by Abdul Aziz Mondal Financial Planning Published on: 14 January 2021 Last Updated on: 26 December 2024

Whether your employees are new to your business or have been working for a decade, it is never too late to start your future retirement plans. And the best part is that you can actually ask your employees to be a part of your retirement plan.

When we talk about retirement, there is no such thing as too much for retirement. The more you can plan for your retirement, the more leisurely you live your retirement life.

Discussing the retirement plan during the onboard is not enough. There are employees that do not have enough financial education to grasp the whole concept and confidently kick off this account.

Increase Employee Participation In Retirement Plans

It might feel like the company is taking action to disrupt employees’ lives more than they should, but helping their employees with a good after retirement life seems beneficial for both employers and employees.

With that being said, one final question remains, how exactly does an organization convince employees to increase their participation with retirement plans?

1. Explain The Situation

The basic rule to enjoy stress-free retirement life is to invest 10% of your paycheck in retirement plans. Walking through the retirement plans with your employees is the first step to onboard them with the retirement plan. Tak with them, and explain the current market situation. Ask them even if they are willing to invest 1% of their salary is still better than saving nothing.

2. Explain Retirement Plans

Most people don’t go for retirement plans because they lack the necessary information to take confirmed steps. Hence, you must clear out the retirement plans to your employees. Talk about the different plans and how each plan can boost their after-retirement life.

3. Educate Them On Various Formats

Every employee is different, so going with the same format of communication might not work. Diversify your communication format. This will help engage with your employees more effectively. You can talk one-on-one with them. You can conduct webinars; you can share printed materials, etc. By offering a mix of options, you will be able to reach out to every employee working for you.

4. Offer An Employer Match

Not every employee is the same nor their requirement. So, it becomes important that you keep this factor in mind while talking with them. Give employees enough freedom to choose the number of percentages they want to invest in retirement plans. Companies that offer matches to the employees have a chance to provide free money to employees receiving tax breaks.

5. Offer Information Regularly

Now that the employee is on board with the retirement plan, it is your responsibility to ensure that they get all the relevant information. This practice helps the employee to understand and value their retirement plans.

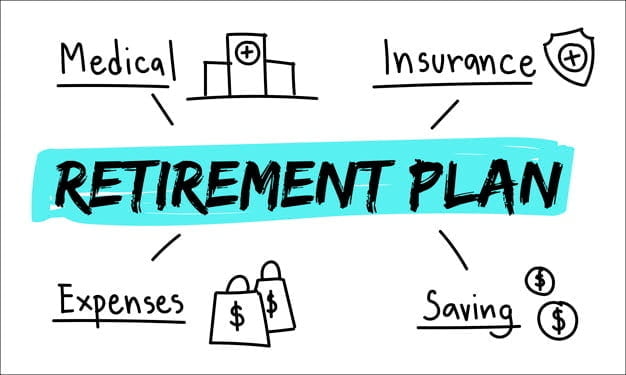

If this piece of information seems hard to understand, you might find the following infographics helpful:

A guide created by Mowery & Schoenfeld

Read Also: