by Shahnawaz Alam Finance 28 July 2023

Employees need to deduct necessary and ordinary expenses associated with their jobs. So, the IRS distributes a tax form called Form 2106. There are many expenses that are common across different business industries. On the other hand, the necessary expenses help a business conduct its regular processes.

Form 2106 is attached to the forms 1040. Employees use this form to deduct different and necessary expenses which relate to their job.

Both businesses and working professionals need to understand the fundamentals and the purpose behind this form. If you are on this page to understand Form 2106, then please keep reading.

What Purpose Does The 2106 Form Server?

When employees make any work-related expenditures, for example, meals, transportation, entertainment, etc, they usually get reimbursement. But, if you were supposed to get reimbursement and you did not, then you have to submit the IRS form 2106 along with your tax return.

Employees have to file this form to deduct both annual and necessary business costs. But, an employee must also understand what a common expense is. These expenses are usually the actual and required business costs in your line of work.

An employee can only deduct these expenses when the total of which exceeds 2% of their AGI. So when you cannot claim the ordinary or necessary expenses because of the AGI limitation, you have to file form 2106. But are you eligible to file a form 2106? Keep reading to find out.

However, employees before 2018 could claim un-reimbursed work expenses before using this form. This claim was made in the form of a miscellaneous itemized deduction. But, miscellaneous itemized deductions are deductible to the limit they exceed two percent of the adjusted gross income for the taxpayer.

Who Can File 2106?

IRS outlines people who are eligible for filing the form 2016. Here are the people who are eligible to file this form –

- Qualified performing artists.

- Employers with work experiences related to impairment.

- Armed forces reservists.

- State or local government officials (fee-basis).

Different Types Of Expenses You Can Deduct On Form 2106

Once you know who can file deductible ordinary expenses, you should know what expenses you can deduct using Form 2016. Here are different expenses you can deduct –

You Must Be An Employee

If you are preparing to file form 2106 to deduct the deductible costs, you have to ensure that you incurred the deductible expenses as an employee. This suggests that you should be an employee directly salaried by the employer who issues you a W2 at year’s end.

However, these expenses are not just exclusive to salaried employers. You can also deduct the ordinary expenses as a contracted employee or as a sole proprietor. But, in that case, you cannot use form 2106.

Work-Related Car Expenses

If your line of work requires you to use your car for the employer, then you can deduct the cost using form 2106. There are two ways for you to calculate these expenses. First, you can track the miles you have driven for your employer using your car and multiply the number with IRS standard rate for mileage. Secondly, you can keep the receipts of gas stations and keep track of your gas expenses for the deduction.

Whatever method of calculation you use is up to you. However, there are additional expenses for parking which you can also attach with form 2106. It is best to use the IRS mileage rate method to easily put all your mileage and parking-related expenses on a simpler form 2106 EZ.

Work-Travel Expenses

When your work requires you to travel a lot, then you can deduct the expenses for airline tickets, overnight stays at hotels, train tickets, and taxi fares. However, hotel stays can be deducted if they are not luxurious.

Entertaining Your Clients

If you are on a business trip, you can report the expenses of entertaining your clients through form 2106. However, no matter the method you are using, you can only claim 50% of the amount spent.

Other Expenses

Travel and lodging expenses also come under other expenses within the common and necessary expenses for a business. Here are some more necessary and ordinary expenses deductible through form 2106.

- Oil

- Gasoline

- Insurance

- Registration

- Repairs

However, you must remember that you cannot deduct any interest on car loans for the car you use for work. You should also remember that you cannot list expenses related to commuting to and from work as ordinary expenses. These expenses are not eligible for business expenses.

How To File Form 2106?

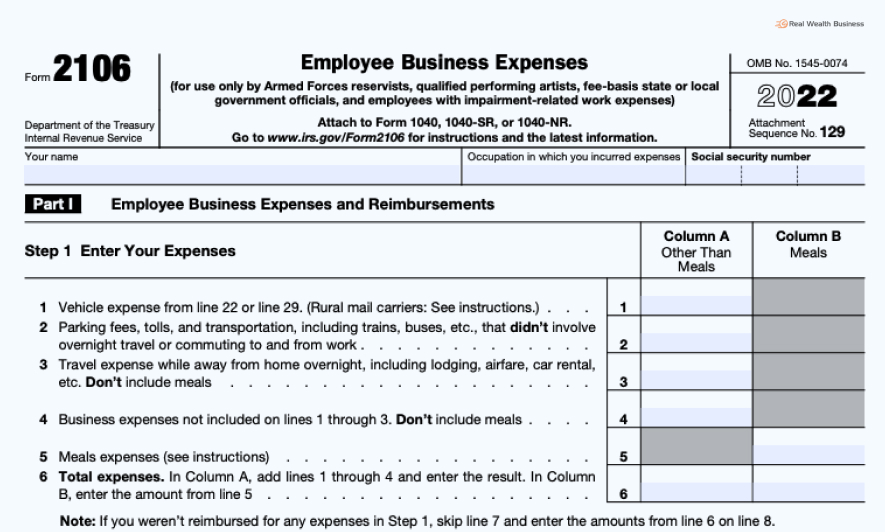

There are two parts to the form 2106. The first part gathers all the expenses and reimbursements of the employee. Then this part calculates which parts of the expenses are eligible for a tax deduction.

Part two of Form 2106 deals with vehicle expenses that are more specific in detail. In this case, the filer of the 2106 form has two separate choices.

Firstly, they can use the standard mileage rate issued by the IRS and calculate the expenses based on the mileage they had to drive for the employer. There are different factors for the mileage rate. It includes the repair expenses, gasoline expenses, and wear-and-tear on the average car.

Secondly, they can also keep the receipts for the gasoline or parking expenses they had to make for work. Then they can submit to get the ordinary expenses reimbursed through form 2106.

But, if you are using the standard IRS rate in 2023, then you can calculate the expenses at a rate of 65.5 cents per mile.

Final Words

Certain employees can deduct the amount of certain expenses from their taxable income. For that, they have to use the form 2106. As I mentioned earlier, you must be a salaried or waged employee whose employer issues a W2 form. You must meet the eligibility criteria to meet this requirement. I have provided all the necessary information you need about form 2106.

However, if you have any additional queries about this form, you can let us know through the comment section below. Thank you for reading.

Read Also: