by Shahnawaz Alam Finance 08 June 2023

Business owners have to own different assets from time to time. Different methods can be utilised when accounting for those assets and their depreciation. The double declining balance method is one of those depreciation methods.

One of many reasons why different methods for accounting depreciation exists is to serve different assets. Different assets depreciate at different rates, so the accounting should also be done accordingly and profitability.

The double declining depreciation method helps depreciate assets that depreciate quickly during the first few years of their life cycle.

So, how to use double declining deprecation? Why is it effective? If you have such questions, you have come to the right place. In this article, I have explained all the details you need to know about this depreciation method.

What Is Double Declining Balance Method?

The double declining balance method for depreciation allows businesses to account for assets that depreciate quickly during their useful early life. The method involves depreciating certain assets at twice the rate used in straight-line depreciation. Doing so allows a business to result in more tax benefits. The method is specially applied to rapidly depreciating assets like vehicles and more.

The depreciation is done at a faster rate as compared to the straight-line depreciation method. That is why it is also called the accelerated depreciation method. The depreciation calculation is done at a higher rate only at the beginning of the asset’s useful life. The depreciation expense of the asset will be lesser in the later years.

DDB Method Of Depreciation: Explained

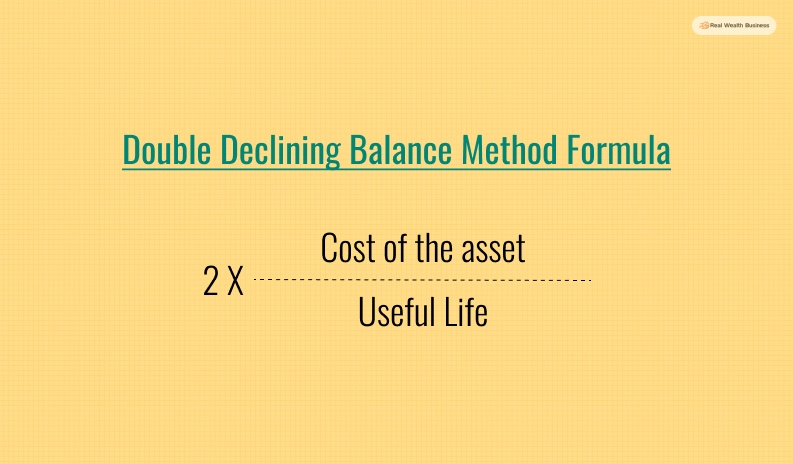

So, how to calculate DDB Depreciation using the double declining balance method? First, you need to know how the formula works. Here, I have listed the double declining depreciation formula and explained how it works –

Double Declining Balance Formula

| Double Declining Balance = 2 X Cost of the asset/Useful Life |

How to Calculate Double Declining Depreciation?

So, first, you must find your asset’s cost and estimate its useful life cycle. Then you are ready to follow the formula and calculate the DDB formula. Here are the steps you need to follow to calculate the DDB for your asset.

- First, determine the cost of the asset when it was purchased.

- You have to estimate the salvage value after completely using it throughout its useful life. The salvage value is the value you can sell for or dispose of once its useful life cycle is over.

- Next, you must also determine the useful life cycle of the asset you will calculate depreciation for.

- Now, you have to calculate the depreciation rate. This can be done by 1/the useful life multiplied by 100.

- You must multiply the book value of the starting period by twice its depreciation rate. This will allow you to find the depreciation expense.

- Deduct the depreciation expenditure from the starting value and calculate your asset’s value for the ending period.

- Once you finish the previous processes, you must keep repeating them until you reach the salvage value.

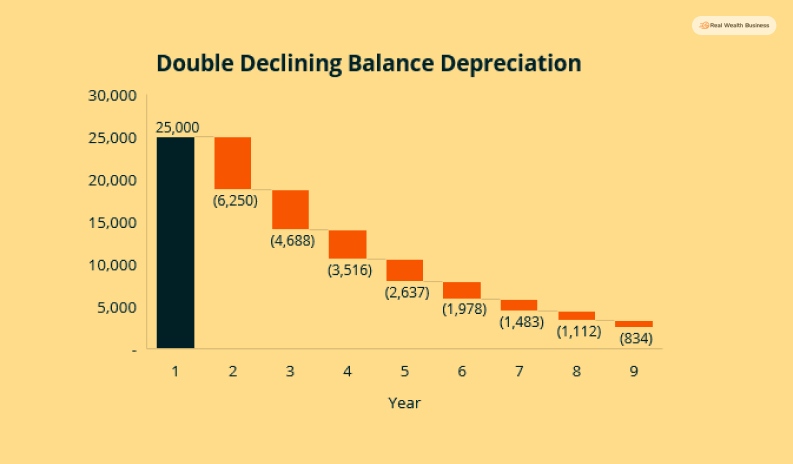

Example Of DDB Depreciation Method Calculation

Let us say that a small business has purchased equipment for $100,00. According to their estimation, the machine’s useful life is 8 years, and the salvage value is $1100. So, we have all the data required to calculate DDB depreciation for that equipment.

- Cost of the asset = $10000

- Salvage value = $1100

- Useful life = 8 years

- Rate of depreciation = ⅛ x 100 = 12.5%

Since we are following the double declining depreciation, the depreciation rate will be 12.5% x 2 = 25%

If you apply the formula, then the result will be –

Depreciation for the year 1 = $10000 x 25% = $2500

Depreciation for the year 2 = $7500 x 25% = $1875

This way, you have to keep repeating the process until you reach the salvage value at the end of the product’s useful life.

Pros & Cons Of Double Declining Balance Method

There are both pros and cons of using the double declining balance method. It may not be applicable to all business processes and assets.

Pros

➕ Companies can reduce their tax liabilities by charging higher depreciation expenses at the starting year of an asset’s useful life.

➕ The declining balance method helps distribute the cost of an asset evenly and more effectively throughout its useful life. The early years do not require any maintenance or repairs. On the other hand, the later years are full of these costs. That is why calculating a higher amount during the initial years of the asset’s useful life helps even out the expense.

➕ The DDB method helps the company reduce the loss when the asset is disposed of. It is because the major portion of the expense of the asset has already been accounted for through depreciation.

Cons

➖ The depreciation amount during the initial years is maximum. It results in less profitability during the start of the financial year.

➖ Due to lower initial profits, the shareholders will have lower dividends in the initial years. Lower profit also affects the company’s financial performance, persuading them to invest no further.

➖ The method is not easy. It is more complex when compared with the straight-line depreciation method. Minute mistakes can result in massive mistakes in calculations and financial blunders.

➖ Also, using the double declining balance method for depreciation, you can never take the asset value down to zero.

When To Use Double Declining Balance Method?

Businesses cannot use this depreciation method for all types of assets. The method applies well to only the assets that quickly lose their value during the first years of their purchase.

Specific assets such as vehicles, cars, computers, and mobiles lose value quickly. Also, depreciation has some tax benefits, and the owner can spare the benefits throughout the useful life of an asset. This process is beneficial to businesses that still have not seen much profit.

But, owners who are planning to sell off their assets before the useful life ends will not profit much from the tax benefits. In this case, the DDB depreciation method will make them accumulate more depreciation and incur more tax liability. It is best to use another depreciation method for such cases.

Bottom Line

Like all the other depreciation calculation methods, double-declining has advantages and disadvantages. But they are the best for businesses willing to spread the tax benefits throughout the financial year. Hopefully, this article has explained the basics you need to know about the double declining balance method.

However, if you need us to solve more queries and discuss a similar topic, please show your support through the comment section. Your opinions and queries are appreciated.

Additional Reading: