Wealth Management Vs Investment Banking: What’s Better for Work-Life Balance According to Experts

by Mashum Mollah Finance 16 October 2024

What is the difference between wealth management vs investment banking? Are they similar? Do you need both, or can you do it with just one? Well, stick around, and you will get answers to these questions.

In this wealth management vs. investment banking article, we will look at some of the most prominent aspects of investment banking and wealth management so that you can make a more informed and educated decision about choosing one as a career.

Let’s go!

Jobs In The Finance Sector

Jobs in the finance sector have always been lucrative. This is why the industry has always been one of the most sought-after job sectors in the market. The jobs are secure, they pay well, and they can help you understand how money flows.

However, the finance sector is like an ocean. Therefore, it is essential to understand the essence of focusing your endeavors. This is why we have picked two significant career opportunities in the finance sector as our subject.

In the article ‘Wealth Management Vs Investment Banking,’ we will discuss some key points that one needs to remember if one wants to break into either of the two sectors.

Understanding Wealth Management

The foremost thing we need to do before we proceed is understand the basics. Therefore, let us start our conversation by understanding the first piece of the puzzle: wealth management. What is Wealth Management?

Wealth management is primarily an umbrella term that is used to state several things at the same time. These include family wealth management, asset management, investment management, etc.

Wealth management is more inclined towards financial goals. In other words, wealth managers would work closely with their high-net-worth clients to work towards a specific goal.

A wealth management professional would devise different strategies to help clients reach specific financial goals by managing and funneling wealth.

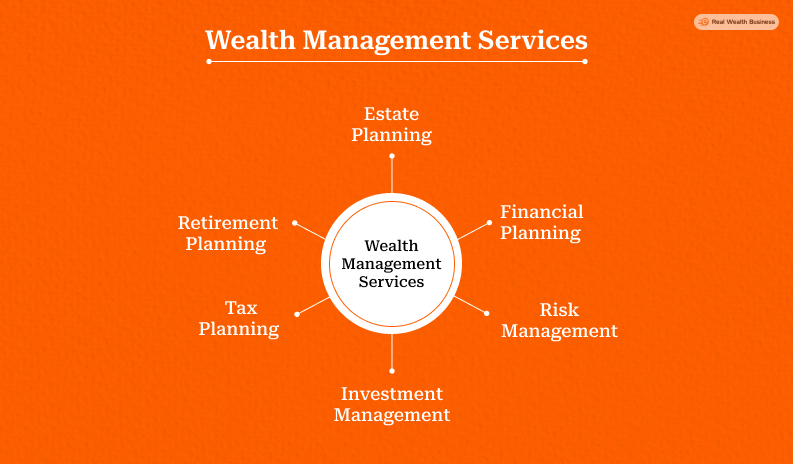

Wealth Management Services

Wealth management is one of the mainstays of the financial sector. Practically, everyone requires the services of a wealth manager from time to time.

However, you can only make an educated decision if you have clarity about the services that you need to provide.

In the following subsections, we will discuss some of the most prominent services wealth managers are expected to offer throughout their careers.

Financial Planning

The foremost thing that wealth managers do is create a checklist and help their clients manage their finances. This is also known as financial planning.

Wealth managers must devise financial plans, goals, and strategies to help reach their clients’ specific goals.

A financial manager needs to look at different aspects of their clients, including cash flow, retirement plans, family requirements, medical bills, etc.

Risk Management

Risk management is one of a wealth manager’s most essential parts. This complex process requires a precise understanding of how risks emerge and how they can be dealt with.

Risk management could be one of a wealth manager’s most challenging aspects. You never genuinely know what to expect and what to do.

Therefore, you need to be on your toes.

Investment Management

Even though we will be discussing investment management and banking separately, wealth management also includes some investment management services.

Wealth managers must assess and see their clients’ investments across different domains. Consequently, the assessment report can be used to formulate a sound investment strategy.

To create an airtight plan, investment management strategies factor in risks, optimal running cost, investment ROI, etc.

Tax Planning

Wealthy individuals often face problems due to taxes. As a result, wealth managers are frequently summoned to get them out of a taxation fix.

Tax management and optimization primarily factor in income rates and different sources of income.

Subsequently, they would streamline everything by minimizing tax liabilities under tax regulations and compliances.

Retirement Planning

Retirement planning is often given its due respect before it is too long. However, you must remember that retirement planning is essential and can save you from becoming homeless during your old age.

This is a long-term service that you are expected to give your clients. As a retirement planner, your job is to ensure your client has enough financial support during their old age.

Estate Planning

Planning an estate or formulating the will can be a tough and challenging task. This is where you and your services can step in.

Estate planning includes strategies like family gifting, tax reduction, estate administration, etc.

Therefore, there are several factors that a wealth manager needs to juggle to help their clients in managing and planning their estate.

Understanding Investment Banking

As stated earlier in this wealth management vs investment banking article, we would like to understand the fundamentals before proceeding. We have already studied and understood wealth management. Therefore, let us proceed with investment banking.

A wealth manager’s job includes a myriad of different services. These start from estate planning to managing taxes. However, investment banking is a more focused task that requires understanding concepts like mergers, divestitures, acquisitions, etc.

An investment banker would spend time analyzing the current market and come up with a streamlined investment plan. This plan would allow the client to make a more educated investment decision.

Investment Banking Services

An investment Banker’s primary job is to multiply the overall ROI of their clients. This is done with the help of an understanding of crucial components.

Hence, if you want to break into this sector, you must have clarity about the services you are expected to provide.

Therefore, follow along to learn more about the services that you need to provide as an investment banker throughout your career.

Merger & Acquisition

An investment banker’s primary job is to work on mergers and acquisitions. Investment bankers primarily provide this service to mega corporations, governments, etc.

Your job will be to assess the acquisition cost as an investment banker. Therefore, they would negotiate pricing and see the liabilities.

An investment banker’s job during a merger and acquisition is to work as a mediator.

Underwriting

This is a unique form of service that investment bankers provide to their clients. Investment bankers work as mediators between investors and the company looking to invest.

Nowadays, this is usually done with the help of technology or the internet and contacts. These two components are necessary for things to get tricky.

Therefore, raising capital for investment or underwriting is often lauded as one of the most essential wealth-building strategies and services an investment banker provides.

Sales and Trading

Earlier, trading was not included in investment banking services. However, trading has eventually become an integral part of business. As a result, most investment banking firms have a dedicated department dealing with stocks, shares, bonds, etc.

As an investment banker, your job will be to take care of the sale of trading assets and ensure you get the best return. You are, subsequently, streamlining the process of investing and the pro.

Asset Management

Big organizations with many assets need help managing and streamlining them. This is where you and your investment banking firm come in.

Investment banking firms can help big organizations streamline and manage their assets. As an asset manager, your job will be managing the entire spectrum.

Therefore, you might be juggling multiple assets simultaneously. Hence, it is a difficult task to master. However, the adoption of technology can help you with the process.

Advisory Services

Many small businesses have started breaking into the current business space. These firms have the money but need to learn how to grow it.

Therefore, you and your investment banking firm could help these businesses to understand what is important and work towards it.

In other words, investment knowledge about investments can help businesses develop their SOPs and business process planning.

Raising Capital

An investment banker’s primary task is understanding and finding means to raise capital. This is a significant detail for companies that are looking to expand.

However, raising capital is a complex task. It is a complex job that involves raising capital and reducing debts. Hence, it is a complex endeavor that is multi-faceted in nature.

This is where wealth management vs investment banking coincides. Wealth management and investment banking work similarly in this aspect. Therefore, they are genuinely different sides of a similar coin.

The Final Thought

In summation, you need to understand these significant differences and expectations if you are looking for a job in either of the two sectors. Therefore, you need to be cautious before making any final decision.

If you liked our wealth management vs investment banking, leave us a comment. Moreover, you can check our page regularly to find more relevant and similar content about managing your wealth and finances.

Till then, have a good time making money!

Additional Reading: