Late Payments Bothering You? THESE 5 Tips Will Help!

by Ankita Tripathy Financial Planning Published on: 20 April 2022 Last Updated on: 21 May 2025

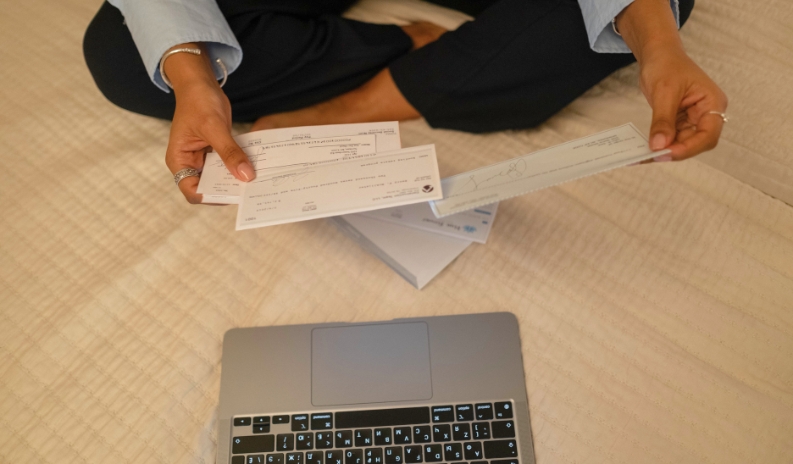

Late payments from customers and clients can be burdensome for small businesses.

Without access to a consistent and regular cash flow, it can be challenging to grow or even maintain the business. Indeed, if this becomes a long-term problem, then it can be difficult to keep the business afloat.

Below, we explore how you can protect your small business against late payments.

Small business late payments are common scenarios.

For the big companies, the customers are to follow strategic payment structures. Where clearly says what types of penalty charge the customers have to pay for the late payments. But these scenarios are directly affecting your revenue generation.

Impact of Late Payment on Small Business

Before we learn the different ways to avoid late payments from customers, it is essential we know what its repercussions are.

Large businesses may not think much about late payments as they have the comfort of financial backing from investors. The major impact is seen on small and medium enterprises who can face several challenges that can deteriorate their upcoming service.

Let’s have a look at the different impacts of late payments:

Disruption in cash flow: one of the major repercussions of late payments is the problem of cash flow. When businesses have a steady cash flow, they can pay their own bills, invest in their growth, and purchase inventory. This leads to reliance on short-term loans or lines of credit which can increase debt and interest costs.

The strain on operations: when payments are delayed businesses struggle to meet operation expenses like rent, salaries, and utilities. This results in reduced productivity layoffs or even delayed projects.

Damages relations with suppliers: businesses that receive late payments end up delaying payment to their own suppliers. This strains their relationship and leads to less favorable payment terms reduced credit limits or even fewer opportunities to conduct business. For a small business, this is not a favorable position.

Reputation and creditworthiness: consistent late payments can harm the company’s credit ratings which makes it harder to secure future financing or negotiate favorable terms with vendors. This in turn affects the business’s reputation in the market with leads to a loss of trust.

5 Tips to Avoid the Late Payments for Small Business

Every business handler has to face problems with late payments. And this is not uncommon. But when you have a small business setup. That time every penny will be worth more than you can count. So how to avoid these types of problems?

This is very easy. Once you have suitable payment protocols, you no longer have to remind your customers. Your customers will go to pay you at the right time for the right amount.

How to do it? Here are five easy tips for encouraging your customers to pay you at the right time.

1. Encourage Frequent Payments

One way in which you can protect your small business against late payments is by encouraging customers to pay their invoices in frequent chunks rather than in one lump sum.

Although you won’t receive everything, you’re due upfront, this can be an excellent way of maintaining cash flow in a way that will incentivize consistent payment from clients and customers.

2. Invoice Financing

Invoice financing is an excellent way of removing the hassle of chasing invoices. Instead of going for payments yourself, you can work with an invoice finance company.

They’ll pay you a fee upfront for the invoice for you to keep your cash flow running, and they’ll then recover the invoice themselves.

Although you won’t receive the full amount of the invoice, this can save your company time and effort while also giving you a more stable cash flow.

You have to tell yourself what the drawbacks of the late payments are. Business payments are similar to credit card bill late payments.

The late payments stay on the credit report. And late payments are staying in the company records. So, they are sometimes going to lose the discounts.

3. Direct Debits

Direct debits are another useful way of protecting your small business from late payments. This refers to the process of setting up an automated payment system with a client.

If the client needs to make regular payments to you, then this recurring payment plan will automatically help you collect these payments without any hassle.

Direct debits are better than credit payments. You have to encourage the customer to pay at the right time.

4. Accepting Card Payments

Another way to ensure that payments are made smoothly is by tailoring your payment technology toward your clients and customers. The easier it is to pay, the more likely you are to receive prompt, punctual payment.

One option to make this easier is by accepting card payments.

Ideally, you’ll be able to set up a card machine on your premises to make contactless payment possible while also setting up an online business banking account in case a client wants to make an online transfer.

5. Keep The Contacts With Customers

Always keep in contact with the present customers. Offer your customers the installment payment methods. The installment fees make your payments consistent.

Many times, the customer cannot be able to pay a large amount of money in a single term. But if the installment payment options are there, they can pay the amount even at the month-end.

To encourage consistent payments, you must submit a fee structure. The written protocols encourage the customers to pay the amount at the right time and avoid late payments.

Late Payments Who?

Late payments can be incredibly frustrating if you’re running a small business. But by following the advice above, you can save yourself time and stress by implementing a system that can safeguard your business from late payments.

However, every business needs to have a backup plan to handle troubled situations during financial problems. So you have to do both of these two jobs. One is encouraging the customers to pay at the right time. Another one has backup planning.

Read Also: