Understanding the Right Risk Management Techniques Of 2024

by Ankita Tripathy Business 16 December 2024

A business can run into trouble without any prior intimation. Such is the world of business in modern times. As a result, having a strategy to get you out of a slump is very important. This is like a game plan that can help you escape a slump.

Therefore, you must have many risk management techniques to keep the wheels rolling. So, keep following on to understand the pain points you need to know before you can formulate or dabble in risk management techniques.

What Is Risk Management?

Risk management is not an exclusive thing that bigshot companies can only have. It is something that your business needs as a form of contingency plan or a ladder to get out of a hole.

Therefore, a risk management plan might seem redundant now, but it is an essential part of a business process and asset protection that needs careful understanding. This is what we are focusing our strengths towards.

Let’s go!!

Stages of Risk Management Strategies

You must understand the different stages and formulate effective risk management strategies. This is an integral part of the understanding, as having some clarity on the stages can help you know the process.

In the following section, we will look at the five primary stages of a risk management plan that you must include while formulating those strategies. Therefore, follow along as we take you on a journey to understand the stages you will have to go through if you plan to formulate your own risk management strategies.

Step #1

The first stage of formulating a risk management strategy is identifying the risk. You must understand that this stage is all about understanding and identifying the risk. Identifying the risk could be a passive process, where someone stumbles upon the risk simply.

While it can also be the product of an active process, an active process is when a vulnerability in a system is found due to an active assessment. Therefore, finding or identifying the problem is the primary stage.

Step #2

Once the risk is identified, it is time to reach the next stage. This stage is called the assessment stage. Here, the risk is assessed to understand its gravity. The way it is and its primary characteristics.

This is done with the help of a series of assessment questionnaires or checks. This is a key stage of the process as it determines your risk management techniques. The routes and the contingencies that you need to take, etc.

Step #3

The third part of the process is mitigating. Some problems or risks can be left alone to dial down or work around for now. Therefore, companies tend to isolate the problem till it does. This is a cost-effective and easy way out that companies usually prefer.

Mitigating is critical as it saves a company money and even solves the problem. Mitigating is to find the solution with the least resistance and back draft. Hence, it is such an essential part of the process.

Step #4

In case a problem cannot be mitigated, then it needs to be responded to actively work to find a solution. At the same time, mitigation and responding are two sides of the same coin. But we have decided to break it up in two stages.

Risk responding over here means a company’s active responses to solve a problem. These responses generally range from having a team of people working on the issue to fixing it, finding the right solution, or bringing in expertise, etc. Therefore, risk response is an umbrella term that needs careful understanding.

Step #5

The final stage of the process is monitoring the risk. The waiting game begins once all the plans and contingencies are put into place. The waiting game can last for a long time, and therefore, a company or its senior management needs patience.

Monitoring risk is the epilogue stage. Here, nothing is expected to happen. Still, companies wait for this stage with bated breath. This is primarily the waiting period that assesses whether a plan works effectively. Therefore, it is an integral part of the domestic asset protection plan.

Why Should You Have A Risk Management Strategy?

A risk management plan is not just effective when things are going to shit. In fact, a reasonable risk management plan is a dynamic thing and needs careful understanding. In this section, we will be primarily looking at the reasons why you must consider having risk management techniques and strategies at your disposal:

- Business Continuity: This is one of the primary reasons you must have a Risk management strategy. A risk management strategy ensures business continuity even when things have imploded.

- Asset Protection Planning: Asset protection planning is essential as it allows your company to protect its necessary assets like physical property, equipment, etc.

- Customer Satisfaction: Risk management techniques are essential as they help a business maintain some semblance of stability. Even if things are going haywire, you can cater to the needs of customers without a break in the process.

- Achieving goals: A proper risk management plan is so much more than mitigating risk. It is also the assurance that things will work out, which can help a business achieve goals and become more productive.

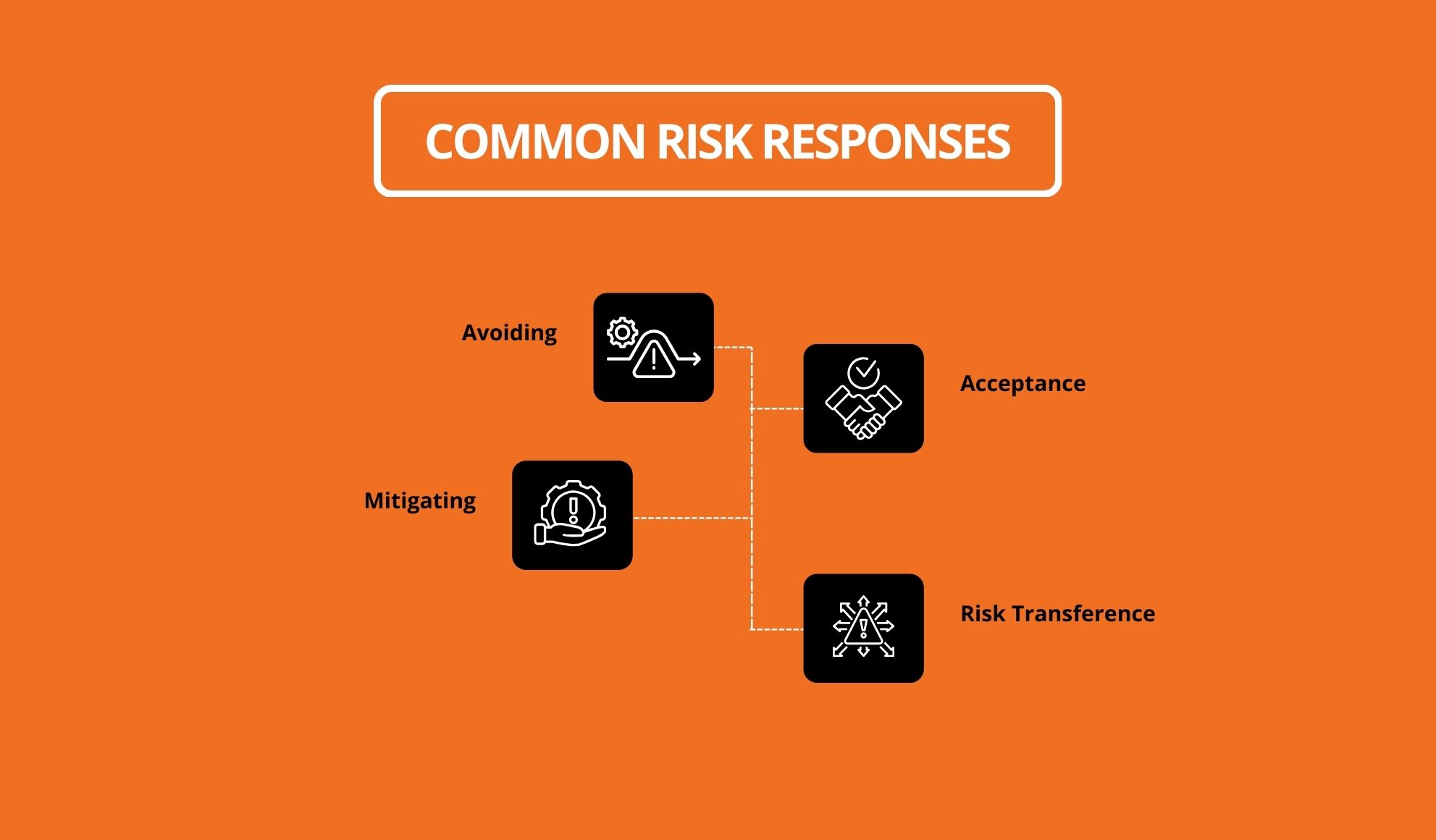

Common Risk Responses

While managing or mitigating risks, businesses often take help or approach the topic in four different ways. These ways are called risk responses. These risk responses largely depend on the problem you are managing and the scale. Here we go:

- Avoiding: Do not call us out, but avoiding risk is also a form of risk response. In some cases, companies choose to avoid risk in order to continue with the business operations to deliver urgent orders. However, in almost all cases, this strategy backfires, and things become worse.

- Acceptance: This is an essential part of the healing process. You can only fix something if you see the errors in it. This is a healthy response but an incomplete one.

- Mitigating: Mitigation, as we have discussed, is to find a workaround, not a solution, but a separate avenue. Like for example, if your vendor has failed to deliver, you see a replacement.

- Risk Transference: This is the most essential part of the process, as this is all about transferring or channelling the risk in a way that does not backfire toward you. Therefore, it is a handy way of dealing with risks.

Prominent Risk Management Strategies You Must Know About

Now that we have dealt with the bulk of the discussion. We should take some more time and look at some instrumental risk management techniques that can help you deal with any risks that might come your way during business.

Type #1

Always keep your staff on tippy toes. Therefore, give them What-If drills. These drills are meant to train people to deal with the worst of the worst situations that the business finds itself in. Therefore, keeping your business in the habit of dealing with such problems makes things easier when the actual problem comes.

Type #2

Theory validation is similar to what-if drills. However, it deals with the theoretical part of it. Here, employees are given questionnaires that they need to fill in with feedback. This is an essential and beneficial practice as it helps a business to get help from multiple people to get the job done with more effectiveness.

Type #3

Developing products in phases is a good way to mitigate risks. A slow and methodical development cycle is critical. It is one of the given parameters that businesses need to follow. The faster you develop a product; the chances are that you will run into problems. Therefore, keep an optimal pacing and get the job done.

Type #4

Once you identify a problem, you must start the process of isolation. This is a key part of the job as it can affect other parts as well. This is the reason why you need to understand and isolate the identified risks. To stop a disaster from happening.

Type #5

Always ensure that you have buffers in place. Buffers actually help businesses to keep their operations running without any hassle. Buffers will not deflect the full brunt of impact but will dampen it for sure. This is why you need to have some buffers in place. It can help you get the job done effectively.

The Final Thought

In summation, you need to understand that formulating risk management techniques are very crucial. However, you must remember that every problem is unique. Therefore, you need to be flexible and build plans that accommodate this aspect in your planning.

Otherwise, you are bound to fail, and there are no two ways about it. If you liked this piece of content, then do let us know and keep following us for more such content on business and wealth management.

Read More: