Tips to Help You Reduce Your Two Wheeler Insurance Premium

by Abdul Aziz Mondal Insurance Published on: 30 May 2018 Last Updated on: 20 May 2025

The two-wheeler is one mode of transportation that can never go out of style, especially with the youth. A bike is still fashionable today, even though scooters are a preferred mode of choice for the middle class. Purchasing a bike or a scooter is an economical and fuel-efficient option. It is also low on maintenance. A two-wheeler helps you move through bumper-to-bumper traffic with ease. However, as you ride the two-wheeler on the roads, you need an insurance policy to help protect you from financial liabilities in case something goes wrong. This is why it is essential to compare price quotes, and the premium you will pay for two wheeler insurance.

Here are a few tips to reduce your two-wheeler premiums.

Opt For The Right Two Wheeler :

The kind of two-wheeler you opt for plays a vital role in deciding the premium amount. Choosing an expensive bike with a powerful engine or opting for a rare, classified or exotic vehicle will demand a higher premium as repair and maintenance costs would be higher. A more standard vehicle, used two-wheelers or an older model, in contrast, comes with slightly affordable premium rates.

Pick Your Add-on Covers After Careful Deliberation :

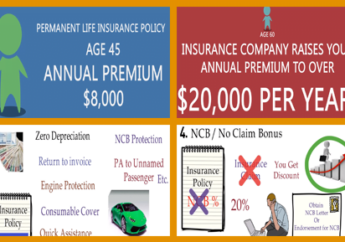

A two-wheeler policy gives you the advantage of purchasing bike insurance add-on covers. This helps you enhance the protection of your existing cover. Add-on covers include roadside assistance cover, personal accident cover and daily cash allowance among others. Be careful not to go overboard when picking add-ons and don’t end up choosing every single one that exists. Choose these covers wisely and only for the ones you really require.

You Should Pay on an Annual Basis :

Pay your insurance premium annually – this is usually the norm with most insurance companies. However, some companies offer the option of paying the premiums on the bi-annual or quarterly basis. Keep in mind – the annual premiums cost less than the other premiums. This can help in reducing your two-wheeler insurance premium cost to a great extent.

Compare Insurance Policies :

There are many kinds of insurance policies that exist and each of them comes with different types of coverage and premium rates. It is always a good idea to compare multiple bike insurance plans before giving your nod to one. Rather than opting for one that consists of the lowest premium, it is a better idea to compare the protection and coverage each policy provides.

Also Read: 5 factors that affect your two-wheeler insurance premium

Refrain From Making Minor Claims :

It is important to check the nature and degree of a collision or mishap before filing a claim. If the damage caused is minor or not that alarming, say, for instance, there ’s a

small dent or scratch, ignore it or pay for the repair out of your own pocket. If you go ahead and make a claim, you do not get the no-claim bonus and additional discounts at the time of policy renewal. No claim bonuses are offered to policyholders who have not made claims for the policy year.

Staying true to these tips will help you get a good and affordable two-wheeler insurance cover. Remember to get as comprehensive a cover as you can to protect against theft, body injury, damage to third-party, etc. All you have to do is take a little time and effort, research your options, understand the premium rates and terms of coverage before deciding the best insurance policy.

Read More :