What will corporations need to do to meet financial regulation and legislation?

by Barsha Bhattacharya Finance 30 May 2025

With this hectic business era, businesses cannot spare any one large area—compliance with financial rules and regulations.

Whether you have a small bakery business or a budding technology enterprise, compliance with the rules is imperative to ensure that your business remains in a legal, secure, and trustworthy position.

What will corporations need to do to comply with financial regulations and legislation? And why do businesses need so many rules and regulations at all?

Here on this blog, we’ll tell you everything in simple, friendly language. There won’t be any complicated legal jargon—just simple information that any business owner needs to know.

Why do we require financial regulation?

First, let’s talk about the why. Why do governments make all these money rules? Why can’t companies do as they please with their own money?

1. To Keep Things Fair and Transparent

Picture banks hiding fees or investment firms deceiving clients without gfacing consequences Financial regulation makes everyone accountable.

Moreover, it’s just about being open and honest, making sure people and businesses receive true information before they make a decision.

2. To Avoid Fraud and Scams

We’ve all heard of Ponzi schemes or insider trading scandals. Regulators are there to catch wrongdoings before they get too far out of hand. They hold companies accountable and keep customers from being exploited.

3. To Promote Economic Stability

When huge companies fail because of bad handling of money (like in the event of the 2008 financial crisis), the impact is felt across the whole economy.

Furthermore, good regulations stop reckless business conduct that will result in another economic disaster.

4. To Safeguard Consumers

Financial regulations shield your money from being treated inappropriately, be it your wages, pension, or home loan. They prevent abusive lending, discriminatory credit, and other problems.

Short, financial regulations are in place to make the money world more secure, fair, and stable for everyone.

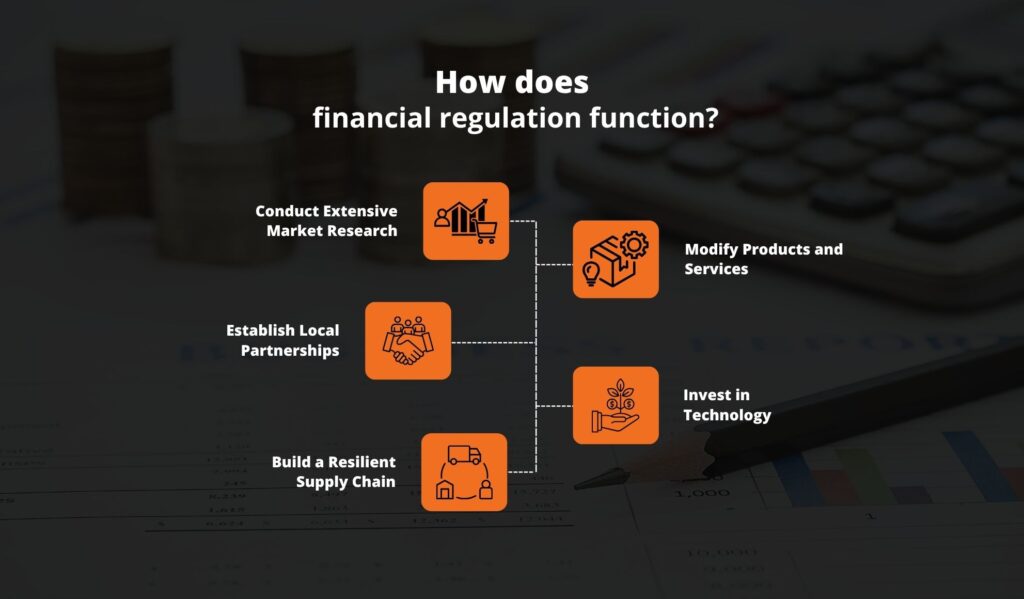

How does financial regulation function?

Good one. Regulating finances is not one of those things where you establish a few guidelines and you are done.

It is a large, organized system with governments, agencies, legislation, and policies all collaborating. Let’s get a glimpse of how it occurs in the background.

1. Rules are established by government agencies.

In every country, there are some government institutions tasked with formulating and implementing financial regulations.

In the United States, for example, we have the Securities and Exchange Commission (SEC), the Federal Reserve, and the Financial Industry Regulatory Authority (FINRA), among others.

These institutions create regulations that specify how banks provide loans and how public businesses distribute their earnings.

2. Registration and Licensing

Before a company can start accepting payments, it typically requires a license or registration. This ensures that the company meets the minimum standards required to conduct business legally.

This includes demonstrating sufficient financial resources, employing competent staff, and maintaining a clean record.

3. Keeping Track and Reporting

Once you get a business up and running, it’s not something you can just leave alone. Financial regulators will usually want periodic reports, like annual statements, tax reports, and disclosures.

These reports help you look at whether or not a business is compliant with the regulations.

4. Audits and Inspections

Regulators also verify and audit to make sure everything is in order. If something is wrong, such as outstanding money or inaccurate information, they can investigate and act accordingly.

5. Punishments for Not Following the Rules.

What if a business breaks the rules? They can be fined very heavily, have their licenses revoked, or even be criminally prosecuted for serious matters.

So, what will corporations need to do to meet financial regulation and legislation?

Having now established what rules are for and how they are enforced, let us now address the main question: What will corporations need to do to meet financial regulation and legislation

Here is your simple, step-by-step guide:

1. Get to know the rules that apply to your enterprise.

Not all companies are the same. The local coffee shop is different from a fintech business. That is why the first thing is to know what laws and regulations pertain to your business.

Depending on your location and business, this could include:

- Tax regulations

- Anti-money laundering (AML) law

- Consumer protection law

- Securities law (for investment companies)

- Data protection and cybersecurity legislation

2. Maintain accurate and up-to-date financial records.

Financial transparency is one of the key aspects of compliance. Companies are expected to have neat, current records of:

- Income and expenditure

- Employee compensation and payroll

- Taxes paid

- Invoices and receipts

- Loans and debt

You can keep yourself in order and audit-compliant using accounting software or an expert accountant.

3. Appoint a Compliance Officer or Responsible Person

Large corporations usually have a compliance officer. They ensure the corporation complies with all the legislation. In small corporations, this might be done by the owner or a trained staff member.

The owner is to be held responsible for:

- Keeping up with regulatory updates.

- Managing audits and reports

- Training employees on compliance matters

4. Educate Employees on Compliance

Yes, your employees stay on track according to the rules! It’s not just the accounting employees. All employees, particularly those who work with money, customer data, or legal documents, should be familiar with the rules and be able to recognize warning signs.

Scheduled training can encompass:

- How to prevent fraud

- Protecting customer data

- Detection of abnormal behavior (particularly in financial institutions)

5. Employ secure and approved money systems.

Companies need to use secure and controlled procedures for operations such as processing payments, payroll, or customer information. It entails:

- PCI-compliant payment processors

- Tax reporting software

- Money programs that support trace records

The objective? Make it all secure and traceable.

6. Stay Current with the Development of the Law

Laws and rules are not fixed. They change with new technology, the economy, and what society cares about. Companies need to follow these changes to stay within the law.

One of the greatest solutions that companies can do in an effort to comply with financial legislation and regulations is to stay up to date.

Subscribe to business publications, take part in professional groups, or consult regularly with legal experts.

7. Get Ready for Checks

Consider an audit as a check-up for your books. If your books are neat and correct, no issue. But if your books are messy, it’s a hassle and costly.

- To be ready

- Keep all documents safe.

- Make electronic copies

- Have a checklist of reporting requirements

- Review your books regularly (monthly or quarterly)

What Does a Non-Compliant Business Face?

If a company fails to adhere to financial regulations and laws, the consequences are dire—sometimes even disastrous.

One of the most immediate threats is monetary penalties. Regulatory agencies can impose enormous fines that eat away at profits, and at times, they can simply continue to add up over decades.

And then there is the risk of being sued. Failure to meet regulations can result in lawsuits from customers, business associates, or even employees.

If the company has violated laws, such as defrauding or breaking consumer protection laws, there can be criminal prosecution, resulting in imprisonment of executives or owners.

There is also the matter of reputation. Once people hear that a company is not complying with the law, it is hard to regain their trust.

Clients can depart, investors can take their money elsewhere, and other companies can be hesitant to cooperate.

In areas like finance or medicine, companies can lose their licenses to operate, i.e., they can no longer operate legally.

Yet another issue? Business disruptions. Compliance audits, investigations, and litigation can bring day-to-day business to a halt or slow it down, resulting in delays, employee stress, and distraction from growth.

In other words, not following the rules isn’t a little mistake—it’s a big deal. That’s why it’s worth knowing what businesses have to do to follow financial laws and regulations. Following the rules not only keeps you out of harm’s way, but it is good for your business in the long term.

Final Thoughts: Compliance = Confidence

Financial regulations may seem frustrating, but they serve a purpose. They create a climate that is secure, fair, and trustworthy for people and businesses.

If you want to know what businesses have to do to meet financial legislation and regulations, just remember:

- Understand the rules.

- Keep good records.

- Train your staff.

- Use the right tools.

- Stay current.

- Be audit-ready.

By doing all this, your business is not only protected, but it also builds customer, investor, and regulator trust.

It is the kind of solid foundation that all successful businesses need. Breathe a sigh of relief, grab the notebook (or fire up your accounting software), and ensure your business is financially prepared for the long haul by playing by the rules!

Also read