Why Invest in Solana?

by Abdul Aziz Mondal Investing Published on: 18 February 2022 Last Updated on: 08 November 2024

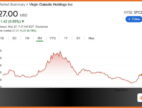

Solana is a blockchain platform that is formulated to host decentralized, scalable applications. The cryptocurrency with ticker symbol SOL has been soaring high since last year with 12,000%. Several people see Solana as fast crypto; it can actually process 50,000 transactions per second.

Solana was launched in April 2020, and it’s the fastest programmable blockchain in the market now; almost 1,000 times faster than Bitcoin and 3,000 times faster than Ethereum! Its fast transaction speed and low transaction costs have made the coin very popular.

When investing in crypto, there will always be a risk. When buying Solana, the price can go up or down as the market is volatile. There are pros and cons of investing, and we should keep that in mind. Only invest money you can afford to lose. Practice your trading strategies and learn more about the crypto market with bitcoin motion. Despite the extreme volatility of the market, Solana remains strong as it’s one of the best performing coins in the crypto world.

The Origin and History of Solana

A beach in San Diego, California. Where Solana’s founder, Anatoly Yakovenko, worked for 12 years in the field of telecommunications. The team that developed Solana consisted of former employees of Google, Qualcomm, Dropbox, Microsoft, and Apple. It was founded in 2017, run by Solana Foundation in Geneva, Switzerland. The blockchain was planned by Solana Labs in San Francisco, California.

His interests were not in Bitcoin and Ethereum. However, he had a dream at 4 o’clock in the morning that was buzzed by coffee as he described it; a realization was made that the hash function of Bitcoin, which was SHA256, could actually be utilized to make a decentralized clock on a crypto blockchain.

How Do Proof of Stake and Proof of History Work?

The blockchain of Solana is built on a Proof-of-Stake system. The Proof of Stake (PoS) grants validators, also known as the individuals who approve exchanges added to the blockchain record, to confirm exchanges in light of the number of coins or tokens they hold.

Proof-of-Stake is a digital currency agreement component for handling exchanges and making new blocks in a blockchain. An agreement mechanism is a technique for approving entries into a conveyed data set and keeping the data set secure. On the other hand, Proof of History (PoH) permits those exchanges to be time stamped and checked rapidly.

The SHA256 Crypto Hash Function

The importance of timestamping transactions was thought of by the CEO and founder of Solana. Without having to sacrifice security or decentralization, the timestamping of transactions aims to increase the scalability of the crypto blockchain.

Repetitive outputs of SHA256 (Secure Hash Algorithm 256-bit) are used by Solana, which makes a “clock tick” of 400ms instead of one second in a regular clock. Consequently, the proof of history model allows transactions to be processed fast.

All Solana events and exchanges are hashed utilizing the SHA256 hash(#) technique. A one-of-a-kind output is generated by this function based on an input that is extremely difficult to predict. The outcome of a transaction is fed into the next hash by Solana.

Solana’s approach and how blockchains work

Solana has around 350 projects, including non-fungible tokens (NFT) and decentralized finance (DeFi), which are both popular with investors nowadays. NFTs are collectibles in the digital world that allows people to authorize and gain information of ownership to the item. The popularity of NFTs and DeFi both contribute to Solana’s growth. The developers of Solana envisioned a goal that they have and that it’s strangely modest and quick. So that was their main objective from the beginning of forming the network.

Solana: The Ethereum Killer

Solana is similar to Ethereum as they both have similar features. What makes Solana stand out is the quick transaction and lower fees, with a programming capability focusing on flexibility. In line with this, Solana is built for speed, and through decentralized applications, it must be known that processing speed is important for projects forming the financial system.

Many individuals consider it to be the “Ethereum (ETH) Killer”. Probably the greatest variable that pushed Solana’s worth is that individuals need options in contrast to Ethereum, the second-biggest cryptocurrency on the market and henceforth working in an overloaded organization. Like Ethereum, Solana also offers brilliant agreements. Smart contracts and blockchain technology are two of the things to consider if you’re thinking of Solana as a long-term investment. Do you see a future with Solana? It would be worth it to include Solana in your portfolio.

When buying Solana or any other coin you have in mind, don’t forget to take a look at the competitive environment. Each coin has its own advantages and disadvantages, so trading wisely is a great tip!

Read Also: