12 Private Student Loan FAQs

by Abdul Aziz Mondal Loans & Credit Published on: 23 April 2018 Last Updated on: 17 May 2025

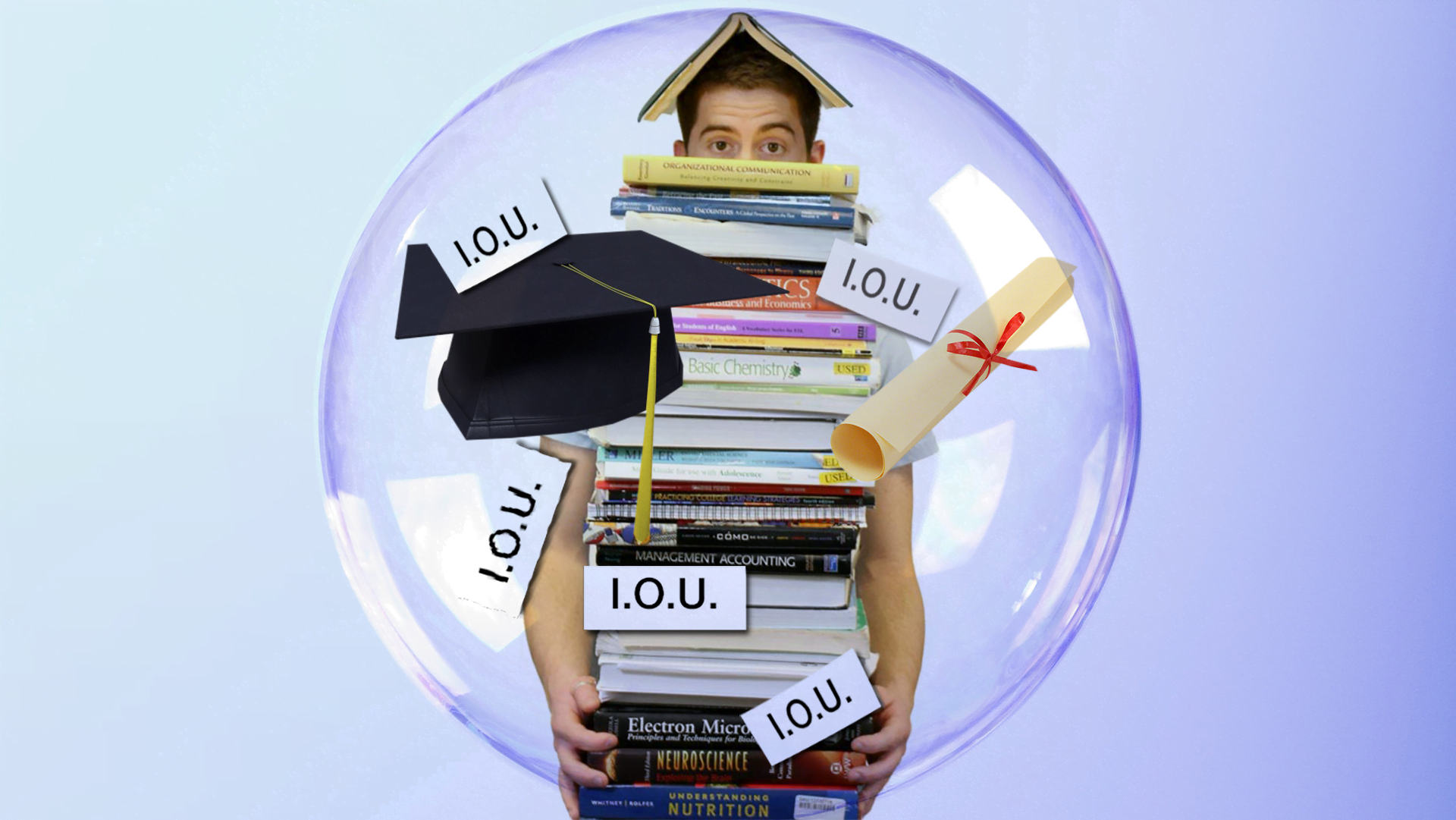

If you’re exploring student loans to fund your undergrad education, here’s all you need to know about private college education loans.

What is a private student loan?

A private student loan is a sum you borrow from an online lender, bank, credit union, financial institution, or university to pay for your college costs, including tuition, room and boarding, books and supplies, and other miscellaneous education-related expenses you’ll incur while at school.

According to one of the world’s leading private student loan financing companies, SoFi, student loans can provide a great helping help to students who are not able to afford the high fees at reputed colleges. The easy terms and conditions allow you to get through college and get your degree to a better and more promising future.

Why do I need a private student loan?

Like federal loans, scholarships, and grants generally don’t cover the entire cost of attending college, private loans help students cover the deficit between the cost of attendance (COA) and the financial aid received.

Do I need to submit the FAFSA to be eligible for a private student loan?

No, it is not necessary for you to file the FAFSA (Free Application for Federal Student Aid) to apply for a private loan. However, without submitting the FAFSA you won’t know if you qualify for any federal loans, student grants, or scholarships. A federal loan or grant can significantly reduce the amount you need to borrow from a private lender. So don’t skip this step.

Should I go for a fixed or variable interest rate?

Private lenders offer both fixed and variable rates, and there are pros and cons to both. The rate offered is largely determined by the credit report of the applicant as well as the cosigner. While a fixed rate will remain unchanged during the entire loan term—regardless of whether you think it’s too high a few years down the line—a variable rate that’s low right now will definitely increase to some extent during the life of your loan.

It may be a good idea to go with a fixed rate that’s reasonably low.

Is it necessary to have a cosigner for private student loans?

It is not compulsory, but having a cosigner with an excellent credit history greatly increases your chances of getting a loan. Moreover, applying with a cosigner can get you a better interest rate and loan terms. This is because a cosigned loan assures the lender that if the student defaults on repayment, the cosigner will take care of the monthly payments, as they wouldn’t want to take a hit on their credit score.

Students with poor credit history generally have difficulty having a loan approved unless they have a cosigner.

Who all can I have as my cosigner?

Your parent, grandparent, relative, guardian, spouse, or any adult with a good credit report can be your cosigner. Some lenders offer the option of later having the cosigner released from the repayment obligation if certain conditions are met.

Can I refinance my private student loan?

Yes. You can refinance your private loan as well as your federal loan together, but with a private lender only. Refinancing can help reduce your loan rate as well as help you repay your loan faster.

What is an income-driven repayment plan?

As the term indicates, these plans allow you to repay your loan as a percentage of your present income, thus limiting the amount you need to pay every month. However, income-driven repayment is not available for private loans.

Do private lenders offer options such as loan forgiveness?

Typically, no. However, there may be other alternatives such as deferment and forbearance you can explore with your private lender in case you find yourself unable to pay back your loan.

I am an international student. Can I still get a private student loan in the U.S.?

Yes, some lenders do offer education loans to international students, although the lending rates and terms may differ from those offered to U.S. nationals. Also, international loan applicants are generally required to have a U.S.-based cosigner as well as an address in the country.

How long and dreary is the process of securing a private student loan, from application to receiving funds?

The processing and approval of your loan application will vary based on the lender, the college being applied to, and a few other factors. Generally, it takes 15 days to 2 months.

You can, however, speed up the process by applying to several lenders through an online loan aggregator that allows filling out a single form for multiple applications and offers tools to calculate the amount you’ll need to borrow and the monthly repayment you can expect.

Another advantage of applying online for private loans for students is the zero origination or processing fees.

Do I need to repeat the process every year?

Yes, you need to reapply for a student loan every academic year, whether it’s a federal loan or a private one.

Read Also :