Planning to Invest in a Property? Home Loans can Help

by Mashum Mollah Finance Published on: 22 September 2017 Last Updated on: 06 November 2024

The first house that people purchase is often used as a self-occupied property, which is pretty understandable as it is one of the basic needs. As time has passed, there has been an increase in the number of new investors, entering the real estate market. For many, this situation can be surprising as the real estate rates have also increased significantly, but then again this is a fact.

We are already aware of the gains that investments in a housing property can benefit us. Despite the increasing property rates, a real estate investment can always help you earn higher returns in future. A real estate investment is considered as the best form of investment these days, mainly due to the favourable policies introduced by the government in recent times.

After the demonetization, many budding investors have shown interest in real estate investments. One of the reasons behind such a scenario can be the reduction of the repo rates by the Reserve Bank of India (RBI), which has made Home Loans economical. Apart from increasing number of new investors, the old depositors have shown interest in investments too. This keen interest of old

depositors has increased rapidly, due to affordable Home Loan options.

Availing a Home Loan not only avail you benefits related to Home Loan rates, but there are many things from which you can seek benefits. They are as follows:

● Top-up loan:

In case you require some urgent funds in future due to a financial emergency, then top-up loans can prove to be beneficial. If you have an existing Home Loan, then you can avail a top-up loan over it. Many-a-times people go for borrowing a personal loan during an emergency, but this can increase their debts, whereas, availing a top-up loan won’t. You can apply for a top-up loan by paying minimum interest rates on it, instead of availing a personal loan.

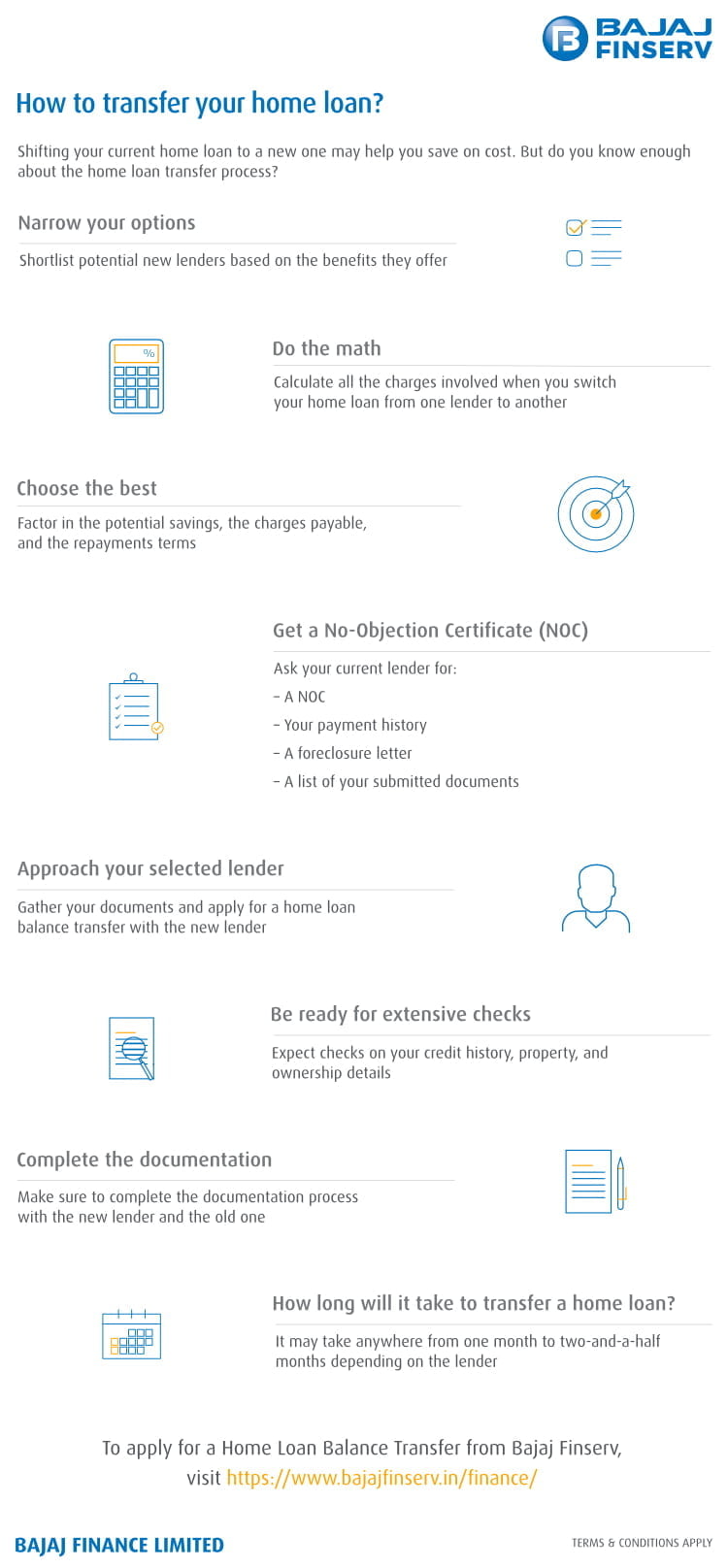

● Home Loan balance transfer:

If you are an existing Home Loan buyer and have borrowed a Home Loan before demonetization, then you cannot benefit with low-interest rates. In such a situation, you can go for a Home Loan balance transfer. You can also get a Home Loan balance transfer if your financial institution is charging you with higher interest rates. Here, you can switch your Home Loan account to another financial institution which charges you a low rate of interest.

Besides these benefits, there are various facilities offered by Home Loan lenders, which can help you manage your loan. One such facility is online EMI calculator. Before applying for a loan, it is essential that you calculate your monthly instalments, as this can help you with your fiscal planning. Many financial institutions offer EMI calculators on their websites. With the help of your loan tenor and the loan amount, you can easily calculate the monthly instalment.

With an Home Loan EMI calculator, the lender also offers you an online eligibility calculator, wherein you can check whether you fit the eligibility criteria set by the financial institution or not. In order to fit the eligibility criteria, you need to have proper documents required for the Home Loan, a good credit score as well as high income. Besides this, you also have to fit the age criteria set by the lender. After you are eligible for the Home Loan, you can check your EMI and proceed for the online application.

As Home Loans offer all above facilities, you can now carry out your property deal smoothly without any financial obstacle with the help of housing loans.