Stock Market Volatility- How Can it be a Good for Investors?

by Abdul Aziz Mondal Investing Published on: 03 October 2022 Last Updated on: 27 February 2025

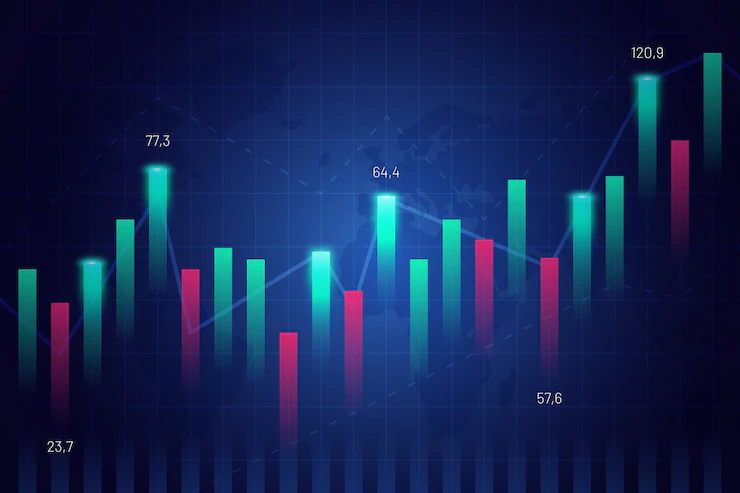

In the share market, the prices of securities keep changing every second.

Just like a sea is constantly in motion due to weather, pressure, tectonic movements, gravity, etc., the share market steadily moves with the news flow, company initiatives, policy changes, or economic decisions. This creates volatility and uncertainties.

Volatility and risk are inherent to the stock market. It is also viewed by many as an investment opportunity. Generally, investors reconsider their regular investment strategy during a volatile market. Up and downs can be an excellent time to review asset allocation in your portfolio.

Let us understand the concept of volatility with more insight.

What is Volatility?

Volatility represents the extent of change in the stock prices above and below their mean price over a period. If the price remains relatively stable, the financial asset has low volatility.

High volatility means the price of the security fluctuates to the extreme on both positive and negative sides. You will see a speedy increase and dramatic fall in asset prices within fractions of a second.

If you want to take advantage of volatility, open your Demat account within a few minutes with a discount broker and trade at low brokerage rates. Discount brokers charge lower Demat account charges and mostly offer Demat accounts for free.

How market volatility can be good for Investors

Let us start with the long-term investing view.

Volatility and Long-Term Investors

A major event might bring volatility to the entire market, like on the day of the union government budget announcement. On such days, volatility reigns across sectors.

Market volatility can bring favorable opportunities which otherwise might not emerge Investors should follow strategies to ride the volatile markets. Here are a few points long-term investors should consider in a volatile market. :

● Investing in quality stocks

Most individuals approach a volatile stock market with a long-term investment strategy focussing on fundamentally strong companies. They go by the assumption that the market will be favorable soon as the stock markets generally recover over time.

Therefore, long-term investors consider investing in the stocks of fundamentally strong companies when they are available at a low price. They remain invested in these stocks for years. Demat accounts allow you to hold all your investment for as many years as you want.

● Timing the market is difficult

When investors try to ‘time the market, they may risk buying high and selling low. It further makes it difficult to administer the trades and possibly increases losses during volatility. Therefore, investors make long-term investments instead of attempting to time the market and bear losses.

As market volatility increases, investors get opportunities to invest in a growing company at a discounted price. Just wait for cumulative growth and wealth accumulation over the long term.

● Longer holding periods for a significant impact

Investors liquidating their positions during volatility may miss out on the long-term benefits. Thus, staying invested even during a volatile market usually benefits investors with a long-term view.

Volatility and Swing and Short-Term Traders

●Day traders who trade many times in a day use advanced trading strategies with a close eye on the market changes every second. Swing traders look for a longer time frame than day traders. It may be days or weeks. These traders understand that no price fluctuations mean no profit. Therefore, they need volatile stocks to generate returns.

● Short-term traders can find a myriad of low-cost and lucrative stocks to trade within a short time frame. Moreover, intraday traders get leverage, where they can take positions in shares by just paying a margin amount. These traders need to use technical indicators like Relative Strength Index, MACD, etc. to make buy-sell decisions.

Volatility and Options Trading

If you are interested in Options trading, you can take advantage of volatile markets.

● The option premiums are sensitive to market volatility. Higher volatility bloats the option premium. There are several strategies available to option traders that can help minimize the risk in the volatile market and protect the positions against surprising price reversals.

Emergency Fund

Stock market volatility can benefit you in the long run, but it does not mean you do not need an emergency fund. It will help you face the market falls without exiting your positions. It will help you ride the rebounds that generally come with market corrections. If the stock market declines, you can use that emergency fund instead of liquidating your positions at a loss.

Closing Statement

A volatile market is considered an opportunity to enter the market for long-term investments. A day trader needs volatile stocks to trade. If investors strategize well, options trading can help earn returns even during a volatile market.

Investments in the securities market are subject to market risk, read all the related documents carefully before investing.

Additionals: