Definition Of A Bill Of Exchange: Examples And Procedures

by Shahnawaz Alam Finance Published on: 06 July 2023 Last Updated on: 25 September 2024

A bill of exchange is defined as a written order that is primarily used in international trade that binds two parties in a way where one party is under the mandate to pay the other a fixed sum of money on demand or on a pre-decided date.

They are similar to checks or promissory notes, can be drawn by banks or individuals, and are usually transferable through endorsements.

Points To Remember

- A bill of exchange is a written document that ties one party to pay a fixed sum of money to the other party on demand or on a pre-decided date.

- There are three parties that are involved in a bill of exchange-

- Drawee: The party that pays the money.

- Payee: The party that receives the money.

- Drawer: Compels the Drawee to pay the Payee.

- A bill of exchange is mainly used by exporters and importers to fulfill international transactions.

- Although a bill of exchange is not considered a contract, the involved parties may use it to specify the transaction terms like credit terms or rate of accrued interest.

Understanding A Bill Of Exchange

There are three parties that are involved in a bill of exchange transaction.

💴 The Drawee: The party that is bound to pay the fixed sum on demand or on a predetermined date.

💴 The Payee: The party that receives the sum from the Drawee.

💴 The Drawer: This is a third party that compels the Drawee to pay the Payee.

The same entity is considered as the Payee and the Drawer unless the bill of exchange is transferred to a third-party payee by the Drawer.

Although it might seem similar to a check, a bill of exchange is a written document that outlines the indebtedness of a debtor to a creditor. It is mostly put to use in international transactions to pay for goods and services.

A bill of exchange, although not considered to be a contract, can be used to fulfill the terms of a contract. It states the payment that is due on demand or on a specific date. The Drawee must accept a bill of exchange in order to validate it.

A bill of exchange does not pay any interest. They may ensue an interest if not paid by a certain date, in case of which the rate must be specified on the instrument itself.

A bill of exchange must, at all costs, clearly detail the sum of money, the date, and the involved parties, which will include both the Drawer and the Drawee.

In case a bank drafts the bill of exchange, it will then be referred to as a bank draft. The transaction guarantee, in this case, will be taken over by the bank itself.

A bill of exchange can be referred to as a trade draft when it is issued by an individual.

In case of immediate payment or on-demand, the bill of exchange is referred to as a sight draft.

When the date of payment is set in the future, the bill of exchange is then known as a time draft. A time gives a short amount of time for the importer to pay the exporter for the goods received.

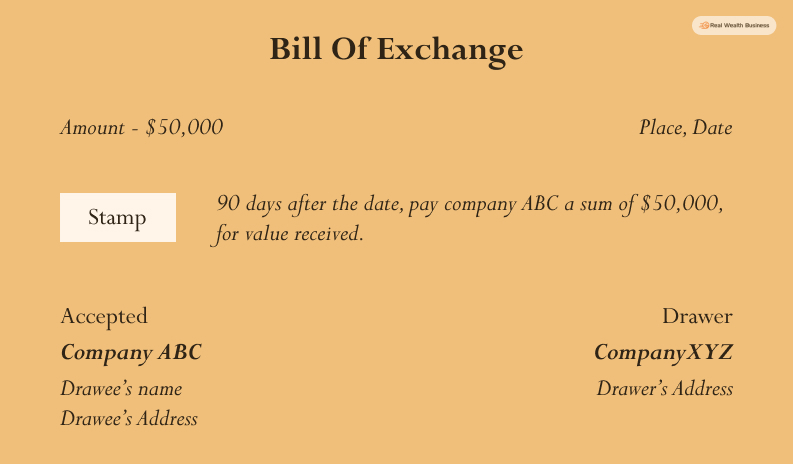

Example Of Bill Of Exchange

Company ABC purchases technical parts from Company XYZ for $50,000. Company XYZ issues a bill of exchange for Company ABC against the purchase. The bill of exchange specifies that Company ABC will pay Company XYZ $50,000 in 90 days for the technical parts that it purchased.

Here,

Company ABC: Drawee

Company XYZ: Payee and Drawer

Within 90 days, Company XYZ will present the bill of exchange to Company ABC for the payment against the purchase. The bill of exchange is an acknowledgment crafted by Company XYZ, who is also, in this case, the creditor that shows the indebtedness of Company ABC, the debtor.

What Are The Different Types Of Bills Of Exchange?

When issued by a bank, a bill of exchange is known as a bank draft. The bank that issues the bill takes guarantee of the transaction of the same.

When issued by an individual, it is referred to as a trade draft. In comparison, a bill of exchange is known as a sight draft if the transaction is to be done immediately or on demand. A sight draft allows exporters to hold the title against exported goods until the importer takes delivery and pays for them in case of international transactions.

Although, a bill of exchange is called a time draft when the sum is to be paid by a set date in the future. This gives the importer a short amount of time to pay for the products purchased from the exporter.

Parties Of A Bill Of Exchange

As mentioned before, there are mainly three parties that are involved in a bill of exchange.

Firstly there is the Drawee, the party that pays the amount specified in the bill of exchange.

Then there is the Payee, which is the party that receives the amount paid by the Drawee.

Lastly, there is the Drawer, the party that compels the Drawee to pay the Payee.

In most cases, the Payee and the Drawer are the same parties unless the Drawer issues the bill of exchange with the name of a third-party payee.

Difference Between A Bill Of Exchange And A Check

While a check always includes a bank, a bill of exchange can be issued by any individual, along with a bank in some cases.

Checks are payable on demand, but a bill of exchange can be payable on demand or on a specified date that is mentioned in the bill itself.

Bills of exchange are not subjected to a rate of interest which makes them, in essence, post-dated checks. Although they might bring in some interest if not paid on time, that happens only if the amount is specified on the bill of exchange itself.

Unlike checks, a bill of exchange is a written document that outlines the indebtedness of a debtor to a creditor.

To Conclude

A bill of exchange is an important instrument in any business. They serve a purpose by outlining the indebtedness of debtors to their creditors and have a fine line of difference from a regular bank check. A bill of exchange can only be called valuable when the Drawee accepts the bill issued by the Drawer.

Additional Resources: