Savings Accounts 101: Tips for Making Your Account Work for You

by Abdul Aziz Mondal Banking Published on: 18 May 2018 Last Updated on: 20 May 2025

When you’ve worked hard to earn yourself some money, you don’t store it in a shoebox. Instead, you go to a bank, choose their most popular savings account, open it, and deposit your money there. Of course, you can also withdraw the money that you’ve deposited in your savings account so you can buy anything you want. However, too much spending and your savings account balance will be depleted to the point where you might end up either skimping on your essentials or asking for money from other people. You wouldn’t have to suffer through all that though with the following tips on how to make your savings account work for you:

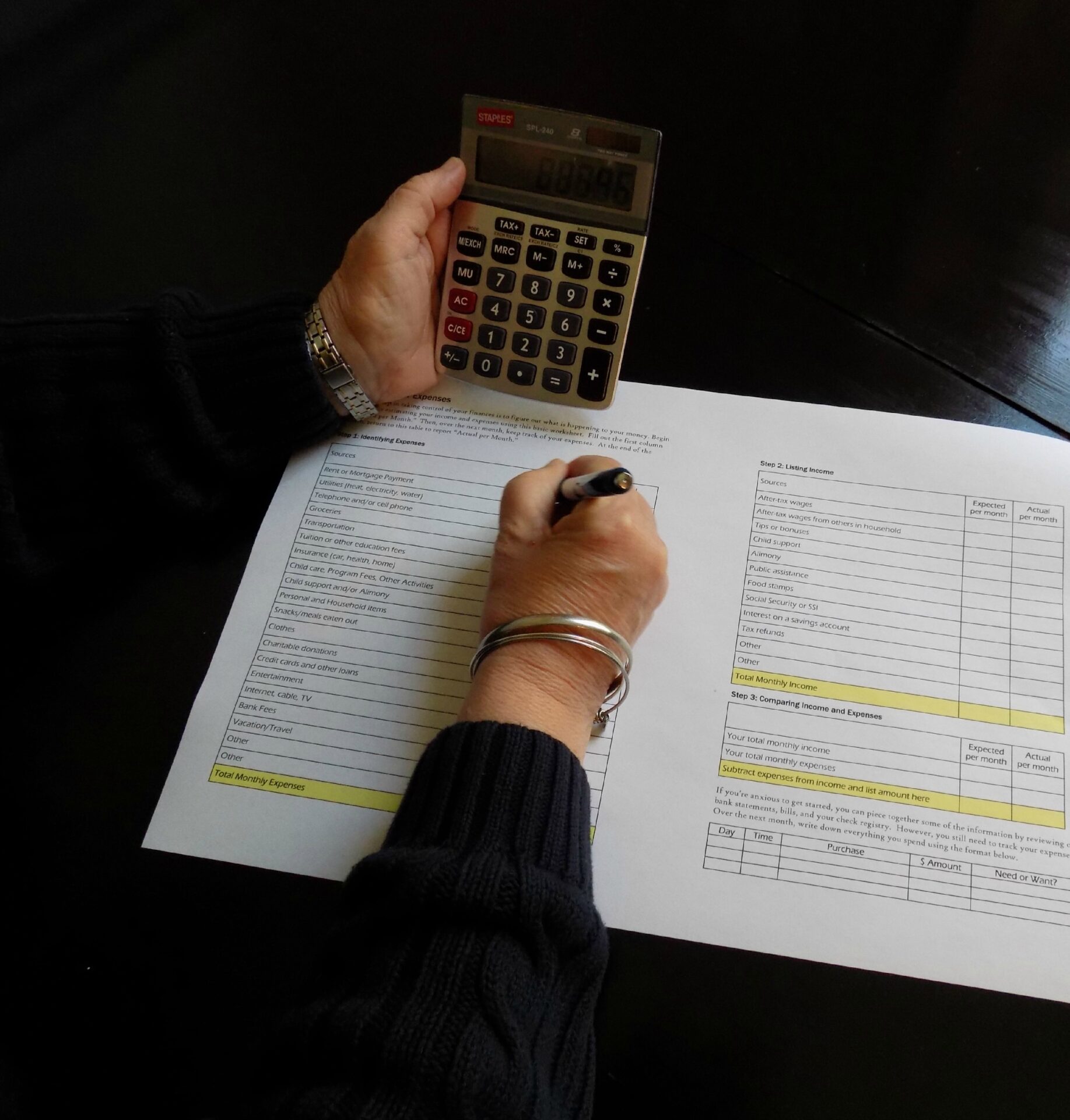

1. Identify your needs and wants, and work your budget around them :

You may have been spending too much money that you’re ending up living from paycheck to paycheck instead of making your savings account work for you. All hope isn’t lost though as you can still recover from your pitfall by taking some time to sit down and make a list. The said list should contain everything that you’ve spent money on thus far which you’ll then have to divide into two categories, namely your needs and wants.

You shouldn’t fool yourself though by listing some of your wants under the Needs category. A good way of knowing what your wants are is by thinking long and hard about which things you can forgo. For instance, a cable subscription is usually more of a want than a need as you can make do with free TV and watch movies online instead.

2. Set some long-term goals to give yourself a concrete reason to start beefing up your savings account :

Identifying your needs and wants isn’t enough though. You should also give your budgeting a discernible direction so that you know why you’re doing it.

Thus, you should list down your long-term financial goals whether they be to buy yourself a home, settle your debt, etc. You should also put an end date to each of your long-term financial goals. This will help you stay grounded when adding money to your savings account within a certain timeframe.

3. Consider getting a part-time job aside from your current one if you can manage to do so :

If you think the monthly salary you’re receiving in your day job isn’t sufficient to fulfill your long-term financial goals, you may want to get yourself a part-time job on the side. However, you should assess first if your schedule would allow you to take on a part-time job. You wouldn’t want to end up exhausted all because you wanted to earn some extra money on the side.

Conclusion :

According to a survey by GOBankingRates they conducted last 2017, 39 percent of Americans have nothing at all in their savings account. The global economy may be tougher than ever, but it shouldn’t be an excuse for you to neglect your savings account. After all, when an emergency strikes and no one’s willing to lend money to you, your savings account is your only line of defense left. Thus, you’ll want to make your savings account work for you by applying the above-listed tips. You’d be surprised at how small measures to make your savings account work for you can make a huge difference later on in case you find yourself caught between a rock and a hard place.

Read Also: