Estate Planning Checklist: Dos, Don’ts, And Mistakes You Need to Avoid

by Ankita Tripathy Real Estate 03 December 2024

Having an estate planning checklist is one of the most important parts of Estate Planning For Family Wealth. If you are thinking about planning your estate is getting an estate attorney or will, then you have only understood the tip of the iceberg.

Follow along if you genuinely want information about the whole process and plan your estate effectively. Let us dive right in without further ado and look at different aspects related to estate planning cost, etc.

What is Estate Planning?

Death is inevitable. It is a chapter that we will have to go through. But before we can go and meet our maker, we need to ensure that the people we leave behind are taken care of. This is what estate planning is.

Estate planning is basically setting your affairs straight and distributing wealth as it benefits your family members. In a way, it is about choosing a successor. A successor of your assets, businesses, etc.

You might even see this as a means of asset protection trust that can safely keep your assets till they can be transferred to its actual successor

Prominent Elements of Estate Planning

Estate planning is a complex process, to say the least. It is so much more than distributing your wealth amongst your children. Estate planning is a legal contract that comes into effect after your death.

It is the final decision most people will ever take. It can also be at the center of family feuds. Hence, to understand the estate planning checklist, you need to understand the concepts that make up the process:

Wills

A will or as it is officially called, ‘last will and testament’, is a legal document that records your wishes and wants when it comes to your assets post your death. Will is absolute and can only be changed by the person who is the grantor or creator of the will. If you hire an estate planning lawyer, you might get the job done more effectively.

Trusts

A trust is a form of legal obligation you pass onto a person, who is called a trustee, to hold your property for the beneficiary, someone who will benefit from the said estate distribution. A trustee cannot make decisions pertaining to the will. They can only hold the wealth to pass on.

Testamentary Trust Vs Living Trust

As a grantor, you have the free rein to choose between a testamentary trust and a living trust. A living trust is activated before as well as after your death. Subsequently, a testamentary trust only comes into action after your death.

Irrevocable Vs. Revocable Living Trusts

A living trust can be further segregated into two sections. These include irrevocable trust. In this variant, you cannot revoke your decision and submit all control. Revocable does the opposite thing. It gives the grantor the power that they want.

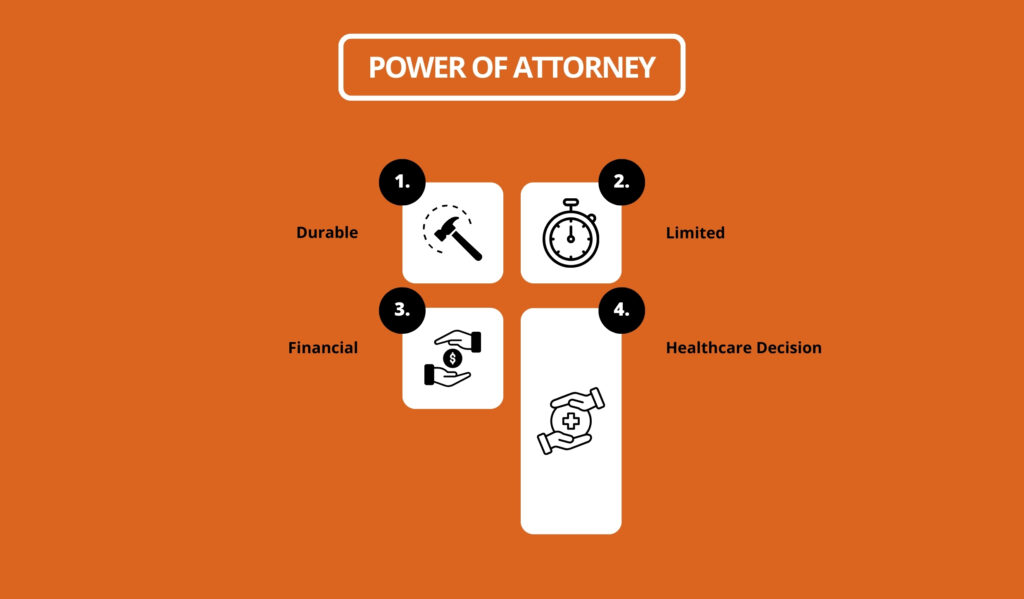

Power of Attorney

Estate planning attorney is often confused with Power of Attorney. Power of attorney is a more nuanced concept compared to trustee. The power of attorney allows the person to decide on the grantor’s behalf. The person to whom you entrust this responsibility is called an agent.

An agent comes into action only after you have been termed invalid or incapable of making any decision. Here is a small rundown of all the different forms of power of attorney that the court of law recognizes.

- Durable: In this variant, the agent can act or make decisions on your behalf in case you are incapacitated. Durable POA can cast a long shadow of influence or become very specific. This is something you, as a grantor, would decide.

- Limited: Limited authority is a particular form of POA where the grantor only allows the agent to have some area of influence in a specific setting.

- Financial: Financial POA allows the agent to make financial decisions on behalf of the grantor. This usually comes into play after the death or invalidity of the grantor.

- Healthcare Decision: This allows the agent the power to make medical decisions as per the grantor’s wish. This is further enforced by tools such as living wills, healthcare proxies, and advanced healthcare directives.

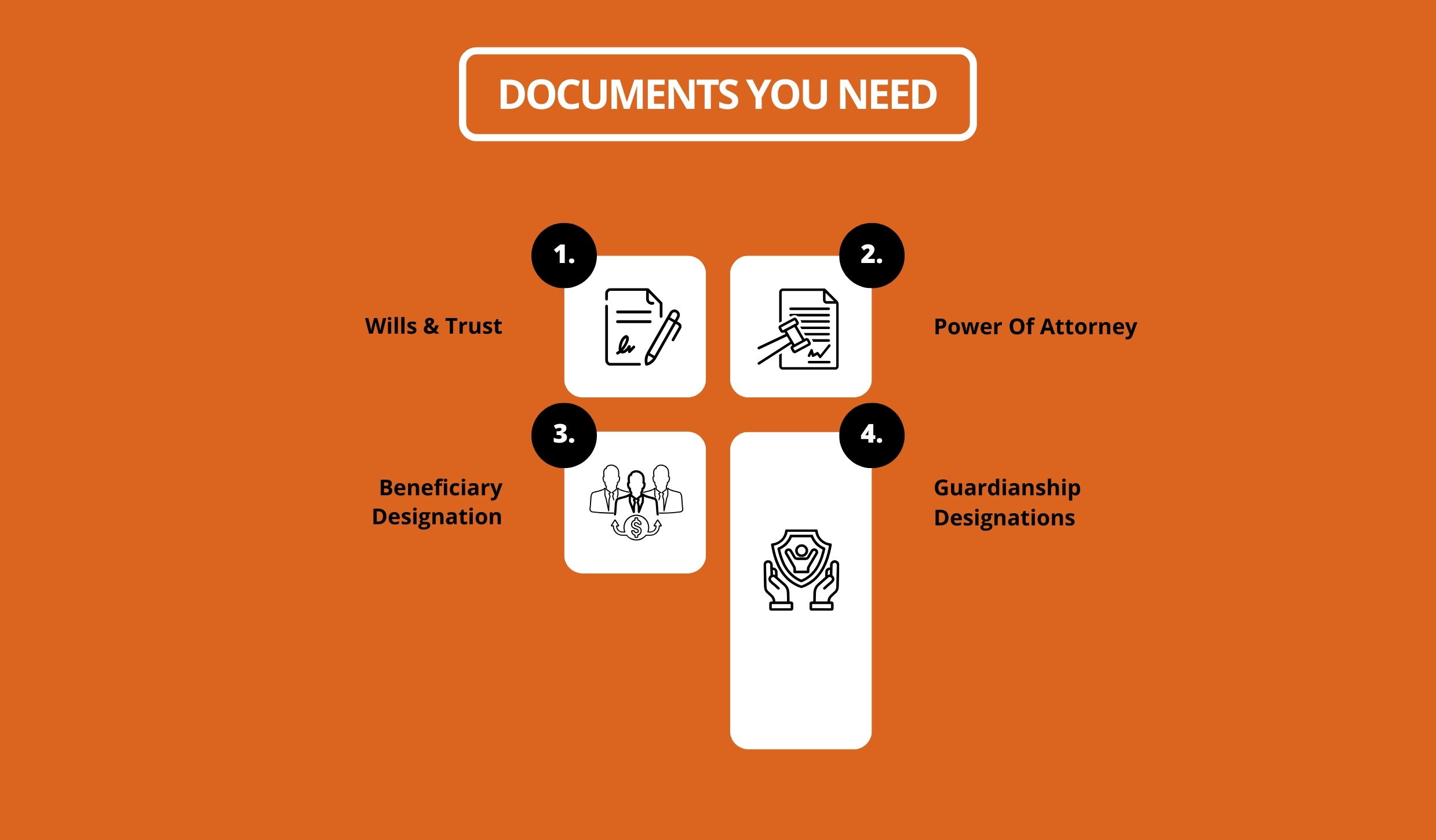

Documents You Need

Estate planning is a permanent affair. In other words, you cannot go back on a dead man’s wishes and wants. As a result, necessary authorities have ensured that they include enough documentation to retain its permanence essence.

If you are planning your estate or know someone who is, here is a brief rundown of all the documents that you are expected to present. However, this is a generalized list that might differ state-wise.

Wills & Trust

Wills and trusts are the cornerstone of an estate planning checklist. You can only plan your estate if you have clarity on the points. Without an effective will or trust, the state will take over and make decisions on your behalf. Trust is prevalent in cases that involve children as successors.

Power of Attorney

The following document that you will need is a power of attorney. In case you are incapacitated, you will have to give a specific person a power of attorney. The power of attorney allows individuals to make decisions on your behalf and comes in several different forms.

Beneficiary Designation

The beneficiary designator is often overlooked but is a crucial piece of the document. The beneficiary document explicitly discusses or names the benefactor who will receive the estate. Therefore, this is very important as it effectively determines the channel of wealth distribution.

Guardianship Designations

If a minor is involved in the case, you must also hold a guardianship designation document. The guardianship designator ensures that a trusted adult works as a guardian of the minor and takes care of legal fiascos that might come along. As a result, this is often confused with POA but has its own differences.

Estate Planning Priorities

Hopefully, you will go through the hassle of estate planning only once in your life. Therefore, setting your priorities straight is very crucial. Otherwise, you might face a lot of blowback.

Here are three fundamental and critical processes that you need to understand if you want to get your estate planning checklist right.

- Asset Distribution: The first thing that you need to understand is the asset distribution. This is a crucial process as it ensures that your assets are distributed effectively.

- Decision-Making Authority: This will allow you or the grantor to select an agent who can make decisions on their behalf.

- Beneficiary Clarity: The final priority is to ensure that you have a clear-cut beneficiary who will receive your wealth after distribution.

While everything about the process is essential, these three are the most basic and crucial aspects of the distribution or estate planning checklist.

Estate Planning Checklist

Estate planning is an essential part of a person’s life. It is the final big thing that a person needs to ensure that they do it right. Therefore, following a step-by-step approach can actually help you get the job done with ease and effortlessly.

In this section, we have taken our time and have gone through each step of the journey so that you do not have to face any sort of problems during this final stage of your life. Here we go!

Step #1

Start by assembling a team. Make sure that you get the right professionals by your side. Take legal help, financial advisor, and tax professional with you. Their expertise will come in very handy in the long run. They will help you chalk out a plan.

Step #2

Incorporate a systemic and methodical approach while planning your will. Do not leave anything to chance. Chalk out every possibility, and make sure you back it up with documents.

Step #3

Be very careful who you give the power of attorney or healthcare proxy. Only give it to people who you can trust. People who would not screw you over. The best way is to choose a family member.

Step #4

If a child is involved, you must ensure that a legal guardian is mentioned. This person will help the kid to navigate the complex landscape of estate laws. Again, make sure that you choose someone from your own family and nobody else.

Step #5

Finally, set your terms and conditions straight. Make sure that everything is jotted down in detail, and nothing is left to chance. However, it is easier said than done. Therefore, you also need to understand some of the common mistakes that one might make while planning an estate.

Common Estate Planning Mistakes

Planning your estate is such a hassle. As you can see, there are so many ways things can go wrong. Hence, it is essential to understand the mistakes you must avoid. In this section, we will be primarily focusing on some of the most common problems or errors that you must avoid at all costs.

- Naming only one beneficiary

- Failing to communicate with all the parties and estate lawyers.

- Not taking into account your digital footprint and social media representation.

- Please update the will according to your familial and mental state.

While there are so many other mistakes that come into the spotlight, these ones take the spotlight.

The End Note

In summation, planning your estate is not an easy task. There are so many aspects that you need to understand before you can go ahead.

However, ensuring that you have an estate planning checklist can help you get the job done effectively. Therefore, before you do anything, ensure that you have the checklist handy and all the pointers ready. This is the only way you will be able to get the job done effectively.

Thank you and have a great day ahead.

Read More: