What are the decisions that the business cycle help firms make?

by Barsha Bhattacharya Business 30 May 2025

Suppose you’ve ever wondered why certain companies succeed and others collapse, even though they are selling the same products. In that case, the answer generally has to do with something you could refer to as the business cycle.

Before you begin to envision complicated graphs and economics teachers speaking in terms of gobbledygook, however, let me cut you off. This is a site committed to being simple, accessible, and uncomplicated.

By the end of this article, you’ll have an idea of what choices the business cycle helps businesses with, why it is important, and how you can use it to stay ahead of the curve if you have a business (or plan to).

Are you ready to learn: What are the decisions that the business cycle help firms make?? Let’s get started!

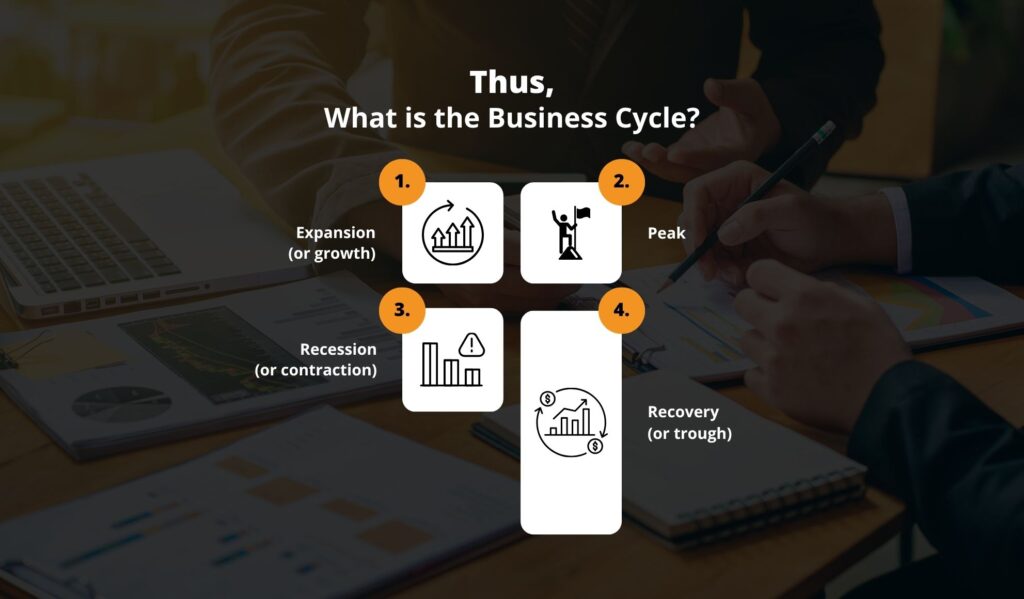

Thus, what is the business cycle?

Consider the business cycle like the cycle of the seasons. We have spring, summer, autumn, and winter. Likewise, the economy also has its periods: growth, peak, recession, and recovery.

Here’s a quick overview:

- Expansion (or growth): All is well. People are spending, companies are making money, and jobs are aplenty.

- Peak: It’s the peak. It’s summer time for the economy — hot and hectic. But after that, things start to slow down.

- Recession (or contraction): People spend less, businesses make less money, layoffs occur, and individuals are careful with their finances.

- Recovery (or trough): The economy begins to improve, individuals consume more, and businesses begin to expand.

These peaks and troughs do not occur overnight; they occur over years or months. And the big question is:

What are the decisions that the business cycle help firms make?

Let’s talk about actual business decisions — not schoolbook ones. The business cycle helps businesses make informed decisions by indicating the direction of the economy, allowing them to prepare accordingly. Let’s walk through every stage and define each.

1. Staffing and Hiring Decisions

Suppose you own a small bakery. In boom economic times, more and more people are indulging in coffee and cupcakes. You will probably need to bring on additional employees in order to keep pace.

But what if a recession occurs? Consumers will spend less on discretionary items, such as your delicious cupcakes.

In that case, the business cycle informs you that it’s time to release some people from work or reduce hours to conserve funds.

Key takeaway: The business cycle informs firms when to add more staff and when to be cautious.

2. Production Planning and Inventory

During the growth phases, companies produce more as more individuals are purchasing. But in a recession, such demand can decline.

Consider a clothing shop. During boom years in the economy, they will purchase new clothes and even fashionable ones.

During a recession, though? They would likely retain their bestsellers that constantly sell and carry less stock, so they won’t be left with excess.

Key takeaway: It tells businesses how much to make or carry in stock, and when.

3. Spend on Marketing and Advertising

Something that most individuals do not consider: how much do you actually spend on marketing?

In boom times, you can spend a lot on flashy ads, influencer partnerships, or even a Super Bowl commercial (all right, perhaps not quite that much).

Times get tough, though? You may need to adjust your marketing budget, focusing on digital channels and promoting offerings that demonstrate value or savings.

Key takeaway: The business cycle teaches you when to invest a lot of capital in marketing and when to invest less.

4. Pricing Plan

Suppose you have a tech firm. When times are good, your customers have disposable income and can afford to pay for the improved version of your product.

But when times are bad, they may cancel their subscription or switch to a less expensive alternative.

By examining the business cycle, you can offer discounts, develop low-price alternatives, or bundle products to make them more appealing during times of distress.

Key takeaway: It helps you determine how to price your products or services to meet what customers can afford.

5. Growth and Investment Plans

Do you have a new outlet or product in mind? The business cycle can actually assist you in that.

When the economy is strong, it’s a great time to invest. Everybody is buying things, banks are lending money, and the market is receptive to new ideas.

If you are in a recession, then it may be wiser to delay expansion, keep your money safe, and ride out the recovery period.

Key takeaway: It informs you when it is appropriate to grow and when it is best to cease.

6. Budgeting and Cash Flow

This is crucial. Long-lived firms are those that have managed their finances effectively. If you believe a recession is imminent, the business cycle recommends that you save, reduce discretionary spending, and establish a safety net.

However, if you are witnessing growth, you can invest the excess money in growth opportunities.

Key takeaway: It enables companies to prepare their finances for the highs and lows to come.

7. Customer Behavior Predictions

Customers act differently based on where we stand in the business cycle. In growth, they desire quality, innovation, and luxury. In a recession, they desire value, ruggedness, and thrift.

Understanding the business cycle enables you to position your products and messaging effectively in terms of what customers are concerned about at a given time.

Key takeaway: You’ll know what your customers are likely to do — and how to satisfy their needs.

Real-Life Example Time!

Let’s consider a business you are familiar with: Amazon.

During the COVID-19 lockdowns, which were a strange time for the economy, there was a big increase in online shopping.

They seized this opportunity to hire more staff, open new warehouses, and expand their services.

However, as the economy shifted again and individuals returned to stores or cut back on spending, Amazon adapted too, laying off some employees, slowing down warehouse openings, and focusing on essentials.

This is an ideal illustration of the kinds of choices the business cycle helps companies make — when to expand aggressively and when to rein in.

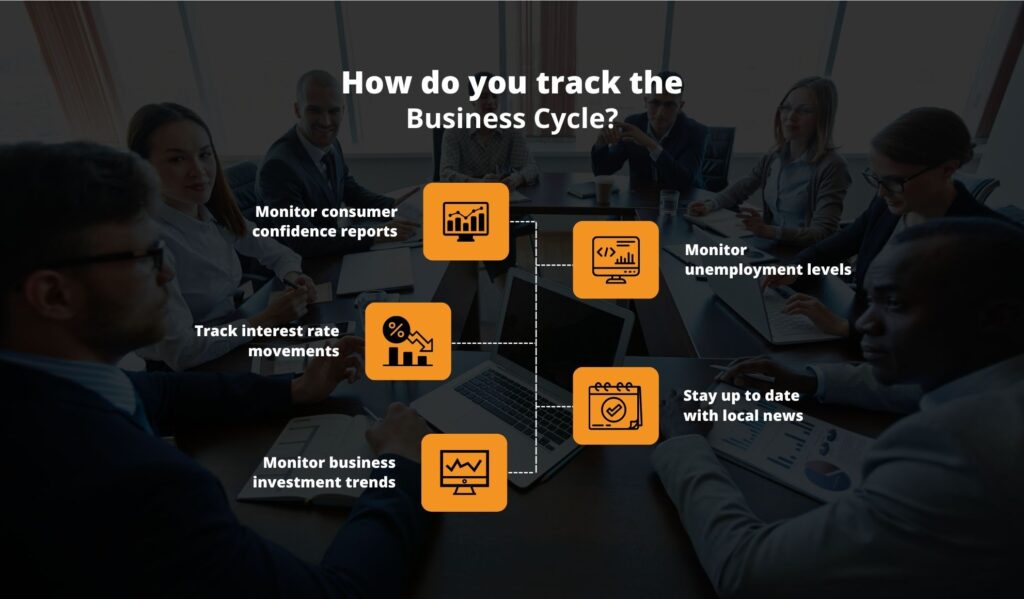

How do you track the business cycle?

You don’t need an economics degree to recognize the business cycle. Believe it or not, there are a few easy ways to stay current, and staying current can make you a better businessperson.

Here’s an easy way to look at where we are in the cycle:

Monitor consumer confidence reports

These show the degree to which individuals are secure in terms of their financial futures. If individuals are safe, they spend more, which is a measure of economic growth. If it drops, individuals hold back — a possible measure of decline.

Monitor unemployment levels

A falling unemployment rate is usually a sign of a sound economy. Rising unemployment might be a sign of a recession or slow growth.

Track interest rate movements

Central banks, such as the Federal Reserve, adjust interest rates in response to economic conditions. When they increase the rates, they might be doing that to slow the economy. When they decrease the rates, they likely want to stimulate spending.

Stay up to date with local news.

Certain industries see the changes in the economy before others do. Notice changes in customers’ behavior, the fluctuation of prices, or demand for your products or services.

Monitor business investment trends.

Are firms investing in new spending or cutting back? An increase in business expenditures is typically an indicator of high confidence, and cuts are indicative of caution.

Monitoring these key indicators can help you gauge the direction of the economy and stay ahead of the curve.

Is the business cycle really that important?

Yes. Whether you have a small coffee house or a tech company expanding in size, understanding the business cycle can benefit you.

Instead of reacting to what’s happening, you can plan ahead. That’s equal to less surprise, smarter decisions, and a greater opportunity for long-term success — even if the economy throws a curveball in your path

Wrapping it up: Allow the Business Cycle to Guide You

What are the decisions that the business cycle help firms make? Well, the business cycle indicates how the economy rises and falls, and can help you make informed decisions.

Whether you are recruiting, setting prices, promoting, or reducing expenses, understanding where we are in the cycle helps you plan for the future.

Are we growing? Let’s expand. Are things slowing down? If so, it’s prudent to cut back and save.

You don’t need to be a guru — simply follow the signs. The business cycle is a map. Use it to navigate your business in the right direction, irrespective of what comes next.

Also Read