Financial Forecasting is the TREND for Success, Here’s Why!

by Mashum Mollah Finance 16 October 2024

You are sitting at the most prominent chair in a company, and you need to make a landslide decision. However, you do not have any data. It would help if You found out what the company has done in the past. Need clarity about the budgeting goal. In other words, you do not know anything.

Sounds nightmarish, right? Well, this is why you need to understand the essence and importance of financial forecasting. It is an essential tool that allows your business to see where it stands. Therefore, think of it like a financial mirror.

But what is the role of financial forecasting in the long term? Well, stick around, and you will get all the answers you need and want about the subject.

What Is Financial Forecasting?

Focusing on finances is crucial for a business. A general lack of focus on financial aspects can lead to catastrophic outcomes. Product development, innovation, and marketing strategies are excellent. However, it is the finances that keep the ball rolling.

Therefore, as a young entrepreneur, you need to understand the importance of financial forecasting. It is one of the most potent components of successful budgeting and maintaining a healthy business ecosystem.

What is financial forecasting? It is assessing and studying past financial data alongside current market trends. This is done to make an educated guess about the economic future.

Therefore, it is understandable why it is considered one of the most prominent and practical financial tools. So, let us understand the importance, benefits, and role of economic forecasting in today’s business landscape.

Financial Forecasting V/S Budgeting

let us begin with the fundamentals Before we start with the meat of things. Financial Forecasting often needs to be clarified with financial budgeting. Both are essential tools for assessing finances. However, both share some key differences.

- Firstly, budgeting is done to create a plan for a company to meet specific goals. These goals could be quarterly, annually, or monthly. On the other hand, it is done to see the success rate of the plan according to the given timeline by assessing past data.

- Not only that but also the content of a financial forecast also contains the data to assess the success rate of a budget. Meanwhile, the budget includes data regarding the goal and the time frame it needs to be fulfilled.

- Lastly, financial experts encourage businesses to conduct financial forecasting at regular intervals. This can help a company understand where it stands. Meanwhile, budgeting is done bi-annually or quarterly.

Are They Complimentary?

Financial forecasting and budgeting are similar and different at the same time. Both are economic tools used for a myriad of other reasons, such as assessing profits, planning multi-asset investing, corporate tax planning, scaling and others. However, they bring something different and new to the table.

Therefore, financial forecasting and budgeting are complementary. While budgeting tries to lay down a planned route, a company needs to take. Meanwhile, it determine whether the path will be viable or not.

Therefore, budgeting and forecasting need to work in tandem to produce results. Hence, these two are different sides of the same coin.

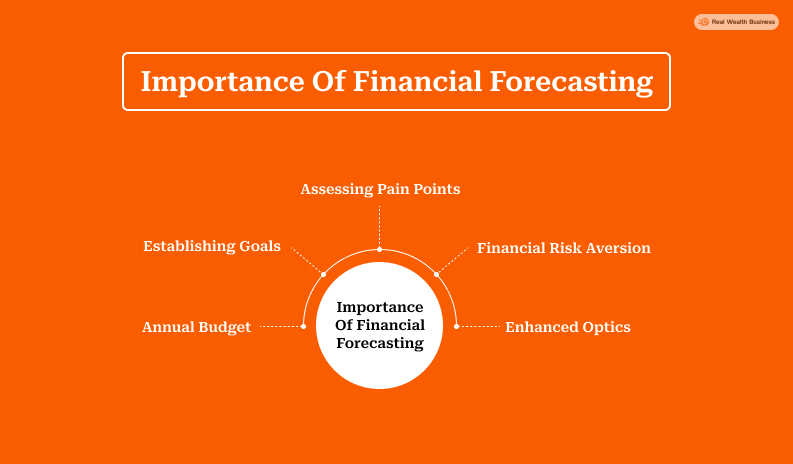

Importance Of Financial Forecasting

Financial forecasting solves a crucial problem for businesses. It looks at different aspects of a company to understand where it stands and the areas of improvement.

Hence, it can help businesses to look at themselves from an objective standpoint.

Financial solid forecasting can help businesses maximize their profit and grow in the food chain. However, more than throwing around random words is required.

Therefore, here are some of the biggest reasons why you should consider conducting financial forecasting as a tool to grow.

Annual Budget

Annual budget planning is an essential part of running a business. We have already discussed how budgeting helps businesses to create a goal. Therefore, budgeting can help your company set financial goals.

However, its assesses the impact and practicality of these goals. Hence, budgeting and financial forecasting work in tandem. A firm budget needs equally solid financial forecasting.

Hence, it is essential for creating accurate budgeting predictions.

Establishing Goals

A business needs to have some goals. It cannot keep doing things in the hopes that something might change. It requires real and tangible goals that it wants to achieve. This is an essential part of the journey.

Thankfully, it can help the business to do just that. This assesses or studies old data to understand the viability of business goals. Therefore, economic data can see if the goals can be met in time.

Therefore, it helps a business assess its goals and work towards establishing them.

Assessing Pain Points

Financial forecasting uses three primary components while assessing a company’s current situation. These components include income statements, cash flow statements, and balance sheets.

These three are very important and can help experts identify problems in a company’s current business operation. Therefore, financial forecasting can be used to assess and understand the pain points.

Financial forecasting can also predict any problems that arise.

Financial Risk Aversion

Risks are part and parcel of a business. No business is truly immune to risks and external detrimental factors. Most of the external factors are out of control and need special attention to be fixed.

This is where financial forecasting steps in. Good financial forecasting can assess the present problems. Additionally, it can predict some of the issues that can come your way.

Therefore, this can help you prepare for what is to come or avert it altogether.

Enhanced Optics

Last, financial forecasting can improve the optics for your investors. Step in an investor’s shoes for once: would you invest your money in a business without clarity about the right direction to pick?

Proper and comprehensive financial planning can help you improve your business’ optics. This would allow the investors to have more faith in you. This, in turn, would enable your business to have good faith and reputation.

Therefore, financial forecasts will not only help your finances, but also help you in other ways.

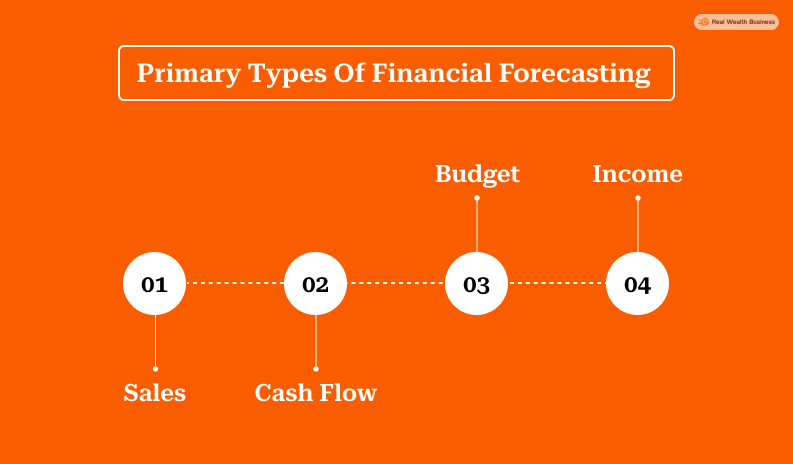

Primary Types Of Financial Forecasting

We have been hearing a lot about financial forecasting for a while now. However, do you know that financial forecasting is an umbrella term? In other words, there are four primary variants of economic forecasting.

In this penultimate section, we discuss some of the most popular variants of financial forecasting methods you may need to know about. However, it would help if you remembered that economic forecasting is an evolving sector.

As a result, newer financial forecasting models might come to the forefront. Therefore, keep an open mind and approach this section.

Here we go!

Sales

The foremost variant is known as sales forecasting. As the name suggests, sales forecasting is primarily focused on sales figures. In other words, it assesses the overall sales figure of a stipulated time frame.

Sales forecasting can be further divided into two variants. These include top-down and bottom-up sales forecasting. Sales forecasting has many beneficial effects, like improving the production cycle and streamlining business processes.

Cash Flow

Financial forecasting can help businesses maintain a steady cash flow. Cash flow is an important detail that monitors how much cash or revenue comes in and goes out of a company in a fiscal period.

Cash flow forecasting tries to assess and analyze factors like expenses and income simultaneously. However, it would help if you remembered that cash flow analysis or forecasting is only accurate over a short period.

Budget

We have already discussed how budgeting and forecasting are very different but intertwined components. Budget forecasting allows businesses to plan for the future by studying past data.

Therefore, this form of forecasting combines budgeting and financial forecasting components simultaneously. As a result, it is often lauded or seen as one of the most prominent and valuable forms of economic forecasting.

Income

The final forecasting variant that we need to talk about is income forecasting. Income forecasting is a complex form that tries to collate past and present revenue data and predict performance.

The income forecast takes past revenue performance and current growth rate to assess the overall growth. This is an integral part of understanding where a business might go eventually.

This is the only form of financial forecasting helpful for your business processes and financers. Business operations would be improved by understanding where the business is standing currently, and investors can use the data to make crucial decisions regarding the investment.

The Final Straw

In the end, financial forecasting is an essential skill that economic experts have in their arsenal. It allows the business to reflect, assess, and take pre-emptive actions to improve the current state.

Hence, financial forecasting is the route if you want your business to perform at a higher efficiency level and generate higher income levels. It will hold a mirror and help you understand what you need to do to grow.

Comment about this article, and follow us for more business and wealth management content. Thank you!

Additional Reading: