Funding For Fun – A Guide To Eligibility Criteria For Personal Loans

by Abdul Aziz Mondal Loans & Credit Published on: 20 October 2018 Last Updated on: 20 May 2025

Taking out a loan can be like entering the murky area of the financial abyss. If not familiar with personal loans, the process can also be equally intimidating. You give them your figures, they check your credit history, crunch some numbers, and then, there you go. You have either been approved or declined.

However, the loan process is not as complicated or mystifying as it might appear. In fact, taking out a loan has been streamlined for today’s consumers making it more convenient. Moreover, with Latitude personal loan and other online banking institutions, the process for taking out one has become much easier for many. Qualifying, though, can be a challenge for those with poor or no credit.

Let’s a take a look at the eligibility criteria for taking out a personal loan, so that you have the information you need before beginning your application.

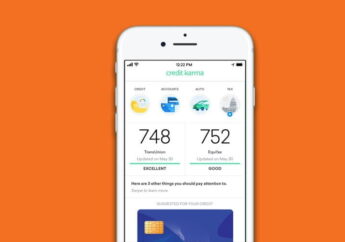

Credit Score:

The first very important eligibility requirement for taking out most personal loans is to have an acceptable FICA. The FICA score is based on the activity on your credit account. The score is between 300 and 850, and the lower your score the worse your credit and vice versa. The score is important because it often influences the interest rate on the loan and whether you will get approved for financing.

One of the factors that can adversely affect your credit score is having too many open accounts. Another factor that can lower the score is having delinquencies or charge-offs (unpaid accounts). Finally, when you apply for credit, agencies treat the application as an open file and lower the score.

Credit History And Debts:

Your credit history also becomes a part of the application process. All of the credit accounts you have ever opened are listed on this report up to at least seven years. This history tells prospective creditors whether or not you are a reliable payer.

People with “slow payer,” “late payer,” and other derogatory remarks on their credit report have problems with obtaining credit. Not that you are automatically denied, but the lender might ask you to explain any negative remarks, and place your response in with other application materials. Also, while it seems contradictory, those with no credit often have problems getting credit because they have not established credit with anyone.

Checking your credit at least once a year is important for a few reasons. If there are inaccuracies on the report, you want to address them before applying for a loan. Also, if you do have any delinquent accounts, you want to pay them off before applying for a loan. By obtaining your report, you can address any issues that might arise.

Income And Assets:

Your income and assets all become a part of the loan application process as well. Most, if not all, financing institutions will ask you for some proof of income, usually a pay stub, or tax records. Furthermore, they will ask you to list any savings, property, and other assets that can be included to offset your debts.

Debt-To-Income Ratio:

The debt-to-income ratio is a percentage of how much you spend on debt in a month. Of all of the information submitted on your loan application, this figure is more of an indication as to whether you can actually meet your obligation. Moreover, the lower the figure the better the state of your finances and the more likely you will be approved for a loan.

Your Loan Application:

While having a perfect package is great, the likelihood is you might have one requirement that outshines others, i.e. excellent credit but low income. One way to guarantee you will have little problems is by making sure your entire file is in the best condition before applying for the loan. Each factor holds its own significance, but one way to guarantee being approved for a loan is by preparing to submit these requirements long before you apply for the loan.

Read Also: