Real Estate Investment Banking for Market Transactions!

by Mashum Mollah Real Estate Published on: 28 October 2024 Last Updated on: 04 November 2024

“My brother is an investment banker!” is something that’s commonly heard. Even then, only some know about real estate investment banking and how to get into it. You present the question to the floor, and there’ll be pin-drop silence, with just a few responses. So, what is it?

Real estate investment banking studies the real estate market to make profitable investments that will be fruitful in the long run. Those who conduct a thorough market analysis are known as real estate investment bankers, and they are the ones you turn to for guidance.

Their knowledge spans understanding government policies and their impact on the real estate investment market. This helps them inform you of real estate investment strategy.

The following sections will help you better understand the intricacies of real estate investment banking.

What Is Real Estate Investment Banking?

Real estate investment banking is a way of finding investment opportunities by purchasing physical, tangible property or land. It goes ahead from here with the help of financial services provided by investment bankers.

You must have a thorough understanding of the financial principles that govern this sector. This helps you make informed investment decisions.

You can build portfolios in real estate investment trusts and private equity firms when engaged in real estate investment banking. Much of investing in real assets revolves around sizable real estate capital market transactions.

Real estate investment banking offers advisory and financing services for real estate transactions. It is vital for REITs and large-scale developments – these are the clients.

Let’s look at these clients in detail.

Trends & Drivers of Real Estate Investment Banking

These trends depend heavily on the sector, even with specific areas such as REITs. Here are some of the real estate investment banking driving factors:

Demographics: The data that reflects the composition of the population such as income, gender, age and migration patterns. In addition, it is also the population growth.

Major growths in the demographic of a nation have a significant impact on the trends. It is specifically seen that real estate pricing and property types change significantly.

Interest rates: Interest rates have a major impact on the real estate market. So, if you are considering buying a home using a mortgage, use a mortgage calculator. This will help you see how different interest rates affect your purchase price. Real estate investment returns are usually high when you make informed decisions.

Economy: Of course, it is a major driving factor in the real estate investment banking sector. The general indicators are employment data, GDP, manufacturing activity and the prices of goods. Broadly speaking, when there is a drop in the economy, the real estate market will reflect it.

The cyclicality of the economy has varying effects on the different types of real estate. For example, if a REIT has a large percentage of investments in hotels, there is bound to be an effect of economic downturn than a REIT in office buildings.

Government subsidies and policies: Legislation has a significant effect on property prices and demand. The deductions, subsidies and tax credits all form ways the government boosts demand for real estate. Albeit temporarily. The current government incentives help determine changes in supply and demand.

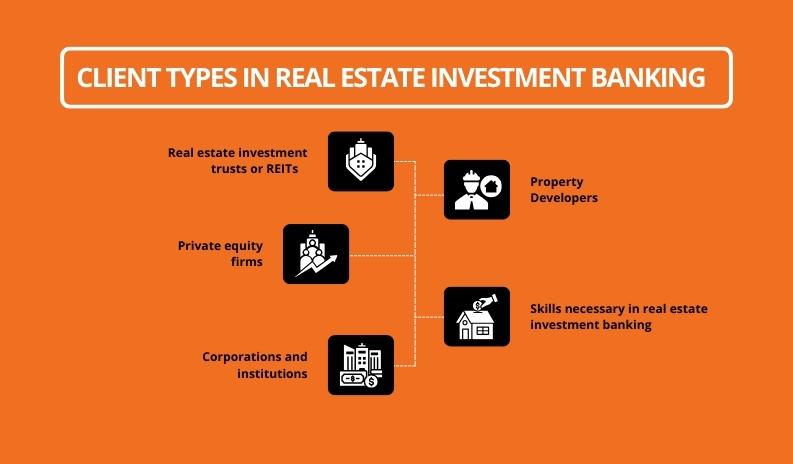

Client Types In Real Estate Investment Banking

Real estate investment banking knowledge is complete with knowing about the clients you would need to deal with daily. Here’s a complete list of the types of clients!

Real Estate Investment Trusts or REITs

REITs rely on investment banks to help them raise capital on the initial public offerings or IPOs – something you may have heard. It can also be for secondary offerings. Investment bankers – if you choose to seek their advice (you should) – will recommend REITs on portfolio management and acquisitions.

Property Developers

Investment banks make a significant difference when you want to secure financing for new projects. Investment banks will work with such developers to secure funds through equity, debt, or hybrid financing solutions.

Private Equity Firms

This is another essential part of real estate investment banking that relies on investment banks to help structure leveraged buyouts. Private equity firms also help structure divestitures and exit strategies for real estate holdings.

Corporations and Institutions

Corporations require investment banking services to expand their real estate portfolios. They may also need it to acquire real estate or sell off non-core assets to support their operations.

These are helpful to know when you want to get into real estate investment banking with or without the help of an investment banker.

Skills Necessary in Real Estate Investment Banking

If you want to get in this sector and help people or yourself out for the time being, the following list of essential skills will be helpful for you.

Complex Data Analysis

Data analysis is one of the most crucial characteristics of real estate investment banking. From market performance to all the big financial numbers, there’s a lot of data that can be complex for any expert.

So, it is best to be confident and have this skill. In recent times, with the help of tools such as Microsoft Power BI, data analysis has become more accessible. As a result, there is a better workflow.

From helping you facilitate data-driven decision-making to empowering stakeholders, tools are a boon, especially in a complex and dynamic sector such as real estate.

Thus, it would help if you had to have the idea of data analysis and using tools that empower your skills.

Financial Modeling

This is an essential part of real estate investment banking, where you analyze a property from the perspective of an equity investor owner or debt investor. Depending on the risks and potential returns, this helps determine whether the equity or debt investor should invest.

This skill will help you forewarn your clients before they invest in a property. If you sign up for a course on real estate investment banking, this will form the foundational skill.

Communication and Relationship-Building

One of the most crucial skills in several sectors (my bet’s on all of them), your communication and relationship-building should be strong. Communication is an important skill to have and hone that helps improve your deals.

Communication as a professional skill is an asset when you can use it properly to share your ideas and insights. When your communication skills are on point, you can make complex concepts in real estate more accessible for your clients.

You also ensure no room for misunderstandings as you can articulate things well. You not only express yourself well, but you also ensure you can read your clients and colleagues/partners well.

Especially the non-verbal cues often missed by those with poor communication skills. In addition, this favors your relationships with colleagues and partners as you learn how to nurture them.

Relationship-building comes in handy in the real estate sector due to its vast yet interconnected nature.

Software Proficiency

This is a given in this rapidly digitalizing age; you do not just require the basics of PowerPoint and Excel; you must be proficient in using major software. As with any data-driven industry, you must comprehend the data.

This is made easy when you know presentations clubbed with your communication skills. Presentations excel reports, and other such data points will be a significant part of your corporate life in this sector.

Software proficiency is essential in the digital age as the tools and software upgrade.

All in all, when you have these skills, you are equipped with all the necessary tools to help you apply your expertise in the field. It is also an essential part of your career as you will also utilize these skills to grow and expand your portfolio.

Now, let’s look at the critical functions of this type of investment banking and how you fit in the picture.

Critical Functions of Real Estate Investment Banking

Now that we know what types of clients exist in real estate investment banking, it’s time to explore the essential functions of this investment banking type. Let’s check it out:

Raising Capital

One of the primary functions of real estate investment banking (REIB) is to help clients raise capital through equity financing and debt. It may include assisting private equity financing or underwriting public offerings for REITs.

The REIB plays an essential role in helping private estate firms raise funds with the help of bond insurance or private placements. They accomplish this through bond insurance or private placements.

Investment bankers connect real estate companies with developers and institutional investors. The other entities that come in contact include high-net-worth individuals interested in real estate financing.

Mergers & Acquisitions

Real estate investment bankers play a critical role in these activities within the real estate sector. REIB are experts in advising companies on acquiring other real estate firms or merging with other entities.

They also advise diverting assets and assisting in property valuation in the transactions. They structure deals and negotiate terms that ensure successful acquisitions and mergers.

Real Estate Development and Project Financing

The role of honest investment bankers includes assisting developers in securing project financing. Along with large-scale developments such as residential complexes, commercial buildings (malls, etc.,) and mixed-use properties.

They are also responsible for working with developers to arrange construction financing, analyze project feasibility and secure long-term solutions for debt.

As a real estate investment banking professional, they help clients manage risk involved in real estate development through structuring deals. These balance equity investment with debt financing.

Advising Their Clients

Lastly, it’s no secret that real estate investment banking has a crucial role in advising clients on raising capital and facilitating deals. This is made possible through the help of strategic advice from bankers. You may help your client buy a maximum investment plan depending on their needs.

This also includes performing property valuation, assessing market conditions and developing investment strategies. In addition, they also assist in analyzing financial projections and advising on the optimal structuring of real estate portfolios.

This and other advisory services are key in minimizing risk while maximizing returns.

Real estate investment banking is an integral part of the financial landscape of real estate companies and investors. They can utilize this for expanding portfolios and optimizing capital structures. Thereby executing high-value transactions.

Pros and Cons of Real Estate Investment Banking

| Pros | Cons |

| Property value increases with time and shows long-term value growth. This is especially important in the context of options for investors. | It is highly susceptible to market volatility and sensitivity to economic factors. This makes it unpredictable, as the property values fluctuate with economic indicators |

| Steady cash flow through rental income. Real estate investors can generate a stream of income through purchasing properties and renting them. | Initial investment is high and becomes an ongoing expense for a long time. It can act as a deterrent for many potential investors. |

| Significant tax benefits and incentives that allow you to capitalize on the various tax deductions that can reduce your tax liability. | Limited liquidity in comparison to other investment options. This is restricting for the investors. |

Real Estate Investment Banking Jobs | Here’s How to Make Money with Your Skills

You can apply for jobs now that you have the right skills and knowledge of the sector and market. The following job options are available for you:

- Investment banking analyst is a role that even an entry-level professional can assume. As an investment banking analyst, you will support senior bankers by applying your skills such as financial modeling and research. You will also be responsible for preparing presentations and analyzing deals.

- Associates. This is an exciting role in the real estate investment banking sector as you can manage structuring deals, advising clients and building client relationships. However, you require an experience of 2-4 years.

- Managing director and partner. Another one of the most coveted positions in the sector, you are the senior associate overseeing all the real estate investment banking practices. In this role, you have a track record of successful deal-making, deep sector expertise and solid institutional client relationships.

Bottom Line

Understanding real estate investment banking is a feat in itself and being on the field with the big players is another legendary thing to do. This article is helpful If you are fresh out of your graduation or looking for a career in this lucrative sector.

The article highlights all the necessary skills and job opportunities you need to look for. Additionally, this informative piece is essential to know the basics of this sector and how you can get a head start.

In the comments below what else would you like to know about this profile?

Additional Reading: