History

When you lend money or do business on credit with a person or company with a poor credit history, the risk of incurring a bad debt expense shoots up.

Lack Of Collateral While Lending Loans

If you lend money to someone or a business without collateral and you don’t receive the repayment, you may experience bad debt expenses.

Where Is Bad Debt Expense Reported? How Bad Debt Expense Is Recorded In Accounting?

Bad debt expense is reported in the income statement. Bad debt expense is recorded in accounting in two methods: the direct write-off method and the allowance method.

Direct Write-Off Method

Suppose your invoice has become uncollectible. In the direct write-off method, you can immediately write this portion of your receivable as a bad debt.

This is how you write a bad debt expense in your journal in a direct bad debt write off method.

| Account | Credit | Debit |

|---|---|---|

| Bad Debt Expense | $X | |

| Accounts Receivable | $X |

The method is straightforward but can often cause confusing account entries. For example, if you enter the bad debt expense at a different time than the sales entry in the journal, there can be a misstatement of income.

Therefore, the direct write-off method will work when the number of uncollected invoices is small. It also works if you are recording immaterial debts.

How Does Bad Debt Expense Work In The Allowance Method?

Generally Accepted Accounting Principles (GAAP) find the allowance for bad debt method more comprehensive despite its complexities. It also works with the matching principle.

In the matching principle, you must record all the revenue earned and the expenses in the same period.

Further, in the allowance method, you create AFDA allowances for doubtful account entries at the end of a fiscal year.

You can follow this step-by-step guide to record a bad expense debt using the allowance method.

- Creating an AFDA journal account.

- Estimating the AFDA account when the journal period ends. You can use a percentage of sales, the percentage of accounts receivable and accounts receivable aging methods for the estimation.

- Then, calculate the actual bad debts.

- Finally, you can record the journal entries. For journal entries, you can credit allowance for doubtful accounts and debit bad expense debt in your income statement.

Further, credit accounts receivable on the account receivable balance sheet and debit allowance for doubtful accounts.

Having explained the allowance method to you, now, I want to briefly touch upon the bad debt vs. doubtful debt comparison.

Then, I will discuss the formulas used in the allowance method for calculating bad debt expense with examples.

Bad Debt Vs. Doubtful Debt: Are Both The Same?

Bad debt and doubtful debt are not the same. A bad debt account refers to an account that is not collectible at all.

A doubtful account, on the other hand, has not become uncollectible yet but has the potential to become a bad debt expense.

As you already know, bad debt expenses are accounted for using the allowance or direct write-off method.

However, for doubtful debts, you can use a reserve or contra account that records the receivable, which has the potential of becoming a bad debt.

In other words, for a bad debt account, the amount receivable is written off at once. On the other hand, for doubtful accounts, you need to create an allowance.

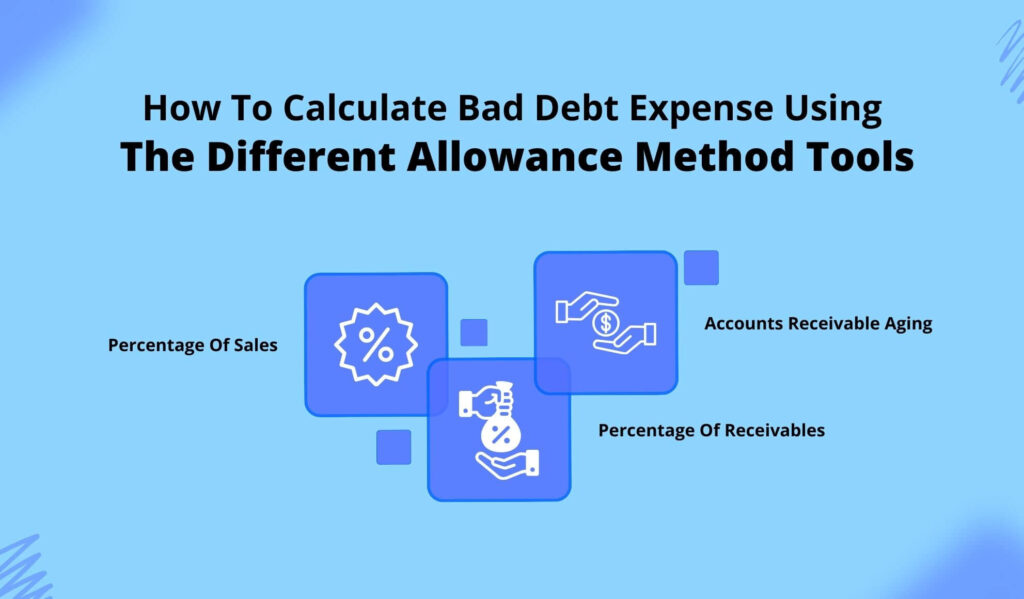

How To Calculate Bad Debt Expense Using The Different Allowance Method Tools?

The percentage of sales, the Percentage of accounts receivable, and the percentage of Accounts receivable aging are three tools or formulas for estimating bad debt expenses in the allowance method.

All these formulas rely on a company’s collection history. Estimating the uncollectible amount based on this historical data is safe when your business is stable.

Here, stability means consistency in the user base, stable growth, and steady economic conditions in the industry in which you operate.

1. Percentage Of Sales

The percentage of sales is calculated using a simple formula. Bad debt expense = historical percentage of uncollectible sales x actual credit sales.

For example, suppose your historical credit sales were $1000000, and the uncollectible credit was $500000 or 5% of the credit sales.

Now, if your actual credit sales are $2000000, your percentage of sales will be 5%*$2000000 = $100000.

2. Percentage Of Receivables

The percentage of receivables method uses the AR. So, in this method, bad debt expense = receivables percentage considered uncollectible* receivables balance.

This method heavily works on the historical data.

For example, suppose your business’s historical receivable was $1500000, and you received $1200000. So, the percentage of uncollectible receivables was 8%.

So, now, if you have receivables of $2000000, your bad debt expense will be 8%* 2000000 = $160000.

3. Accounts Receivable Aging

The accounts receivable aging method extends the percentage of the receivable method. First, you will need to create an AR aging report.

Here, you will not use one average value to determine the percentage of uncollectible receivables. Instead, you will use collection probability for every AR aging category.

First, you will calculate the bad debt allowance for every bucket and then add them to get the ending balance. The formula for the entire calculation is:

Accounts Receivable Aging = The percentage of outstanding receivables that can become uncollectible* receivable balance for each bucket. Then, you will have to add the data together.

Check out the table below to understand how accounts receivable aging works.

| Customer | Total AR | 0-30 | 31-60 | 61-90 | 91+ |

|---|---|---|---|---|---|

| X | $6000000 | $600000 | $360000 | ||

| Y | $800000 | $650000 | $100000 | ||

| Z | $1500000 | $800000 | |||

| Probability of Default | 0.5 | 5 | 8 | 15 | |

| Total | $83,00,000 | $600000 | $650000 | $900000 | $360000 |

Bad Debt Expense Accounting: Helping Businesses To Know Their Financial Position

Bad Debt Expense gives a business clarity about its financial conditions. Further, it also helps a business to understand its level of customer satisfaction.

Further, the amount of bad debt expense a company has can change its position in the eyes of the employees and investors.

So, timely and accurate recording of bad debt expenses is essential. It will help a business to identify the customers they must avoid in the future to increase their net income.