Is Inflation Killing Major Currencies?

by Abdul Aziz Mondal Finance Published on: 03 January 2023 Last Updated on: 04 March 2025

A global inflationary trend in developed nations is having a significant impact on many domestic currency values. How do rising price levels affect the forex and other markets, and what role do interest rates play in the economic picture?

There’s always been a symbiotic relationship between inflation, a local currency’s health, and interest rates. The main question for investors and traders in 2023 is how to measure the effects of placing profitable forex and equity-based trades.

The irony is that inflationary environments weaken currencies while rising interest rates do the opposite. However, some countries have better luck with keeping inflation under control.

Forex traders need to delve into all the factors that affect the relative values of the major pairs, like the US dollar and Japanese yen (USD/JPY), the Euro and the yen (EUR/JPY), and others. What are the opportunities and potential pitfalls for trading enthusiasts amid a worldwide round of rising prices, changing rates, random economic forces, and political factors?

Additionally, how can account holders better understand the interplay of all these components and minimize risk in all the positions they take? Review the following points before delving into the markets.

US and UK Examples

The American and British economies are typical examples of how macro forces sustain or weaken the dollar and pound, respectively. Historically, when either nation’s central banks acted to boost the prime lending rate, the dollar and pound eventually responded to the move by rising in value. Traders who navigate the forex (FX) markers know this landscape quite well.

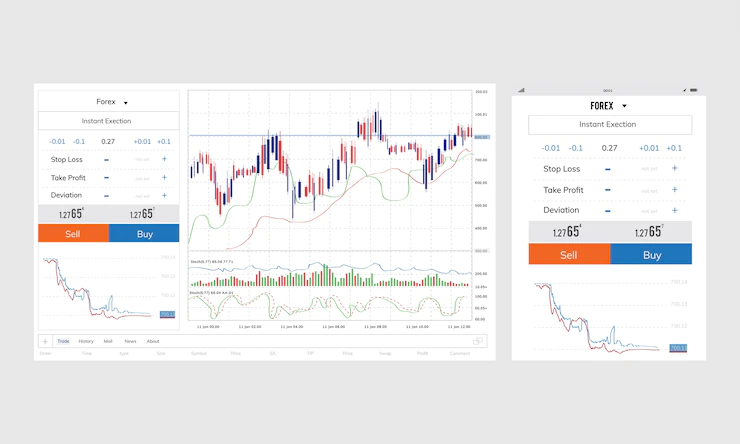

If your broker offers a metatrader 4 download page, use it to acquire the platform and experiment with a demo account. Try making predictions about how the USD/GBP (US dollar, British pound) will behave based on each nation’s respective inflation and interest rates.

The lesson is transferrable to most other pairs, like USD/JPY, GBP/EUR, etc. Study national political actions concerning prime rates and rising prices. Usually, in a hypothetical pair, the country experiencing more economic stability will outperform the one with a less secure financial situation.

The General Rule

There are some economic rules about how forces interact with each other. The concepts and guidelines are only sometimes 100% accurate, but they hold most of the time. There is a go-to remedy for any national government whose economy is suffering from rising prices or standard inflationary pressure. That’s why many political leaders immediately seek to raise key interest rates, like the prime, when price levels get out of hand.

The problem with the tactic is that it only sometimes works, and even when it does deliver results, there can be a long delay between rate raising and positive results. What about the domestic currency, like the US dollar, Japanese yen, Euro, or Russian ruble? Inflation usually acts as a depressive force on a currency’s health, while rising rates tend to cause increased demand and thus support economic health.

Opportunities for Traders

Even in volatile, uncertain financial situations, there are excellent opportunities for trading devotees who understand how macroeconomic forces interact. That means that even when most domestic and international news is negative, there are still openings in FX markets for savvy individuals who realize that one side of a pair, in a given transaction, always performs better than the other. So, in good times and bad, the essential skill for success is accurate prediction.

Learning to make educated guesses is the primary component for long-term profitability in FX. Experienced practitioners follow significant trends, look for gaps in relative economic strength, and track several financial parameters within the nations whose currencies they trade.

Some people prefer to deal with short-term forex trends, while others look to take medium-term swing positions or make long-term commitments that might last for more than a month.

Potential Risks in 2023

What are the risks? In any environment, trends can change rather quickly. A single political decision or international incident could undercut your profits if you don’t keep a close eye on the news. Minimizing risk is the goal for everyone who has their capital on the line.

One tactic that works for many is to avoid making significant financial commitments to individual positions. Instead, consider diversifying FX holdings among several small ones.

Remember to set stop-loss and take-profit limits before making a purchase. As with the equity markets, it’s wise to set a percentage rule for all buying. Commit up to 1% of your total capital to a single forex position. A 2% rule has become common among experienced traders, but it’s best to find your way by trial and error.

Additional: