Finding the Best Retirement Plans for Self-employed

by Ankita Tripathy Financial Planning 27 December 2024

Finding the best retirement plans for self-employed individuals can be a tricky little detail. There are so many points that one needs to understand and study before one can even start thinking about retirement plans.

Therefore, stick around as we will help you understand what retirement plans are and how they can be helpful in the long run.

What is Retirement Planning?

Retirement can be the best year of your life. That is if you plan ahead and have a sumptuous retirement saving plan. Suppose you have a sense of clarity and context on what to do. These are very important in formulating the best retirement plans for the self-employed.

What is a retirement plan? A retirement plan is a financial plan that can help you when you stop being an earning member of the family. This is a critical process as it gives individuals the cushion to bank on in their old age, especially if they are self-employed and are not covered under any Employee Retirement Plans.

There is no fixed definition of what a retirement plan is. This is primarily because it is a highly dynamic process that needs multi-layered understanding.

Why Do You Need It?

Being a self-employed individual can be a tricky thing to navigate especially if you are nearing retirement age. You definitely need a specialized plan that can aid you in the endeavour. If you still need some more convincing, here are some of the prominent points that you need to remember.

- Security: Old age can be costly and complex. Therefore, having a financial cushion can always come in handy. A proper retirement plan gives you that cushion to bank on. This security can be multi-layered and cover your family and expenses effectively.

- Flexibility: Having a retirement plan also means that you have a sense of flexibility when it comes to retirement. You do not have to rely on anything or anyone. You can make your own decisions and choose to carve your own path.

- Tax saving: Having a retirement plan also eases off the tax weight that you need to take. However, you need to understand that this is a complex subject. Therefore, be careful and consult a financial expert to get the best advice.

- Health Insurance: Some specialized plans also have access to health insurance plans as well. Therefore, allowing an extra level of security.

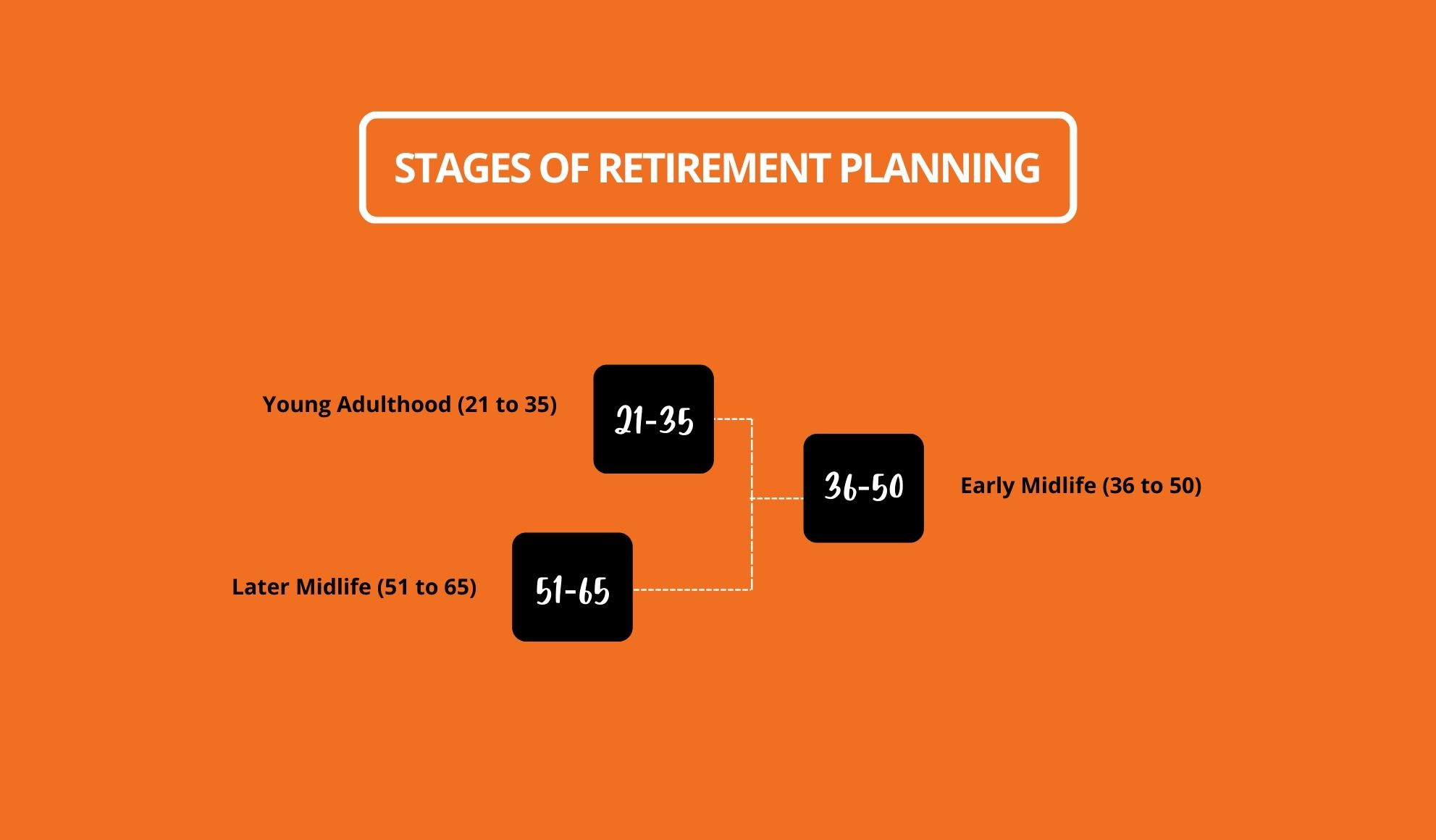

Stages of Retirement Planning

Retirement planning is not putting a penny in the piggy bank. While you can try to do that, you will need more than that. Retirement planning requires finesse, expertise, and clarity. These are not easy characteristics to inculcate.

But, do not worry as we got you. In this article, we will discuss more than just the best retirement plans for self-employed individuals. In fact, we will also be looking at three primary stages of planning your retirement.

However, this is just our opinion. You might approach the topic with a different mindset. Here they are.

Young Adulthood (21 to 35)

The first stage of planning your retirement starts quite early. In fact, you should consider starting a retirement plan at the very age of 21. While retirement may seem far off from now, but time can be an ass. Today, you are 21 with zero responsibilities, and suddenly, you are 30 with three loans.

So, consider starting early and then slowly building it. Many people might come at us saying, ‘We do not have enough money to start.’ Well, that is true, but you have time to spare. The time that allows investments to mature.

Compounding can be a beautiful thing if you know how to use it for your benefit. Therefore, start early and let mathematics take care of it.

Early Midlife (36 to 50)

The next stage of your retirement planning spans from 36 years of age to 50 years of age. This is called the early midlife. In this stage, you will have more money to spare but you will have financial strains as well, like mortgages, student loans, etc.

Still, you must be bold in investing in your future. You need to learn about aggressive saving and how it can help you in the long run. Experts often refute this form of saving, but it can be helpful. Try to follow the Pomodoro method of saving.

In other words, save aggressively every alternative month. This helps you balance things out in the long run. For example, if you manage to save $100 this month, try to save at least $500 in the next. This helps you maintain a balance.

Later Midlife (51 to 65)

This is the final stage of your retirement planning. This stage is near the end of the retirement planning process. This is when you need to really start saving aggressively. Therefore, you need to be careful and start saving effectively.

People in this age group tend to have more disposable income compared to other age groups. As a result, you should really go in all gears. This is especially true for people who are self-employed.

You must consider saving at least three times more than what you were saving and keep it up throughout the next one and a half decades. Otherwise, the coffer will remain empty.

Primary Components of Retirement Planning

Planning your retirement is a process that takes time and effort. There are so many components that need clarity and understanding. Hence, if you are actually unemployed and want to formulate your own retirement plan, you need to have clarity on these components.

In this section, we will primarily be looking at some of the determining factors of the kind and quality of your retirement plan. Therefore, stick around to know more about this topic.

Your Home

‘The biggest and most lucrative asset you can own is your house. As a result, just remember that it plays a huge role in almost all financial decisions. Just remember that you should not enter your retirement with a home debt. You should have a plan to pay off your mortgage or HELOC.

Therefore, ensure that your home is your own home. It is not under any debt or mortgage plans. Thus, allowing you that space to grow and save more money. Therefore, ensure that your home is not under any financial liability or stress.

Medical Insurance

The second determining factor is medical insurance. Medical insurance plays a significant role in retirement planning. In fact, it is one of the most critical factors that determine the retirement plan bracket and the way the money is saved.

People with Medicaid or other medical insurance can face cuts in their retirement plans. However, that does not mean that you will not have any form of medical insurance. Hence, making it a complex balancing act.

Best Retirement Plans for Self-Employed

Now that we have got the basics out of the way, it is time that we look at some of the best retirement plans for the self-employed. As a result, in this final section, we will be looking at some of the best retirement plans that you can go for.

However, remember that this is not a ranking section. In fact, it is more of an informative section that you need to understand. Therefore, approach the section in whichever way you can.

Roth IRA

The first form of retirement planning you can go for is called the Roth IRA. A Roth IRA is perfect for people who are leaving their jobs and want to start a business. This is because of its simplicity and effectiveness.

IRAs come in two different shapes. However, you must remember that Roth IRAs are better in terms of tax treatment. As a result, Roth IRAs can really help out people with limited finances.

Solo 401(K)

Solo 401(k)s are great for people who are employed. Solo 401(K)s are a beefier version of company 401(K)s. However, that does not mean that one is better than the other. In fact, both of these serve different purposes and benefits.

If you are planning for a 401(k) Retirement plan, you need to understand that you must go for the Roth 401(K)s. However, this is more suited for employed individuals. Therefore, a self-employed individual might not find it beneficial in any way.

SEP IRA

SEP IRA is a unique program that not only allows people to set up their own retirement plans but also for their employees. The best part about this is that SEP IRA programs won’t stop you from using traditional or Roth IRAs.

However, SEP IRA is only viable for people with high incomes. Hence, this makes the program restrictive to a certain extent. Otherwise, it is one of the best retirement plans for self-employed individuals.

The Final Thought: Which One to Pick?

In summation, these were some of the best retirement plans for self-employed people, and I will explain how you can go about them. Therefore, we hope that we were helpful in some small ways. Honestly, you can choose anyone.

Then again, you must be cautious and vigilant about the program you are choosing for your retirement savings. The withdrawal strategies of all the plans are not similar.

If you liked this piece of content, then don’t let us know. Keep following our page for more such content on business and other similar subjects. Thank you and have a great day ahead.

Read More: