How to Find and Evaluate Low Cost Businesses for Sale: A Comprehensive Guide

by Barsha Bhattacharya Small Business 27 May 2025

If you’ve been dreaming of being your boss but just the thought of money is holding you back, let’s talk about it. Did you know that you don’t need to create everything from scratch to have your own business?

Yes, low cost businesses for sale are out there, and they’re offering entrepreneurs like you the chance to own a business without breaking the bank.

In this article, we’ll tell you why purchasing a low-cost existing business can be very lucrative, what kind of returns you can anticipate, and how to start safely and intelligently.

And don’t worry—we’ll include some real-life facts, practical tips, and a critical checklist to keep you on track and ready for your next step.

Why Go for Low Cost Businesses for Sale?

It is difficult to start a business from scratch. You must come up with a wonderful idea, test to see if anyone is interested in it, locate customers, and pray that it works.

But what if you could avoid all of that and simply inherit something that is already successful?.

That’s the beauty of purchasing low cost businesses for sale: they usually already have things going on—customers, processes, inventory, even staff.

You’re entering a system that already functions. Sure, you’ll still have to do some work, but you’re not starting over.

Some of the main reasons individuals opt for such types of businesses:

- Lower Barrier to Entry: You do not have to have $100,000 or more to begin anew. You can usually acquire decent businesses for under $20,000 or even less.

- Quicker Cash Flow: An established business already has money available that you can tap into from day one. Compare that to a startup that will take 6–18 months just to be cash-flow positive.

- Less Risky Than Starting From Scratch: The U.S. Small Business Administration (SBA) estimates that nearly 20% of new businesses fail in the first year. Purchasing an established business can significantly lower that risk.

- Easy Market Access: The last owner likely worked hard to gain loyal customers. You can build on that.

So, short and sweet—fewer headaches, quicker results, and an affordable route to entrepreneurship. What’s not to love?

Types of Low-Cost Businesses to Buy that You Can Research

Whereas “low cost” will vary from person to person, here are some types of companies that typically fall in the sub-$50K range:

Dropshipping/E-commerce websites: There are numerous Shopify or WooCommerce websites with decent SEO and product-market fit that sell for under $10 K.

Cleaning businesses: They are inexpensive, and you are also able to obtain customer contracts.

Mobile services: Consider mobile car wash detailing, pet grooming, or lawn care—most are turnkey operations.

Blogging or content websites: Content or blog websites can earn money via affiliate links, ads, or e-books.

Coaching or tutoring companies: These usually have local or online customers and don’t need much money to run.

If you wish to save and earn more profit, service-based businesses tend to be the optimum choice.

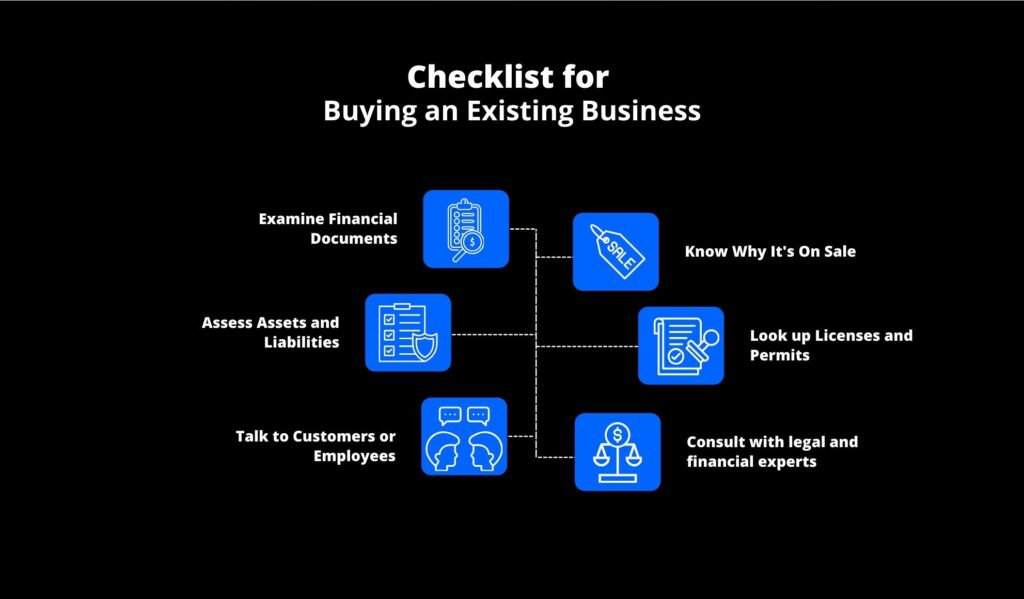

Checklist for Buying an Existing Business

Okay, now that you are excited about low cost businesses for sale, let’s be realistic. Buying a business—any business—is still a big deal.

You don’t want the bad ones, and you do want the good ones. Here is your simple Buying an Existing Business Checklist:

Examine Financial Documents

Review the last 2 to 3 years of profit and loss statements, tax returns, and balance sheets. Don’t take the seller’s word for it—consult an accountant if necessary.

Know Why It’s On Sale

Retirement? Burnout? Or is the market drying up? Don’t stop yourself from asking point-blank. Most importantly, you must beware of evasive answers.

Assess Assets and Liabilities

What do you receive for your money? Equipment, location, inventory, customer lists? And liabilities or outstanding lawsuits, too?

Look up Licenses and Permits

Certain companies, particularly food or health-oriented ones, require licenses to operate.

Talk to Customers or Employees

Where possible, interview current customers or employees. They will give you a sense of the company that you won’t get from printed data.

Consult with legal and financial experts

Seriously, don’t neglect to. Even for an inexpensive buy, having an attorney review contract can be worth the trouble.

Things to Watch Out for While Buying Low Cost Businesses for Sale

Purchasing a business on a shoestring is exhilarating and satisfying. But not all bargains are as sweet as they appear.

Sometimes, what appears to be an excellent deal can become a huge financial issue if you are not paying attention.

This can occur due to buried debt, outdated systems, or unscrupulous accounting. It pays to be familiar with the warning signs.

Here are the most critical items to watch out for—why they are crucial and how one can learn more about them:

1. Vague or Incomplete Financial Records

Red Flag: The seller is unable to produce tax returns, profit and loss accounts, or periodic bookkeeping.

Why it matters: Without clear financial reporting, you won’t be able to tell if the business is profitable or barely scraping by. Worse, some sellers will fudge their numbers to make the business sound better.

What to do: Always request 2–3 years of financial records and have a financial advisor or CPA review them. Check for trends in income, expense, and profit. If missing or mismatched records exist, beware—or back away from the deal.

2. Reliance on the Present Owner

Red Flag: The company depends very much on the owner’s personal relationships, acquaintances, or special abilities.

Why it matters: When the owner is the primary face people encounter or does everything personally, the company may suffer if they are away.

This is particularly the case for service-based industries such as coaching, consulting, or personal training.

What to do: Ask how much the owner is involved in day-to-day activities. If everything is tied to them, ask if there are written processes and if they will assist in a transition or training phase.

3. Sudden Decrease in Customers or Sales

Red Flag: Sales have declined in recent times, or customer reviews have significantly deteriorated.

Why it matters: Performance may plummet suddenly as a warning sign of greater issues, such as increased competition, the loss of a key customer, or operational problems.

What to do: Request reports on monthly revenues, not yearly reports. Search on sites like Yelp, Google, Trustpilot, or industry forums for customer reviews. If the decline is recent, ask “why.”

4. Outstanding Legal or Tax Matters

Red Flag: There are suits, back taxes, or regulatory violations that relate to the business.

Why it matters: When you buy a business, you can inherit its legal problems. These can create surprising fines, problems running the business, or even a complete shutdown if things are terrible.

What to do: Research the company and have your attorney review any legal matters, tax lines, or violations. Also, request information from the local chamber of commerce or Better Business Bureau.

5. Defective or out-of-date systems and equipment

Red Flag: The firm uses old software, broken equipment, or slow processes that have not been updated for a very long time.

Why it matters: Even though it is less expensive for the company, it can be costly to replace or update machinery and systems. That can hurt your profit margin right away.

What to do: Request a list of all web and physical assets. If possible, go there in person. Request from them what technology or tools they utilize for sales, marketing, customer maintenance, etc.

If you walk into a company with no web presence or automation, be prepared to invest more to bring it up to speed.

6. No presence online or poor digital reputation.

Red Flag: The company has a poor website, no social media presence, or bad online reviews.

Why it matters: Today, if the customers can’t find business online, the business doesn’t exist as far as they’re concerned. Additionally, bad reviews can damage customer trust and make marketing considerably more difficult.

What to do: Search the company name on Google and look on review sites such as Facebook, Instagram, Yelp, and Google Business. If it has no online presence or is negative, determine how much time and money will be needed to rectify it.

7. Problems with Inventory or Old Stock

Red Flag: There is obsolete inventory that does not move, or no tracking system for the stock.

Why it matters: Excess inventory occupies cash and space. Worse, it may be a reflection of poor management or a failure in demand.

What to do: Request an inventory list. Look at the expiration dates (if it’s a food or health business), how fast the products move, and your supplier relationships. You don’t want a garage full of products that won’t sell.

Is this an improvement over beginning again?

Let’s compare. From scratch, you can design your brand to your heart’s content. But then it also has more variables, higher initial expenses (such as branding, marketing, and legal establishment), and longer breakeven periods.

On the contrary, purchasing inexpensive businesses for sale provides you with:

- An operational base

- Current income

- Direct customer base

- Potentially transferable goodwill (i.e., trust in the brand)

So, if you are the type who prefers to dive in and change an existing model instead of creating one from scratch, then purchasing is a viable choice.

Final Thoughts

Low cost businesses for sale are the hidden treasures of the business world—You have my word!

You may see that the big investors are bypassing them! Young businessmen fail to see their value! They believe starting something from scratch is the only way to make it big.

If you wish to see results quickly and do not wish to mortgage your house to start, then the purchase of an existing business, particularly one that is profitable and well-run, is a good recommendation.

Be sure to utilize the checklist for purchasing an existing business, research thoroughly, and avoid poor deals.

The proper opportunity awaits you, and when you do see it, it has the potential to transform your financial future beyond anything you ever imagined.

If you have a vision of financial freedom, self-improvement, or a new adventure, you can start with a simple search: low cost businesses for sale. And you never know? You can find something amazing—without spending a fortune.