What Are Some Critical Components of Successful Budgeting?: Strategies and Tips

by Mashum Mollah Finance Published on: 16 October 2024 Last Updated on: 21 May 2025

What are some critical components of successful budgeting? If this is your query, you have come to the right place.

We have tried to understand the true essence and importance of budgeting so that you can build your idea with the help of our blog. So, if you genuinely want to understand the components of budgeting, then follow along.

So, let us dive right in.

What Is A Budget?

A business can only prosper if it has the needed clarity regarding finances. It needs to have a clear idea about the organization’s spending and earnings to grow or sustain itself.

This is where the need for a successful budget arises. But before we delve deep into and understand some critical components of successful budgeting, we need to understand budgeting. So, what is a budget?

In simple terms, budgeting is a financial plan that simultaneously factors income and expense. This plan can help a business or an individual to understand the right path to walk.

Budgeting helps a business assess and understand how much money it will make and lose at a specific time. Therefore, a reasonable budget can keep a company from sinking and swimming.

The Purpose Of A Budget

People often scorn the word ‘budget’ or ‘business budget.’ They think budgeting is about depriving yourself of the financial resources to survive. This is a detrimental understanding of the phenomenon.

On the contrary, budgeting is more about streamlining your finances to achieve specific goals in the long term. Therefore, you can say that it is about taking control of your finances so that they perform well.

Secondly, successful budgeting can work as a financial mirror that helps an individual understand where the business stands.

This is why companies should budget their finances from time to time. This could be bi-monthly, quarterly, or yearly.

Why Do You Need A Budget?

Budgeting is about more than saving up for the future. It is a dynamic concept that has several uses. Therefore, it is crucial to understand these uses if you plan on understanding some critical components of successful budgeting. Here we go!

- Understand the relationship of your finances: Sit down and see where your finances stand. This is not going to be an easy job. In fact, it will be a humbling experience. Understand your income and expenses simultaneously. This should make the financial patterns more visible.

- Save Up: A successful budget will convince you on the subject of saving money. It will help you understand the importance of saving up for the future.

- Clear Debts: As a financial being, you are bound to build up debt occasionally. A good budgeting plan will ensure you are debt-free and have healthy finances. This can help you seize more investment opportunities and remain stress-free.

Starting A Budget

Budgeting is not about sitting with your finances with paper and pen and jotting down expenses and earnings. This is a complex process that requires expertise and an understanding of finances.

In this section, we will help you understand the effective means of starting your budget and understand ‘what are some key components of successful budgeting?”. Here we go!

- Income Outline: This is an essential part of the process. Outlining your expenses means understanding the overall pricing, salary, and social security payments.

- Tracking your expenses: Select a time frame and then jot down all the essential costs you must bear. These could be the bills or something more complex. Therefore, tracking these expenses can help you determine your budget.

- Prioritizing: A successful budget always keeps some buffer room for wriggling around. Therefore, once you have prioritized your expenses, put aside some funds for the rainy days. This would help you stay afloat.

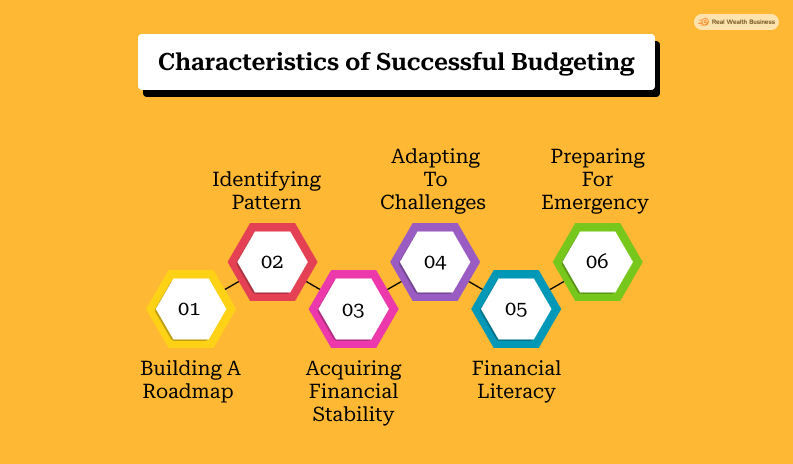

Characteristics of Successful Budgeting

Budgeting your finances sounds like a linear task. However, it is furthest from the truth. Budgeting can be a complicated process that requires a careful understanding of conflicting and complex concepts simultaneously.

Therefore, someone who is starting out anew must have some clarity and understanding of the critical characteristics of a successful budget. This section would familiarize you with the factors you need to strive for to make your budgeting a successful endeavor.

Here we go!

Building A Roadmap

Budgeting is an essential part of managing your finances. A company with any form of budgeting components would perform at all. Instead, the business would not have the means to scale.

Therefore, the primary task of a budget is to present a financial roadmap to follow. This roadmap can help your business maintain a tight ship and present optimal results financially.

Identifying Pattern

A budget is like a financial mirror. Its job is to show and keep track of finances and so much more. Therefore, one can say that budgeting helps an individual observe their finances.

As a result, budgeting can also help businesses to identify their spending pattern. Identifying these patterns can genuinely help you make a checklist and follow it religiously.

Acquiring Financial Stability

A successful budget’s primary task is to bring financial stability. It ensures financial stability by ensuring that finances are under tight control. This can be greatly helpful.

Therefore, these things start bringing stability to your finances. Something that can significantly help your business or financial self.

Adapting To Challenges

Budgeting is a static yet evolving process. In other words, the means of budgeting stays the same. However, it should have some space to accommodate aberrations and challenges.

This is one of the most significant and important parts of budgeting. It allows businesses to stay adaptive to challenges. Which, in turn, can make your businesses immune to mishaps.

Financial Literacy

A rich man understands the essence of money. However, a wealthy man understands the importance of financial literacy. The latter is something that can help you prepare for anything.

Therefore, if you do your budgets for a long time, you can also develop this financial literacy. This literacy would help you understand how the money must flow and the checklist it needs to fulfill.

Preparing For Emergency

Building preparedness is one of the best and most impressive aspects of effective budgeting. A reasonable budget will always help you get prepared for a rainy day so that you can pull through.

Therefore, next time you ask, ‘What are some key components of successful budgeting?” Just remember that building up preparedness is one of those characteristics or components.

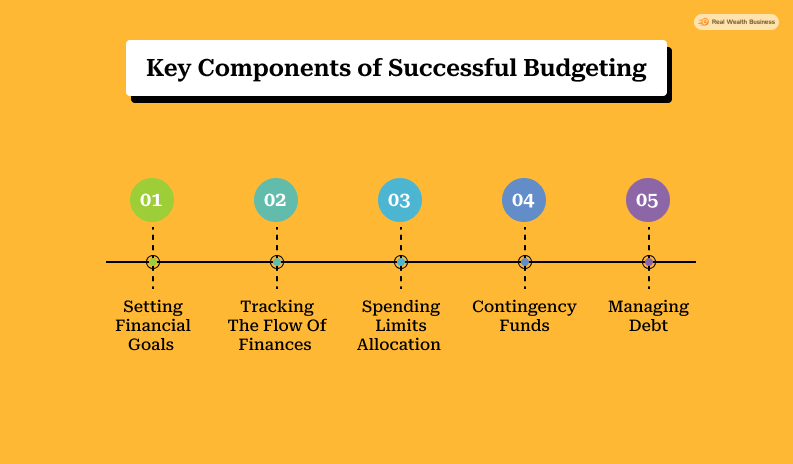

What Are Some Key Components of Successful Budgeting?

We have already understood the essence and importance of budgeting. We have seen how budgeting can help you build good financial habits and so much more.

However, we have yet to see some critical components of a successful budget. Well, the wait is finally over. Here are the essential elements of budgeting that you need to understand and learn more about.

Therefore, stick around as we delve deeper and understand what makes a budget successful budget.

Here we go!

Setting Financial Goals

Setting up financial goals is the foremost thing a successful budgeting does. This is a crucial step, as everything else is built upon that idea. Hence, one of the critical components of budgeting is financial goals.

Tracking The Flow Of Finances

Tracking your cash flow is the next component of a successful budget. If you want, you can maintain control over your finances if you manage to keep track of your company’s cash flow. This can help you identify the areas of improvement.

Spending Limits Allocation

As soon as you start budgeting, you can begin to enforce spending limits. Setting spending limits is a super important job as it can help you keep your finances in check. This would stop you from getting irresponsible with your finances.

Contingency Funds

We have already pointed out that a reasonable budget will always help you save some funds for a rainy day. This is an important skill set, as financial devastation can creep up on you silently and without a moment’s notice. Therefore, a successful budget can help you with that endeavor.

Managing Debt

Last but not least, budgeting can help you free yourself from debt. We all tend to go into debt. This could be in the form of loans, private borrowing, etc. Hence, budgeting can actually help you manage finances and debts, which can help you stay afloat.

That’s A Wrap!

In summation, budgeting is an important skill set that can help you get through financial trials with ease and comfort. However, being aware of its benefits is never enough.

A genuine financial literate individual also needs to know what some critical components of successful budgeting are.

Therefore, we hope that you can develop this sensibility over time and start understanding the true importance of budgeting your finances and financial goals.

Do let us know if you liked this piece of content and follow our page for more.

Additional Reading: