How to Turn Your Bitcoin Into Cash

by Ankita Tripathy Finance Published on: 25 April 2022 Last Updated on: 24 May 2025

After you make your bitcoin profits, you need a secure way to cash them out. For a beginner crypto enthusiast, the process may appear complex and time-consuming.

This guide is here to make your life easier and take you by hand by converting your Bitcoin coins into hard cash.

What is Bitcoin?

Bitcoin was first introduced in the year 2009. Since then, it started a whole new revolution. Not long after, bitcoin enjoyed the magnanimous status of a real-time digital currency.

The best part about this currency is its valuation and transactional nature. Anybody can buy a Bitcoin if they have the said equipment.

There are no physical bitcoins; balances are kept on a public ledger for everyone to see.

Bitcoin employs the Proof-of-Work protocol, which entails miners using their computer power to solve hashes to create Bitcoin blocks. It is an ingenious system with one drawback: it consumes a lot of electricity.

The Bitcoin network consists of nodes. Nodes are basically computers that are connected to a network array and whose job is to store and code bitcoins. These storages are called blockchains and are part of the cryptosystem.

Bitcoin Price Formation

The price of Bitcoin is primarily determined by utility, mining, and demand. Because the cryptocurrency’s supply is restricted to 21 million coins, a rise in demand will result in a price increase.

The price can also rise as the press promotes Bitcoin, nations recognize it as legal money, and, most importantly, mining ceases in a few years.

Can You Convert BTC to Cash and Other Cryptocurrencies?

BTC may be converted to cash or any other altcoin via exchanges, peer-to-peer platforms, and bitcoin ATMs.

Choosing the method depends on your goal: for a BTC to ZEC exchange, choose a platform like Godex; for quick conversion to USD, choose a convenient ATM near you.

So, exactly how to cash out Bitcoin?

Find the Way That Suits You Best in the Descriptions Below:

Dabbling in crypto is something all the cool kids are doing. You use jargon, trade, and do the whole Gen-Z thing. However, you need to understand the nuances of how to get ahead and make the most of the currency system.

This section is meant for that. Here, we will be discussing some of the most prominent aspects of maximizing profits in

1. Cryptocurrency Exchanges

To purchase cryptocurrency via an online exchange, you must first create a trading account and pass their KYC protocol. Personal information, such as an ID, must be provided, and verification may take a few days.

Also, Make sure to pay attention to the fees the platform charges. For example, Binance has a fee rate of 0.01-0.1, depending on the monthly volume of transactions. Coinbase charges a fee of up to 0.5%.

At the same time, some exchanges do not require registration. On decentralized and anonymous platforms like Godex.io, you can make transactions without providing personal information or waiting for verification. However, such exchanges will only allow converting BTC to other coins — not fiat.

2. Individual Peer-to-Peer Transfers

You can also remain anonymous using peer-to-peer systems. To protect your connection, you can utilize a VPN and select payment options such as online money or gift cards.

First, you must determine which platform you intend to employ. Paxful and LocalBitcoins are the two most popular systems, with hundreds of nations available.

After you choose the platform, the next step is to search the marketplace for a buyer. Following that, on most platforms, you will send a trade request with an escrow option to carry out the transaction.

3. Bitcoin ATM

To use a Bitcoin ATM, all you need is your digital wallet, your phone number, and a valid ID. When withdrawing money, you enter your wallet account info into the ATM and select the coin-selling option.

A Bitcoin ATM is a physical location where you can purchase or sell Bitcoin using fiat currency. As of this writing, there are approximately 25,000 crypto ATMs in operation throughout the world.

The main advantage of an ATM is that you may withdraw BTC anonymously. You do not have to wait for days for the exchange. This is one of the best parts about the Bitcoin ATM.

However, it’s important to remember that most ATMs have a deposit and withdrawal limit. The main drawback is that it has high transaction fees.

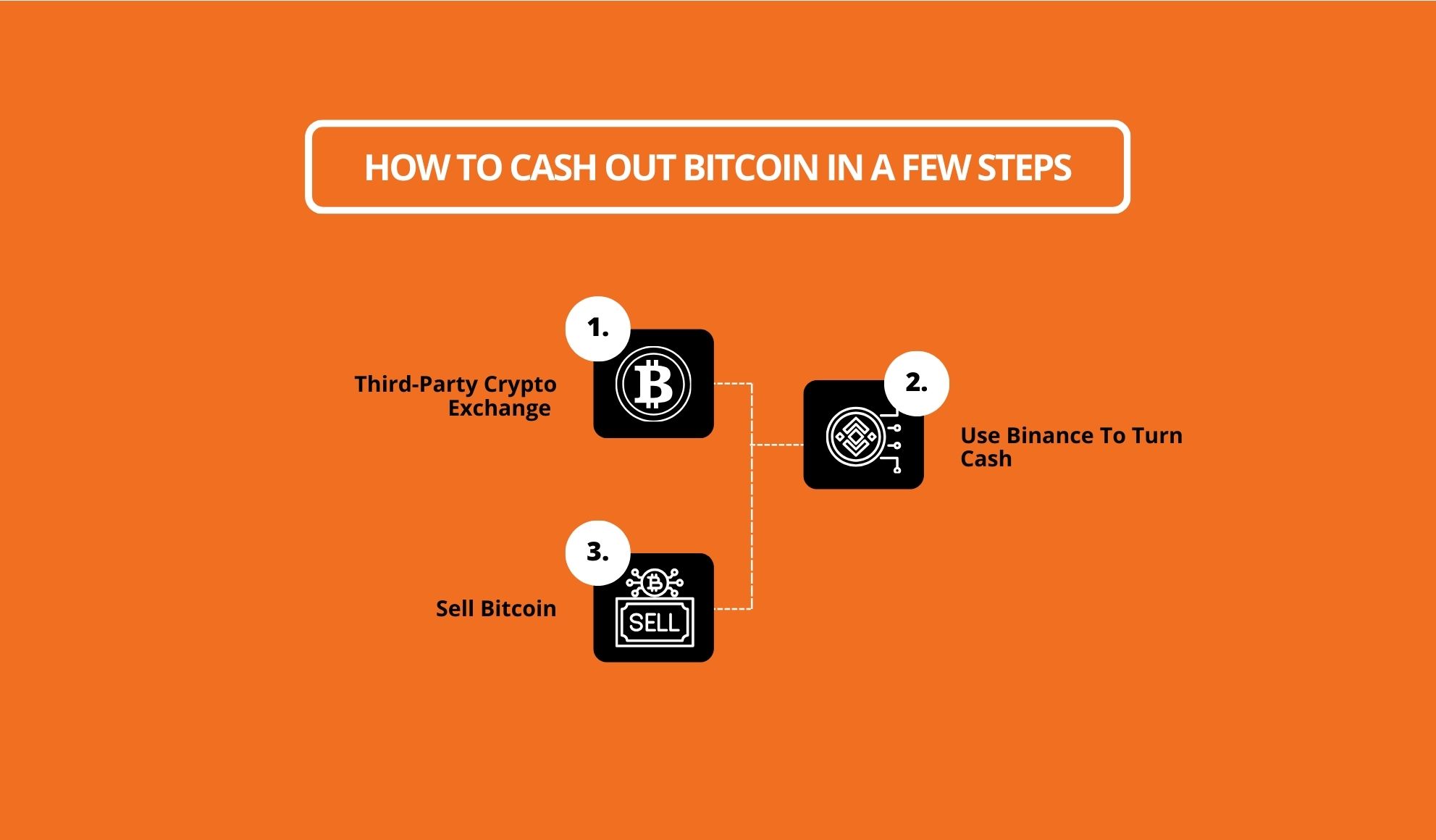

How to Cash Out Bitcoin in a Few Steps

Several ways can help you encash Bitcoin. As a result, if you are looking for answers on how to cash out on Bitcoin, you are in luck.

Here are three of the most prominent methods of encashing Bitcoin that everyone needs to know. Here we go!

Third-Party Crypto Exchange

The best way to proceed is to take the help of third-party encashing applications like Coinbase or equivalent. They take around 1 to five business days, but they are reliable.

Use Binance To Turn Cash

Choosing Binance can help you encash or turn your crypto exchange into cash. It is one of the most prominent third-party trading platforms that can help you a lot. Therefore, using Binance can automatically help you with the said endeavour.

Sell Bitcoin

Finally, you can physically sell your bitcoin in exchange for fiat money. This can be done using online as well as offline methods. Therefore, you pick your poison. However, it is often subjected to scrutiny and regulation checks. Hence, Keep this in mind.

Conclusion

Perhaps you’d want to know how to convert Bitcoin to cash so you can pay your bills. Or maybe you want to cash out on your investment now that it has generated a profit.

Cashing bitcoins through third-party broker exchanges is simple, and it may be easier and safer for cryptocurrency newcomers.

Try a peer-to-peer trading site if you want to sell your Bitcoin for a better price or use an ATM if you need an instant withdrawal.

Read Also: