Effective Personal Finance Planning Tools for Students

by Mashum Mollah Financial Planning Published on: 21 June 2019 Last Updated on: 17 March 2020

Most students do not give much thought to financial management. This could be mainly because most of them receive support from their parents and they only care about spending. However, there is more a student can learn as far as planning for their finances is concerned. Apart from saving, the mere act of spending should be planned to avoid wastage and unnecessary debts. Ewritingservice.com is one among the many sites that avail useful planning tips for students. There are students who spend their money prudently and are able to save and even invest during and after their college days. The following are some of the effective personal financial planning tools for students.

Effective Personal Finance Planning Tools for Students:

Wally:

\This is an application that helps an individual to track their expenses. If a student is able to know where their money is going, then they can plan for it wisely. This application allows one to follow their expenses even on a daily basis. It is possible to pick out the things that are causing one to overspend and slash them off if they are not as important or allocate less money to them. When most finances are channeled to the things that matter most, then wastage becomes a thing of the past.

BudgetSimple:

This app offers what may sound rather obvious and quite traditional but its importance in financial planning cannot be over-emphasized. Money that is not planned for ends up being misused. If students can budget for the much or little money they have, then they can accomplish a lot even before graduation. Having a budget enables one to give top priority to the most important things and only allocate the extra cash to luxuries. Most students seek writing help from professionals hence the need to budget for such.

Level:

This is another useful application available for both Android and iPhone users. It informs the user on how much more money they can spend in a day, month or any given period. This means that it remains in sync with your projected budget so that you do not overspend. Once the student knows how much is left to spend, then they can give priority to what is more important. Also, with such information, one is able to turn down some commitments early enough to avoid unnecessary fixes.

Mint:

For one to be a good planner and manager of their finances, they need to always be aware of how much money they have in all their accounts. Mint is the kind of application that keeps track of all personal accounts whether in the bank or mobile money accounts. One is able to view all their balances at the click of a button to know how they are faring. A prudent student will plan for what they have without expecting more from their parents.

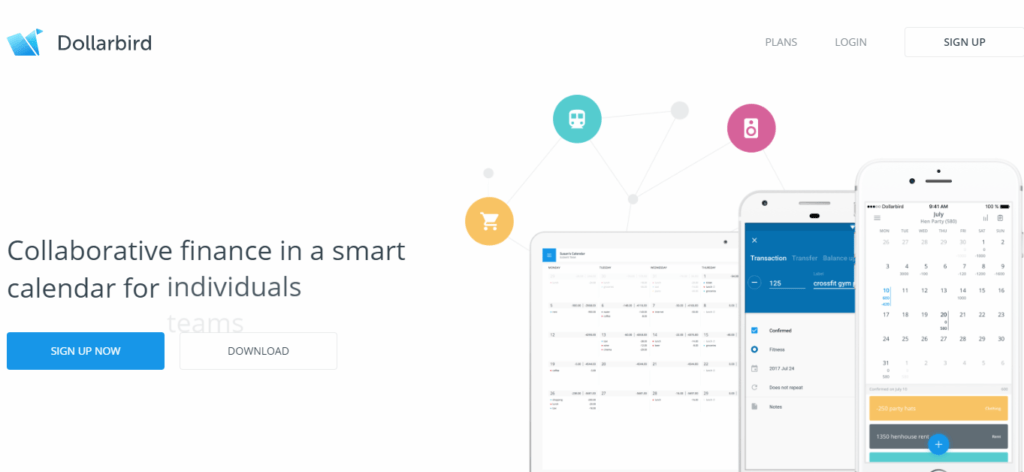

Dollarbird:

Students need to project their possible expenditures way before so that they can plan on how to spend. Dollarbird is one of the apps that enables a student to plan for huge future expenses so that they are not caught by surprise. For instance, if one plans on buying papers online, they need to save up for the same so that when the time comes they can get the best. Sometimes online writing service providers can be costly especially the well-polished ones.

Final Advice:

Students do not have to always depend on their parents for financial support even though it has always been the norm. What is lacking among many of them is financial planning and management skills. The tips discussed here will be of help to any students seeking to become a better financial planner.

Read Also: