by Shahnawaz Alam Finance Published on: 30 May 2022 Last Updated on: 18 October 2024

Among many obligations of a company, paying off debt is crucial. The interest coverage ratio is one parameter against which you can measure a company’s capability of paying off debt.

When it comes to debt is one of the key responsibilities a company has to carry out. So, if you are investing in a company, you should calculate the possibility of the company being able to pay off debt.

This article will help you understand the interest coverage ratio formula. I will answer a few of the popular questions like –

- What is the interest coverage ratio?

- What does the interest coverage ratio mean?

- How to calculate the interest coverage ratio?

If you are curious about these questions, you can read the following article.

What Is Interest Coverage Ratio?

The interest coverage ratio is a ratio of profitability and debt. The ratio is used to determine how well the company is capable of paying its debts. The process of measuring the interest coverage ratio involves dividing a company’s earnings before taxes and interest by the interest expense at a certain period.

This ratio determines the strength of a company and builds reliability about itself. For example, when a company has a low-interest coverage ratio, it means that the company will remain in debt and is most likely to go bankrupt.

A low-interest coverage ratio also means that a company is unable to generate enough profit and is vulnerable to interest volatility.

Interest Coverage Ratio Key Takeaways

- This coverage ratio helps measure a company’s ability to pay interest on outstanding debt.

- The measurement is done by dividing the earnings of a company before interest and taxes (EBIT) by the interest expense at a certain tenure.

- The higher the coverage ratio, the better it is for a company, and the ideal ratio may vary from industry to industry.

Read more: Business Debt Relief: 10 Options to Consider When You’re Deep in Debt

Interest Coverage Ratio Formula

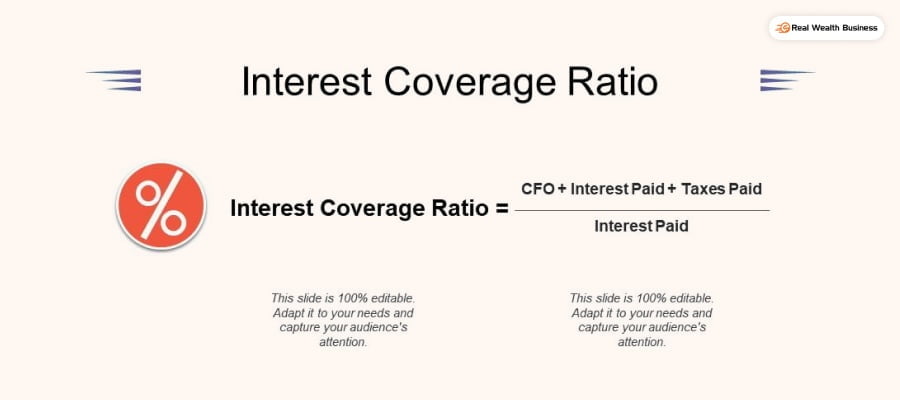

How to calculate the interest coverage ratio? You need to use the ICR formula to calculate the ICR of a company.

Here is the formula–

Interest Coverage Ratio = EBIT/ Interest Expense

The EBIT means – earnings before interest and taxes.

When a company has a lower ICR rate they are burdened with more debt and it cannot use the capital for any other way than paying the debt.

1.5 is a very low rate of ICR for a company. It is questionable when it comes to meeting the annual expenses of a company. Companies that have a higher ICR are on the side of profit and they are capable of paying off interest against a huge debt.

Mathematical Example

How to calculate the interest coverage ratio of a company?

Here is a step-by-step process of calculating ICR—

Sales revenue of a company = 1000000

Cost of sold goods= 50000

_________________________________

Gross profit = 950000

Total expense

Salaries – 10000

Rent – 5000

Utilities–2000

depreciation – 1000

_________________________________

Operating Profit – 932000 (EBIT)

Interest Expense – 300000

_______________________________

Earnings before taxes (EBT) – 632000

Taxes– 100000

________________

Net Income – 532000

The Interest Coverage Ratio, in this case, is 3.10.

An ICR above 1.5 is considered healthy. When a company has an ICR of 3.10 we can say that it is running healthy.

You may like to read: Looking for a Business Debt Consolidation Loan? Find the Best Company

Usages Of Interest Coverage Ratio

There are different usages of ICR–

- ICR helps calculate a company’s ability to pay off colossal debt interest expenses.

- Lenders, creditors, and investors benefit from using the ICR. They can calculate the risk of investing money in a company or lending money to them.

- It is a good parameter to determine a company’s stability. If a company has a declining ICR, it means it is on the way to bankruptcy.

- It can also help calculate the short-term health of a company.

Frequently Asked Questions (FAQ):

I have answered some questions related to ICR –

The ICR of a company is really significant. It explains a company’s capability of paying off interest with outstanding debt. When a company has a lower ICR, it means that it is on the brink of bankruptcy. Many lenders, investors, and companies themselves use ICR calculators to measure their health. This measurement helps in investment-related decisions.

A higher ICR is always considered better. A higher ICR means that a company is making enough profit to pay off interest against outstanding debt. They are also capable of growing the business after paying off the debt and other expenses.

A lower ICR, on the other hand, means that a company is not doing well. Although there is an average of 1.5 ICR, it changes across different industries. A low ICR of a company explains that a company is hardly capable of paying off interest. A low ICR also means that the interest rate of the company is volatile.

There are two ways of improving the ICR of an organization.

•The first way is to increase earnings before interest and tax. A company can do this by generating more revenue. They can also do it through better management of the cost.

•Reducing the level of debt or decreasing the finance cost is also another way of improving ICR.

I have already told you that a higher interest coverage ratio is always better. But when it comes to a certain number, an ICR above 3.0 is considered excellent. However, an ICR of 1.5 or lower is not healthy.

Bottom Line

Whether you are an investor or a moneylender, calculating the ICR is important. You need to calculate the ICR of a company before lending them money or investing in them. A company with a low ICR is almost incapable of paying off interest against a high debt.

I hope this article was able to help you understand the meaning of ICR and how to calculate it. Please share your feedback on the same through the comment box.

Read Also: