Understanding the Youngest Auto Car Insurance Brand in the USA: Hugo Insurance

by Ankita Tripathy Insurance 19 November 2024

Hugo Insurance is a household name in America. The brand has successfully created a space in the automobile insurance landscape. This was only possible due to its easy-to-access interface and so much more.

Therefore, if you want to buy insurance from this brand, you should go through this article first. Here, we will look at some of the most prominent points you must remember or know about this financial organization.

What is A Car Insurance?

Hugo Insurance is a prominent name in the car insurance industry. It has managed to become a paragon for automobile finance in the states. However, we do not believe in brands here in Real Wealth Business.

Therefore, even though we will discuss Hugo insurance in this blog post, we would like to take things back to the fundamentals of car insurance. In the introductory sections, we would like to educate you on car insurance so you can choose better.

Car insurance is exactly like every other form of insurance. Car insurance makes sure that you are financially covered in case something happens. It buffers the necessary cushion to help you get some financial aid from the organization responsible for insuring your car.

Car insurance covers accidents, some of them also cover breakdowns or theft. Therefore, car insurance aims to cover all kinds of damage. However, you will not be covered for everything by one single insurance. Thus, look out for different variations.

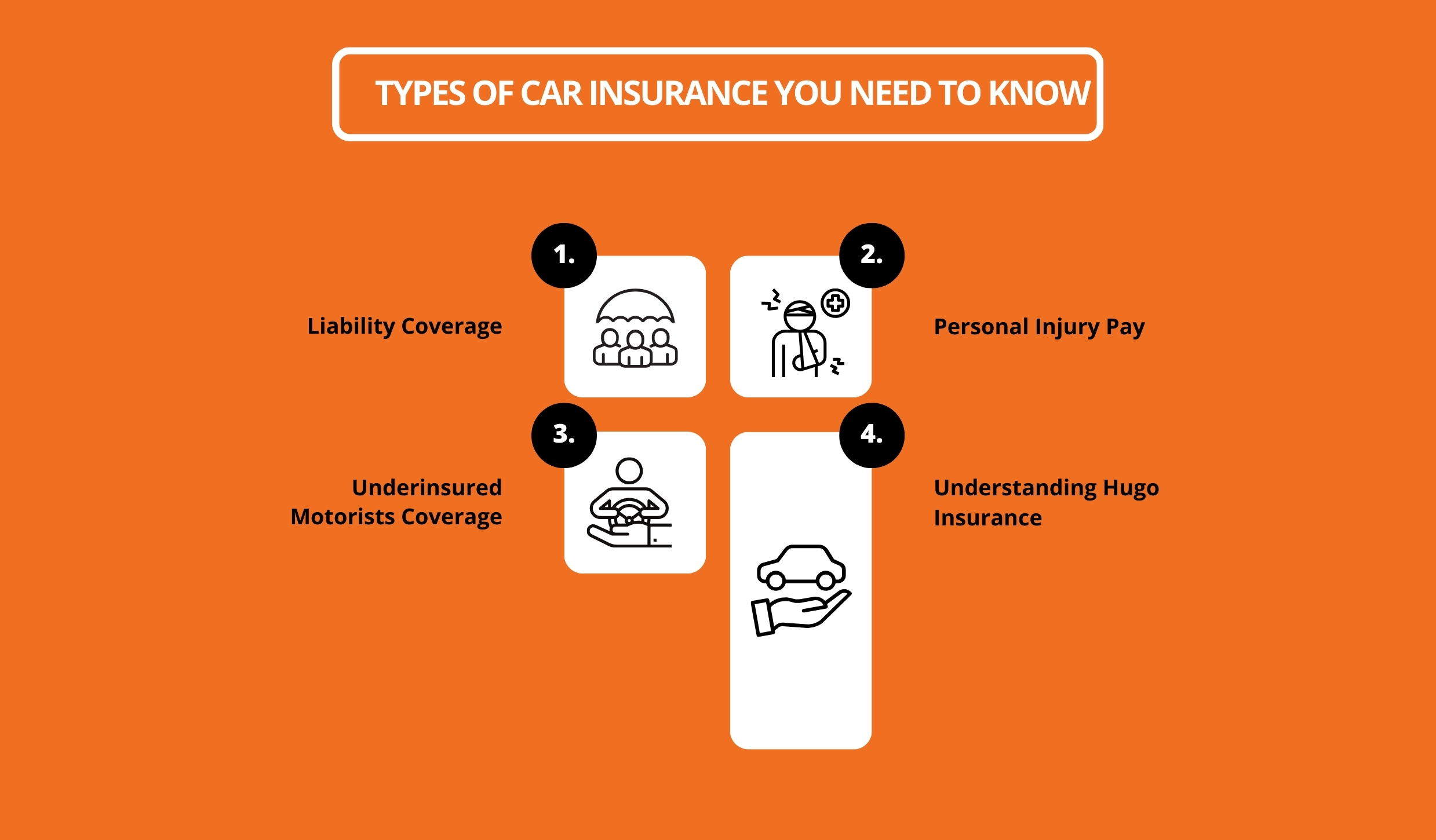

Types of Car Insurance You Need to Know

Different car insurance covers various parts of your vehicle. Therefore, having a clear idea of the right kind can help you understand the best car insurance . In this section and the following subsections, we will be looking at some of the most prominent forms of car insurance out there.

However, remember that the automobile finance industry is robust and constantly shifting sands. Hence, keeping track of all the different kinds out there can be challenging. Therefore, having some sense of clarity on the basics will help you assess the market effectively.

With that, let us begin.

Liability Coverage

The most basic and popular car insurance policy variant is liability coverage. Liability coverage is viral and is present all across the United States of America. Liability coverage covers expenses that are related to accidents.

This form of coverage usually comes in two different variations. The first is called the Bodily Injury Liability or BIL for ease. BIL covers injuries, medical expenses, and lost wages in case of an accident. This is mandatory across America, except for the state of Florida.

The next variation is called the Property Damage Liability or PDL. PDL covers the cost of repair and replacement of a damaged vehicle. This is mandatory across the United States Of America and cannot be ignored.

Personal Injury Pay

Next up is Personal Injury Protection or PIP. This is a more robust version of the BIL. However, PIP is a more detailed and extensive insurance form. PIP covers the lion’s share of medical expenses incurred after an accident.

PIP is not just for bodily injuries. In fact, some PIPs even cover funeral expenses. This sounds gloomy, but being prepared is much better than being unprepared. PIP is an essential form of car insurance but is not imposed as a mandatory practice.

However, people living in Maine need to get this as it is mandatory insurance. Therefore, people in Maine have to have PIP.

Underinsured Motorists Coverage

In many cases, someone else might be the driver. Instead, you were simply a passenger traveling with someone uninsured. This is where uninsured or underinsured motorist coverage comes into play.

In this insurance, you will be covered if you are traveling with someone not effectively insured. The government has kept this variation optional. This means only some people need to have it.

However, it is a crucial car insurance variation you must explore as a vehicle owner, as it can save you and your passenger from financial ruin due to an accident.

Understanding Hugo Insurance

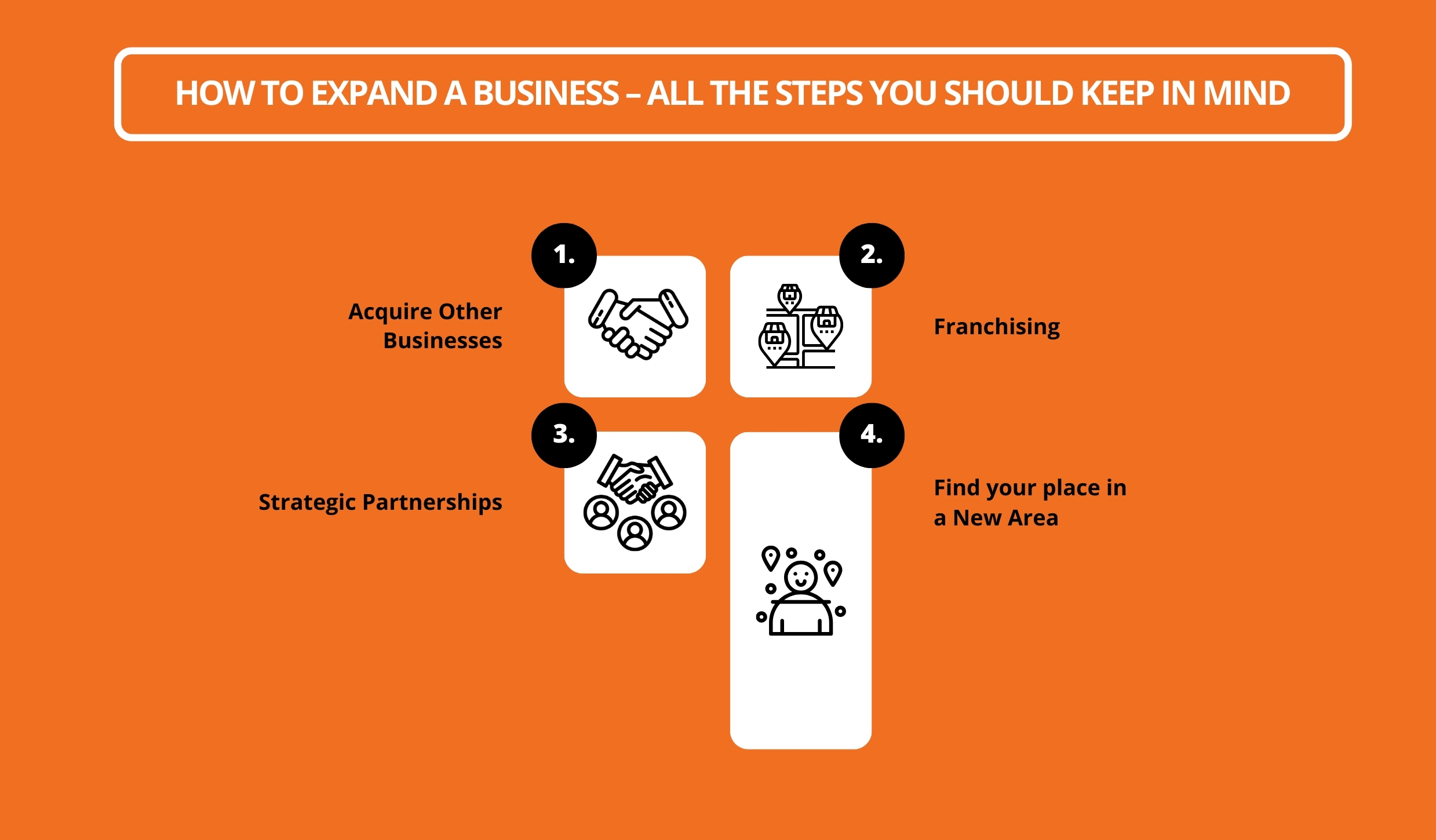

With the basics out of the way, it is time to start looking at the meat of the matter: Hugo insurance. Hugo Insurance began to offer car insurance policies back in the year 2020. The company started in Illinois and has gradually grown its area of influence across 12 states.

Hugo Insurance is all about affordability. In other words, Hugo plans on bringing affordable automobile and motorcycle insurance to the general masses. As a result, Hugo offers cheap car insurance rates and micropayments. In fact, it is one of the only names in the industry that offers weekly payments.

David Bergendahl founded Hugo Insurance. David is a renowned man in the industry who has grown his small-scale financial business into a multimillion-dollar brand. Therefore, this shows the kind of services Hugo offers to its customers.

Hugo Car Insurance Itinerary

Hugo Auto Insurance is a robust and renowned name in the automobile insurance landscape. Hugo currently offers its services across 13 different states and offers three primary insurance plans: Unlimited Premium, Unlimited Basic, and Flex .

these plans offer mandatory liability coverage, overdraft protection, flexible payment, and zero downpayments. However, the Unlimited introductory and full offers added comprehensive along with collision coverage.

However, the flex plan allows insurers to switch off payment as desired. This is the most popular variant of insurance that the company sells. This is why this is one of the most popular variants.

How Does Hugo Insurance Work?

Hugo Insurance has made it its mortal onus to make automobile insurance easy and accessible. This is rare when it comes to insurance brokers. In other words, you see few insurance companies making this a priority. Therefore, understanding the work will be easy for everyone. Still, we are here to help.

- Entering Information: Hugo claims you can get your insurance policy up and running in about a minute or so. Thankfully, the company has kept its promise and will present you with an easy-to-fill form. The form only asks for basic and relevant information like DOB, driver’s license, license plate, and details about the car (make and model). The company does ask for a Social Security Number, but it is optional.

- Selection Of Policy: Hugo has kept its itinerary simple and accessible. Therefore, you will be able to select from a few options. This is a double-edged sword. It does focus the search but also limits it. Then again, Hugo is known for his reliability. Therefore, a small but effective itinerary is still better than a robust and confusing one.

- Pay For Policy: As we have stated, Hugo Insurance offers three primary insurance kinds. Therefore, choose the plan you want to go for. However, we suggest that you go for the flex plan. This allows for more flexible payment. Then again, you must understand that the flex plan is only active in a few states like California and Illinois.

- Coverage On/Off: Higo insurance primary functions on an on-demand model. This allows the insurer to switch off coverage on or off with just a click of a button. However, we suggest you not consider turning off coverage, as it can take you down a rabbit hole.

Pros vs. Cons of Hugo Insurance

Hugo Insurance is an excellent choice for anybody who wants to start small or would like to begin their auto car insurance journey slowly. However, it is criminal to invest your effort and money without understanding the pros and cons of the system. This section is all about that. Here are some of the prominent pros and cons that you need to know:

- Pro: Hugo insurance comes with an easy-to-use interface.

- Con: The on-demand feature is only available in Illinois and Chicago.

- Pro: Multiple payment options can help you pay off the insurance more easily.

- Con: The collision or comprehensive coverage is separate from the basic plans.

- Pro: You can get your policies approved on the same day of application.

- Con: The rates can be changed surprisingly, without any prior intimation.

Decoding Subscriber Contribution of Hugo Insurance

If you are planning on getting a policy from Hugo Insurance, you must think again. While there are many pros and cons of Hugo insurance, you need to understand that Hugo has a subscriber contribution.

This means that subscribers need to pay around 10% of the premium. This is a form of member’s fee that every Hugo customer is expected to pay. However, some people might have some objections on paying this.

Therefore, assess every aspect before you make the choice.

Hugo Insurance Customer Support

Hugo Insurance is well known for its customer support. You can easily take their help in case you hit a snafu. However, we found that connecting with them via email is more reliable. Therefore, you can quickly get help from them by emailing support@withhugo.com.

They will get back to you in a matter of a few hours and will provide you with a plausible solution. This is a massive plus in our books as it allows for a better customer experience.

Hugo Insurance Competitors/Alternatives

Hugo is a massive name in the industry, but it is not the only name. In fact, the industry is full of big shots that are equally good. In this final section of our Higo insurance review, we will discuss the names of some of the more prominent Hugo insurance competitors.

- Liberty Mutual

- Root

- Metromile

These three insurance brokers are some of the biggest competitors of Hugo insurance. Therefore, if Hugo is different from what you want, check these out .

The Final Word

In the end, getting car insurance matters, whether from Hugo Insurance or any of its competitors. However, Hugo has been in the business for four years and has already made a name for itself in the industry.

Leave us feedback if you liked this content and follow Real Wealth Business for more such content on business and wealth management. Thank you and have a great day ahead.

Read More: