by Ankita Tripathy Loans & Credit Published on: 21 November 2023 Last Updated on: 27 May 2025

Navigating through the world of finance has always been a challenge for me! It made me feel like I’m walking on a tightrope.

Thank god! My dad was always there to help me out, to understand every single area, even how to maintain a good credit score!

That’s when I understood that a good credit score is always essential if you plan to take out a loan, as it helps secure financial assistance when needed.

These credit scores serve as evidence to demonstrate your creditworthiness and repayment capacity. Now! If your credit score is low, the financial institution may deny your loan approval.

Want to know more about it? Read this comprehensive guide as we explore what a credit score is and how a bad credit score can affect your overall chances of getting your loan application approved.

Don’t worry! I will also help you develop strategies to maintain a good credit score. Read on…

What Is A Credit Score?

A credit score mainly represents your creditworthiness. The number primarily consists of three-digit numbers, ranging from 300 to 900.

Now, how is it calculated? Well, the calculation is based on your:

- Credit history

- Payment partners

- Total debts

- Credit utilization ratio and other factors.

So, if you have a higher credit score, it means you have the repayment capability within a proper timeline.

Financial institutions, NBFCs, and even banks refer to this credit score when reviewing your loan application. This helps to determine whether there are any risks involved in lending your money!

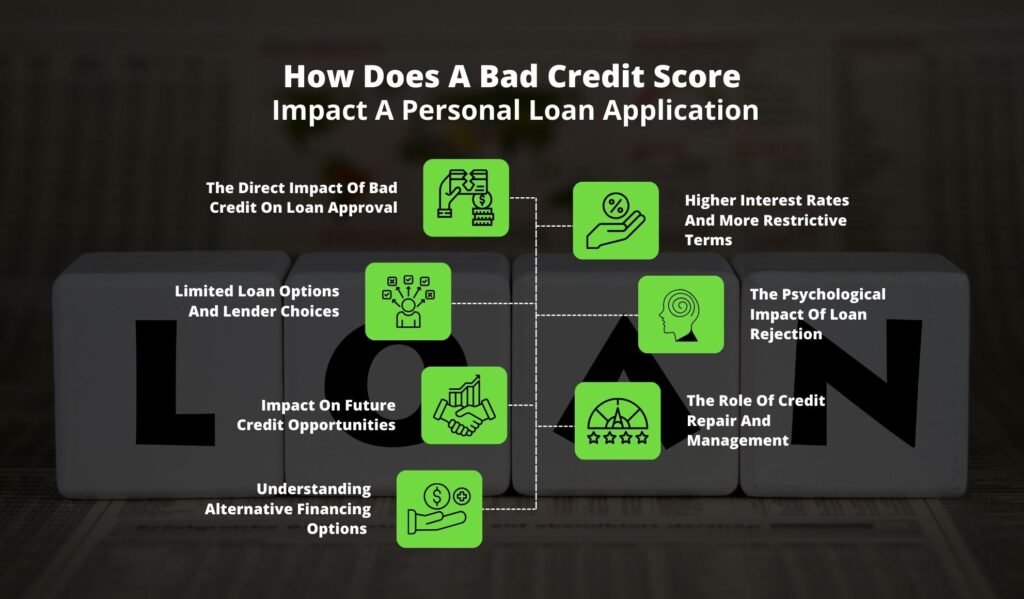

How Does A Bad Credit Score Impact A Personal Loan Application?

A low credit score can significantly impact your personal loan application, potentially leading to rejection.

You may also face high interest rates along with less favorable loan terms. On the other hand, the lenders view this low score as an indication of higher risks. This can further lead to even stricter requirements for loan approval.

Read on to know more about in detail:

1. The Direct Impact Of Bad Credit On Loan Approval

Bad credit is often seen as a red flag by lenders. It indicates a history of missed payments or financial mismanagement, which makes lending money to such individuals a risky proposition. As a result, having bad credit can significantly reduce your chances of getting a traditional loan approved. However, there are alternatives, like online loans for bad credit, which are tailored to assist those with less-than-perfect credit scores. These loans often come with higher interest rates but can be a viable option for urgent financial needs.

2. Higher Interest Rates And More Restrictive Terms

One of the most immediate consequences of bad credit is the imposition of higher interest rates. Lenders view individuals with poor credit scores as high-risk borrowers and, therefore, charge a premium in the form of higher interest to mitigate this risk.

Additionally, bad credit often leads to more restrictive loan terms, such as shorter repayment periods or lower borrowing limits, further complicating one’s financial situation.

3. Limited Loan Options And Lender Choices

Bad credit narrows the pool of lenders willing to offer you a loan. Many traditional banks and credit institutions might outright deny loan applications from individuals with poor credit scores.

This limitation forces individuals to seek alternative lending sources, which might not always offer the most favorable terms. It’s important to thoroughly research and compare different lenders to find the best possible deal under these circumstances.

4. The Psychological Impact Of Loan Rejection

Repeated rejections for loan applications can have a psychological impact, leading to feelings of stress and hopelessness. This emotional toll can affect one’s quality of life and further complicate financial decision-making. It’s essential to approach this situation with a positive mindset and seek professional financial advice if needed.

5. Impact On Future Credit Opportunities

Your current credit situation also influences future credit opportunities. A history of bad credit can haunt your financial journey for years, making it difficult to obtain mortgages, car loans, or even smaller personal loans. Improving your credit score should be a priority if you’re planning significant financial decisions in the future.

6. The Role Of Credit Repair And Management

While bad credit can hinder loan approvals, it’s not an irreversible situation. Engaging in credit repair and management strategies can gradually improve your credit score. This includes timely payments, reducing credit card balances, and avoiding new debts. A healthier credit score can eventually open the door to better loan terms and approvals.

7. Understanding Alternative Financing Options

For those with bad credit, understanding and utilizing alternative financing options is key. This includes peer-to-peer lending, credit unions, and other non-traditional lenders. These alternatives often offer more flexibility and understanding of your financial situation, although due diligence is always advised.

Is There Any Way To Improve Your Credit Score?

Once you improve your credit score, you can enjoy better loan opportunities in the future. Here are some practical tips that you can follow:

- First comes paying bills right on time. It is one of the most effective ways to boost your credit score. There are various applications available that can give you timely reminders.

- Secondly, you can reduce the debt. Try to lower your credit card balance. This way, you can improve your credit utilization ratio.

- Lastly, you can monitor your credit report. Regularly check your credit report. This way, you can report if there are any fraudulent cases.

A good credit score is always necessary if you are trying to secure a personal loan. But if you don’t have a good score already! Don’t worry it is never too late to start with your financial responsibilities.

In Conclusion

Bad credit significantly impacts loan approval, often resulting in high-interest rates, limited options, and the psychological burden of financial stress. However, it’s important to remember that this isn’t a permanent state.

Through careful financial planning, exploring alternative lending options, and diligent credit management, you can improve your credit score and enhance your chances of loan approval in the future. The journey to financial stability might be challenging, but it is certainly achievable with the right approach and mindset.

Read Also:

All Comments

ez loans

Your cash is locked away until you repay the loan.

easy loans for Bad Credit online

A payday loan may also be called an unsecured mortgage.