Simple Solutions: 4 Tips For Making Tax Season Easier

by Abdul Aziz Mondal Finance Published on: 19 October 2021 Last Updated on: 30 December 2024

Filing a tax return can be a daunting concept, especially if hours Googling “how to lodge my tax return online” leaves you with no real understanding of what you need to do. However, completing a tax return doesn’t need to feel overwhelming. Here are five four to make tax season easier:

1. Know What Is Deductible When Claiming Tax Relief from Working at Home

If your home is your principal workplace, there are many deductions you can claim when filing a tax return. These include:

- Electricity and energy expenses such as heating, cooling, and lighting in the main working area(s)

- Cleaning costs

- Internet and phone bills

- Stationary

- Home office equipment such as laptops and computers, printers, scanners, furniture, and furnishings

With the latter category, there is the option to claim for the total cost of items in the office up to $300 or the decline in value for items valued at $300 and over.

2. Put Money Aside Consistently (and Check on It)

There’s nothing worse than checking your bank account and realizing there’s little or no money to pay taxes. That’s an easy way to spike utter panic. However, there’s no reason for it to happen. Organization and pre-planning can save the day.

Put money aside and know when tax season is approaching. Having a separate account to transfer money into can be a visual divider to encourage you to refrain from touching the funds that should be kept for tax.

Consider Reading: What Will Happen If I Do Not Pay Taxes

3. Keep All Receipts

The most effective way to claim tax deductions is by keeping evidence for everything claimed. Specifically, keep receipts for purchases like:

- Home office equipment

- Phone and internet bills

- Car expenses

When using an accountant, it’s worth noting that they will only claim expenses that have clear proof of purchase (i.e., receipts).

Invest in a scanner to log all receipts digitally or a folder to organize receipts into months and categories. This will make life far easier when it’s time to lodge a tax return.

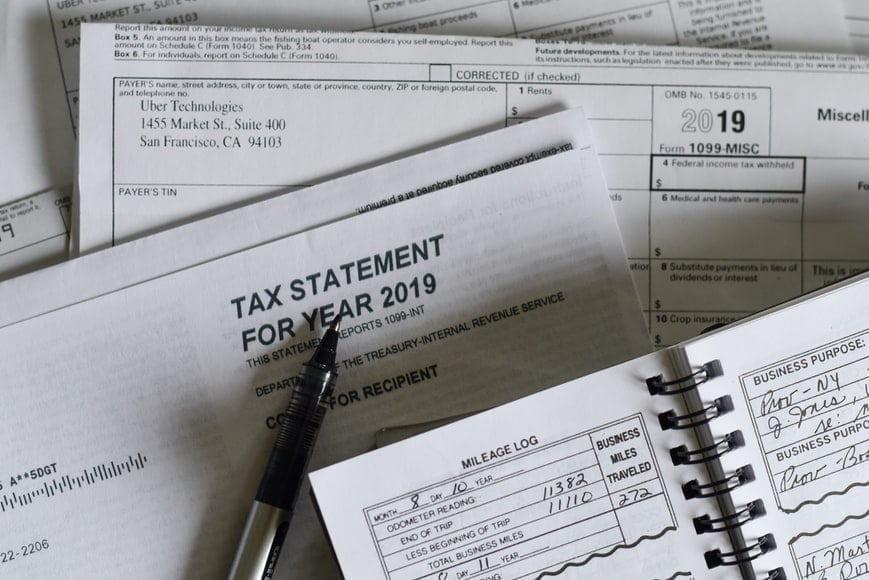

4. Don’t Embellish Deductions

It’s essential to claim deductions for everything you’re entitled to and for which you have supporting evidence. This is how tax returns work. However, it’s crucial not to embellish the deductions claimed. There is no ability to claim for more than was spent.

The easiest process to follow is to claim only those expenses for which you have a receipt. These receipts are hard evidence of the cost and the fact that your money has been spent on the item. If this rule is followed, embellishing deductions is out of the question, and the penalties for doing so won’t be something you have to worry about.

Consider Reading: Filing Quarterly Taxes Procedure

Tax Season Doesn’t Need to Be Difficult

Filing a tax return can be a high-stress situation. If evidence hasn’t been collected throughout the year, there can be a rush of turning the house or workplace upside down, looking for receipts and other relevant paperwork.

There’s no doubt that this high-pressure situation taints the process of lodging a tax return. However, if receipts have been collected over the year and organized digitally, this immediately cuts out the whirlwind, last-minute evidence hunt.

This is similar to putting money aside regularly. Throughout the year, you’ll notice a build-up of cash which can be used for taxes as soon as tax season comes. Plus, if over-compensated, the remainder can be kept as a bonus.

Understand what items and expenses can be claimed as a deduction and by which method, stay organized, start early, and don’t lie. Ultimately, these tips will make tax season far more manageable.

Read Also: