Question for Your Money: How can Insurance Protect You from Financial Loss?

by Ankita Tripathy Insurance 26 November 2024

Having the right financial policy for yourself can give you the right boost during times of need. However, it can also be one of the most confusing things to decipher. In this article about how insurance can protect you from financial ruin, we will be looking to simplify it for you.

Therefore, it is our onus to make this thing simple for you. So that you have some idea about the right way to proceed and get the financial cushioning you need. Here we go!

What is Insurance?

The best and the worst aspect of our mortality is that nothing is permanent. This is the biggest bane and curse of our species. Anything can happen at any point in time. Now add a hint of responsibility to this volatile mix, and you have an anxiety-inducing concoction. A concoction that will turn your hair gray.

Thankfully, there are financial policies called insurance policies that can help you. It will not make you immortal. It will simply take care of finances when you are gone. Then again, what is insurance and how can insurance protect you from financial loss?

Insurance is a contract between a business or an individual and an insurance company. The terms of this contract are simple. The policyholder will pay premiums to the company. In exchange, the company would help the person when it is needed.

However, the entire process is more challenging than it sounds. There are so many caveats that one needs to understand. Hence, you must follow along to learn more about how insurance works and how insurance can protect you from financial loss.

Let’s go!

How Does Insurance Work?

The proper way to understand how insurance can protect you from financial loss is first to understand the working. This section is all about that. Here, we will be discussing the overall workings of an insurance policy to understand it better.

Insurance works with the help of the pooling method. In other words, Insurance companies pool resources or money received via premiums into a singular pool. This collective pool includes cash from people who are anticipating the same problems.

This collective pool is used to compensate people in case the time comes. Hence, this can be a vital resource for people who are looking to have a financial parachute.

Why Being Insured Matters?

Being insured is not just about investing. In fact, it is also about saving yourself when the time comes. Therefore, being insured is one of the most necessary details that people of today must understand.

Luckily, we are here, and we can help you with that. In this section, we will be listing some of the reasons or benefits of why you must get an insurance policy for yourself or loved ones. Here we go!

Risk Management

The first and foremost reason why you must consider getting insured is risk management. Risk management is one of the most important aspects of covering yourself financially. You need to understand that financial problems can come at any point in time.

In fact, sometimes, financial ruin can creep up on you very fast, and you might have no idea whatsoever. Therefore, having a clear understanding of what to do will help you get ahead.

Asset Protection

Insurance policies are not just financial parachutes. They are all-encompassing in so many ways. One essential feature of having a policy is to protect your assets. These assets could be your home, your car, your business, etc.

Therefore, if you insure the property you want to protect, you are securing it financially. Consequently, you do not have to worry about damage and other aspects. Whatever happens, you are safe and secure.

Critical Cost Coverage

Critical costs are the ones that you cannot avoid. These include emergency costs like hospital bills, medicine bills, etc. These are the costs that you have to bear no matter what. Therefore, since you cannot avoid it, the best way to proceed is to get it addressed beforehand.

Hence, having the right policy from Hugo Insurance or similar, will not just help you bring down the overall payable amount but will also help you get the whole thing for free as well. Therefore, this is another significant benefit of an insurance policy.

Income Replacement

Many people have the idea that they would like to retire in their 40s. This is a great idea to have. However, it also requires planning. Therefore, this is where an insurance policy steps in. Some insurance policies can help you retire early in life.

However, retiring should not be confused with unemployment. Over here, retiring simply means income replacement. To leave a 9 to 5 job for something new. The right insurance can help you get this done with some careful planning and money rolling.

Budgeting

Having the right insurance policy can help you get the budgeting right. In other words, it increases financial obligation for the moment but returns the money back tenfold. Therefore, it allows the individual to get into the habit of budgeting oneself.

Therefore, having insurance will make you more competent to keep your money under lock and key and survive on a thin budget. This is a skill that will enable you to get out of a lot of fixes. Therefore, this is also a significant benefit of having an insurance policy to your name.

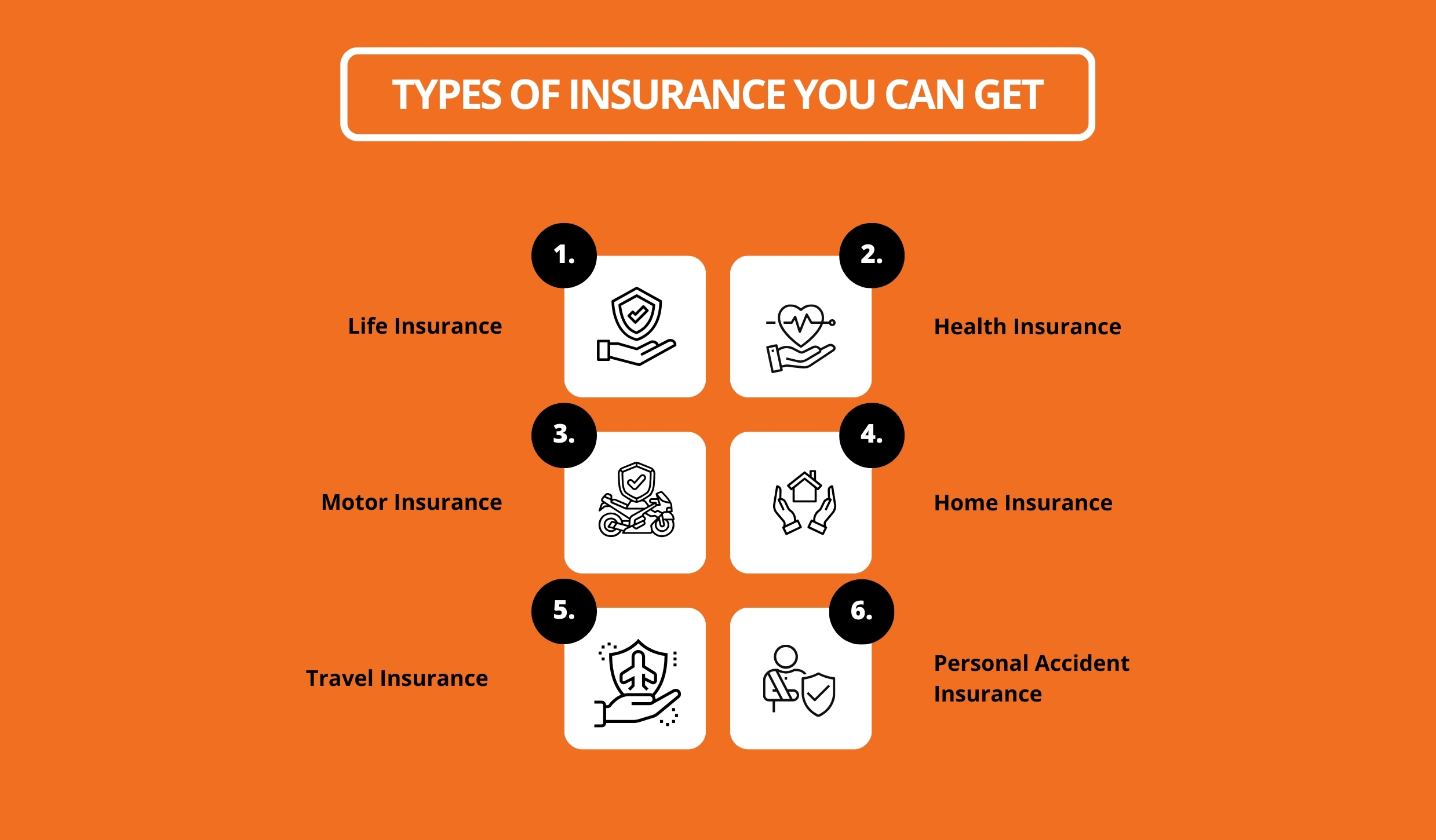

Types Of Insurance You Can Get

Given the myriad benefits of having the right insurance policy, it is not surprising that companies have created a whole host of insurance policies taking care of different aspects of human life.

Therefore, to understand how insurance can protect you from financial loss, you need to understand the kind you need to get. Here are some of the most prominent forms of insurance policies that you might find.

However, remember that the itinerary solely depends upon the company you are choosing. Therefore, only expect one company to offer some of the following coverages at the same time.

- Life Insurance: This is the most basic variation of insurance policies. This kind of provides financial coverage to people in case the person dies in any way.

- Health Insurance: This kind tries to cover a person’s medical expenses in case they get injured in any way whatsoever. This can be a family plan or a floater plan at the same time.

- Motor Insurance: Motor insurance covers your vehicle and makes sure that you have financial backing in case the car gets damaged.

- Home Insurance: Home insurance covers the financial expenses if your home gets damaged. Subsequently, it also covers other mis-happenings like theft, robbery, structural collapse, etc. Therefore, it is expansive.

- Travel Insurance: Travel insurance covers an individual during traveling. This includes trip cancellations, accidents, medical bills, etc.

- Personal Accident Insurance: Personal accident insurance covers a person in case they run into an accident. In fact, many states have made this insurance a mandatory affair. Therefore, if you have a car, you might have this insurance as well.

There are so many other variations, like motorcycle insurance and hazard insurance, that we still need to cover. However, we got articles for them.

Tips to Choose the Best Insurance

With the basics out of the way, it is time that we make efforts to close the topic. In this final section of our article, we would like you to learn more about the general methodology of choosing the right policy.

This may not seem related to the topic at hand, but it will help you save some money while looking for the right policy. Therefore, follow along to learn how insurance can protect you from financial loss by choosing the right kind.

Assess Your Needs

First things first, understand the need for your policy. You need to understand the essence of why you are getting a policy. This should make the process easier to handle and more focused. Therefore, sit down and assess your needs accurately.

Research, Research & Some More Research

Make sure that you dedicate some hours to searching for the right policy for yourself. When it comes to finances, do as much research as possible. This will seem tedious, but you need to get your feet dirty. Otherwise, you might end up regretting it.

Understand the Coverage, Deductible & Premium equation.

The overall game of picking the right insurance is to understand the equation of coverage, premium, and deductibles. This is one of the most important aspects of getting your own insurance policy. The percentage matters, and you must be careful about that.

Seek Professional Help

Lastly, you must seek professional help. Professional help can actually help you. However, seeking professional help means taking advice from someone other than your insurance broker.

Always remember that a broker is only looking to make profits off of you. Therefore, get hold of a professional advisor, as it will be their job to keep your finances safe.

End Note

In summation, this is all we have when it comes to ‘how can insurance protect you from financial loss.’ Well, an insurance policy is like a financial parachute. It will help you dampen the fall.

However, it is not a magic wand that will make your problems disappear. Therefore, keep this in mind and temper your expectations accordingly. Otherwise, it is a great way to save yourself financially.

Thank you and have a great day ahead.

Read More: